As the global markets navigate through a complex economic landscape, Hong Kong's Hang Seng Index has recently faced challenges, contrasting with gains seen in other regions such as the U.S. small-cap indices. In this environment, identifying potential growth opportunities often involves looking beyond headline indices to uncover stocks with strong fundamentals and resilience amid broader market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Tianjin Port Development Holdings (SEHK:3382)

Simply Wall St Value Rating: ★★★★★★

Overview: Tianjin Port Development Holdings Limited, an investment holding company, operates the port of Tianjin in the People’s Republic of China with a market capitalization of HK$4.25 billion.

Operations: The company generates revenue primarily from cargo handling (HK$7.62 billion), sales (HK$3.78 billion), and port ancillary services (HK$3.14 billion).

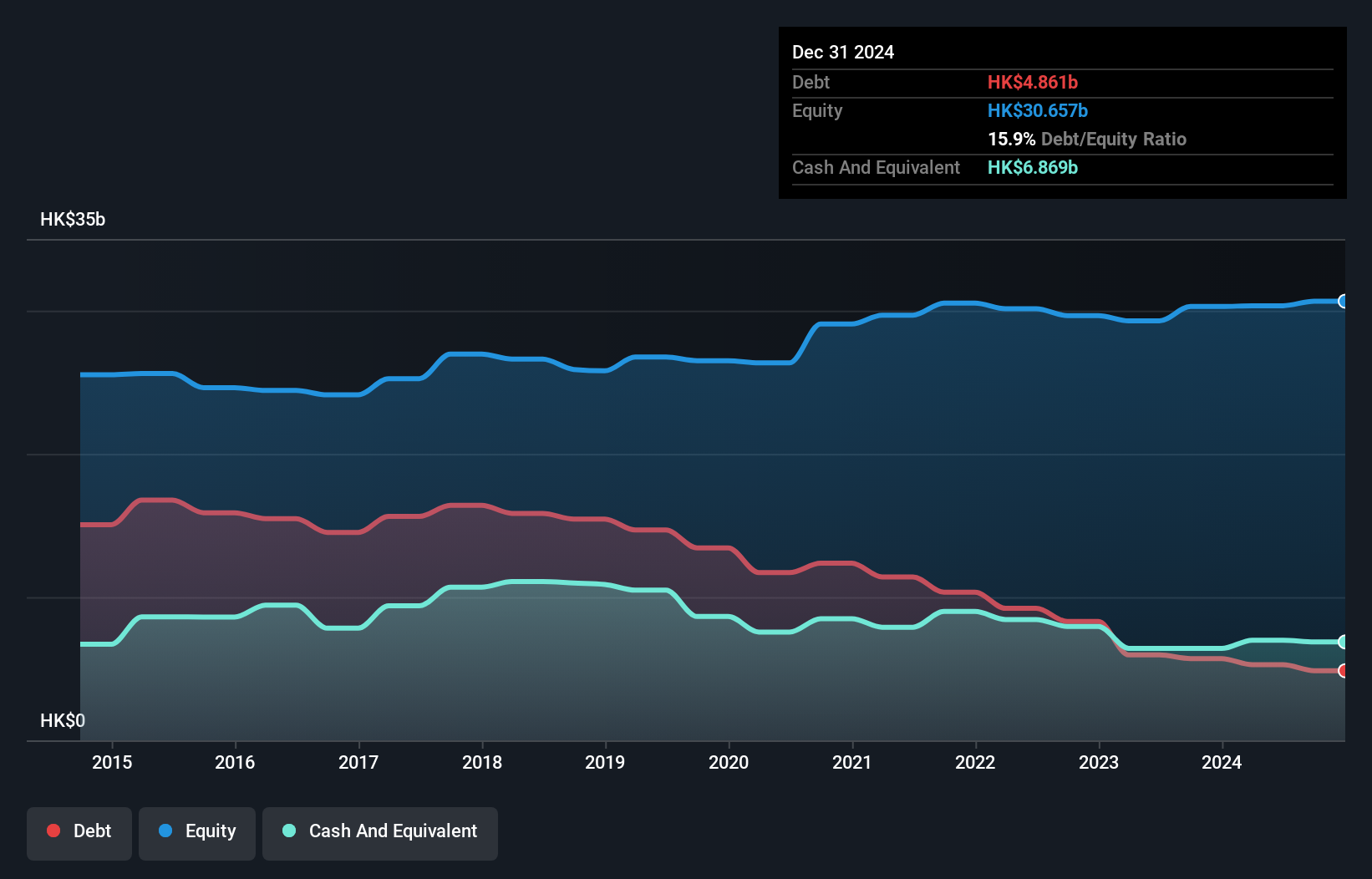

Tianjin Port Development Holdings, a relatively small player in the infrastructure sector, has made notable strides with earnings growth of 26% over the past year, outpacing the industry average of 9.7%. This performance is underpinned by high-quality earnings and a robust debt management strategy, evidenced by a reduction in its debt-to-equity ratio from 54.9% to 17.4% over five years. Despite net income dipping to HK$418 million from HK$474 million last year, sales rose to HK$6.75 billion from HK$6.24 billion in the same period, reflecting potential resilience amid market fluctuations. The company's addition to the S&P Global BMI Index further highlights its growing recognition within the market landscape.

- Click to explore a detailed breakdown of our findings in Tianjin Port Development Holdings' health report.

