- Hong Kong

- /

- Personal Products

- /

- SEHK:3332

Nanjing Sinolife United Company Limited's (HKG:3332) Business Is Yet to Catch Up With Its Share Price

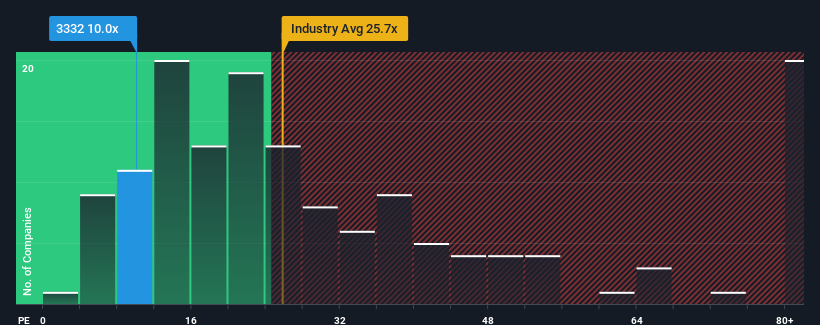

With a median price-to-earnings (or "P/E") ratio of close to 10x in Hong Kong, you could be forgiven for feeling indifferent about Nanjing Sinolife United Company Limited's (HKG:3332) P/E ratio of 10x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been quite advantageous for Nanjing Sinolife United as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Nanjing Sinolife United

Is There Some Growth For Nanjing Sinolife United?

There's an inherent assumption that a company should be matching the market for P/E ratios like Nanjing Sinolife United's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 210% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's noticeably less attractive on an annualised basis.

With this information, we find it interesting that Nanjing Sinolife United is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Nanjing Sinolife United's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Nanjing Sinolife United revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for Nanjing Sinolife United you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Sinolife United might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3332

Nanjing Sinolife United

An investment holding company, engages in the manufacture and sale of nutritional supplements in the People’s Republic of China, Australia, New Zealand, and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives