- Hong Kong

- /

- Personal Products

- /

- SEHK:3332

Nanjing Sinolife United Company Limited's (HKG:3332) CEO Looks Like They Deserve Their Pay Packet

Key Insights

- Nanjing Sinolife United's Annual General Meeting to take place on 6th of June

- CEO Yuan Zhang's total compensation includes salary of CN¥456.0k

- The total compensation is similar to the average for the industry

- Nanjing Sinolife United's total shareholder return over the past three years was 184% while its EPS grew by 99% over the past three years

It would be hard to discount the role that CEO Yuan Zhang has played in delivering the impressive results at Nanjing Sinolife United Company Limited (HKG:3332) recently. Coming up to the next AGM on 6th of June, shareholders would be keeping this in mind. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

View our latest analysis for Nanjing Sinolife United

Comparing Nanjing Sinolife United Company Limited's CEO Compensation With The Industry

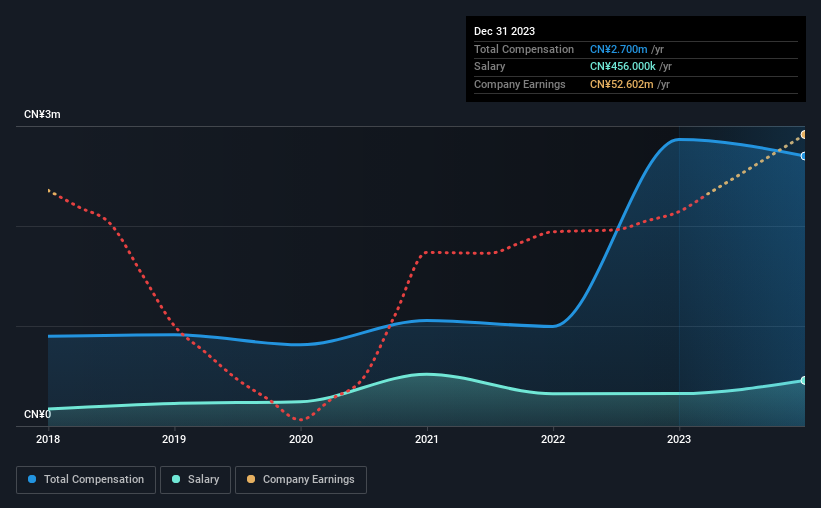

At the time of writing, our data shows that Nanjing Sinolife United Company Limited has a market capitalization of HK$511m, and reported total annual CEO compensation of CN¥2.7m for the year to December 2023. We note that's a small decrease of 5.8% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥456k.

In comparison with other companies in the Hong Kong Personal Products industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was CN¥2.2m. This suggests that Nanjing Sinolife United remunerates its CEO largely in line with the industry average. Furthermore, Yuan Zhang directly owns HK$3.7m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥456k | CN¥324k | 17% |

| Other | CN¥2.2m | CN¥2.5m | 83% |

| Total Compensation | CN¥2.7m | CN¥2.9m | 100% |

Talking in terms of the industry, salary represented approximately 68% of total compensation out of all the companies we analyzed, while other remuneration made up 32% of the pie. Nanjing Sinolife United sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Nanjing Sinolife United Company Limited's Growth Numbers

Over the past three years, Nanjing Sinolife United Company Limited has seen its earnings per share (EPS) grow by 99% per year. In the last year, its revenue is up 105%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Nanjing Sinolife United Company Limited Been A Good Investment?

Boasting a total shareholder return of 184% over three years, Nanjing Sinolife United Company Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. Seeing that earnings growth and share price performance seems to be on the right path, the more pressing focus for shareholders at the AGM may be how the board and management plans to turn the company into a sustainably profitable one.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 2 warning signs for Nanjing Sinolife United that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking to trade Nanjing Sinolife United, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nanjing Sinolife United might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3332

Nanjing Sinolife United

An investment holding company, engages in the manufacture and sale of nutritional supplements in the People’s Republic of China, Australia, New Zealand, and internationally.

Flawless balance sheet with solid track record.