Learn about Tianjin Port Development Holdings' historical performance.

Golden Throat Holdings Group (SEHK:6896)

Simply Wall St Value Rating: ★★★★★☆

Overview: Golden Throat Holdings Group Company Limited is an investment holding company that manufactures and sells pharmaceutical, healthcare food, and other products in the People’s Republic of China with a market cap of HK$2.41 billion.

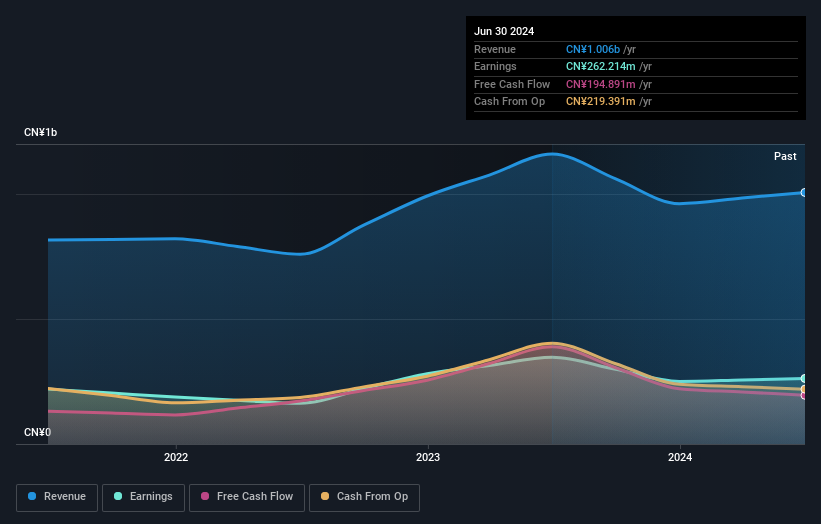

Operations: Golden Throat Holdings Group generates revenue primarily from its pharmaceuticals segment, amounting to CN¥1.01 billion.

Golden Throat Holdings, a smaller player in the Hong Kong market, shows a mixed financial picture. Despite a challenging year with earnings growth at -24.4%, its price-to-earnings ratio stands attractively at 8.4x, below the market average of 10x. The company has more cash than total debt and maintains high-quality past earnings, indicating sound financial health. Recent results for the half-year ending June 2024 showed sales of CNY 524 million and net income of CNY 134 million, reflecting steady performance compared to last year’s figures. Earnings per share rose slightly to CNY 0.1815 from CNY 0.1652 previously, suggesting modest progress despite broader industry challenges.

Shandong Xinhua Pharmaceutical (SEHK:719)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Xinhua Pharmaceutical Company Limited, with a market cap of approximately HK$9.73 billion, is engaged in the development, manufacturing, and sale of bulk pharmaceuticals, preparations, and chemical products across China and international markets including the Americas and Europe.

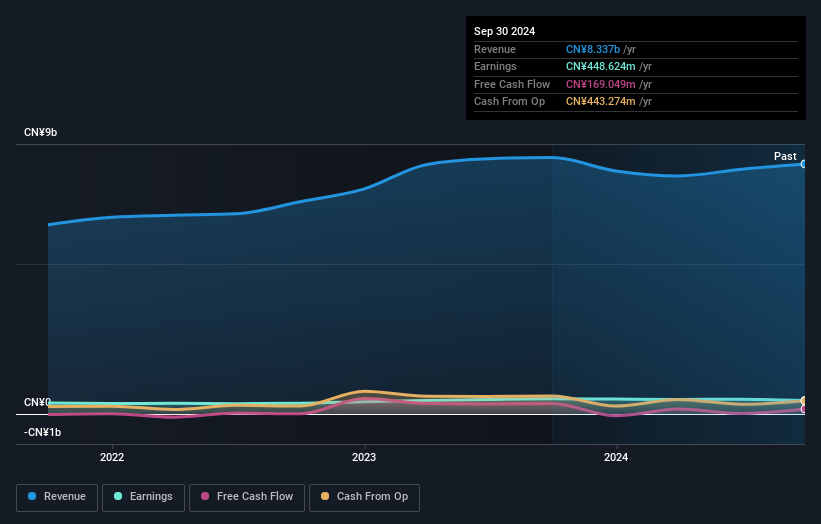

Operations: The company generates revenue primarily from preparations, chemical bulk drugs, and pharmaceutical intermediates with figures of CN¥4.68 billion, CN¥2.81 billion, and CN¥2.42 billion respectively.

Shandong Xinhua Pharmaceutical, a smaller player in the Hong Kong market, shows a promising yet mixed financial landscape. The company's debt to equity ratio has improved significantly from 44.6% to 28.1% over five years, indicating better financial management. Although its earnings growth of 12.1% per year over five years is commendable, recent performance at 1.2% lags behind the industry average of 6.4%. With a price-to-earnings ratio of 7.7x below the market average and high-quality past earnings, it remains attractive for value seekers despite recent modest net income figures and dividend announcements reflecting stability rather than rapid growth potential.

Make It Happen

- Take a closer look at our SEHK Undiscovered Gems With Strong Fundamentals list of 166 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shandong Xinhua Pharmaceutical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:719

Shandong Xinhua Pharmaceutical

Develops, manufactures, and sells bulk pharmaceuticals, preparations, and chemical products in the People’s Republic of China, the Americas, Europe, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives