- Hong Kong

- /

- Real Estate

- /

- SEHK:1972

Asian Stocks That May Be Trading Below Their Estimated Value In March 2025

Reviewed by Simply Wall St

As global markets grapple with inflation concerns and trade uncertainties, Asian economies are navigating a complex landscape marked by modest gains in Japan's stock markets and stimulus hopes in China. In this environment, identifying stocks that may be trading below their estimated value can present opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Cfmoto PowerLtd (SHSE:603129) | CN¥178.81 | CN¥351.04 | 49.1% |

| Insource (TSE:6200) | ¥804.00 | ¥1584.36 | 49.3% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.40 | CN¥30.37 | 49.3% |

| APAC Realty (SGX:CLN) | SGD0.42 | SGD0.83 | 49.7% |

| JSHLtd (TSE:150A) | ¥561.00 | ¥1107.45 | 49.3% |

| GMO internet group (TSE:9449) | ¥3149.00 | ¥6181.69 | 49.1% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.665 | SGD1.33 | 49.9% |

| BalnibarbiLtd (TSE:3418) | ¥1092.00 | ¥2179.32 | 49.9% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.54 | CN¥16.97 | 49.7% |

| Doosan Fuel Cell (KOSE:A336260) | ₩15910.00 | ₩31537.45 | 49.6% |

Underneath we present a selection of stocks filtered out by our screen.

Yuhan (KOSE:A000100)

Overview: Yuhan Corporation manufactures and sells prescription, over-the-counter, and veterinary drugs as well as household goods in South Korea and internationally, with a market cap of ₩9.34 trillion.

Operations: The company's revenue segments include prescription drugs, over-the-counter drugs, veterinary drugs, and household goods.

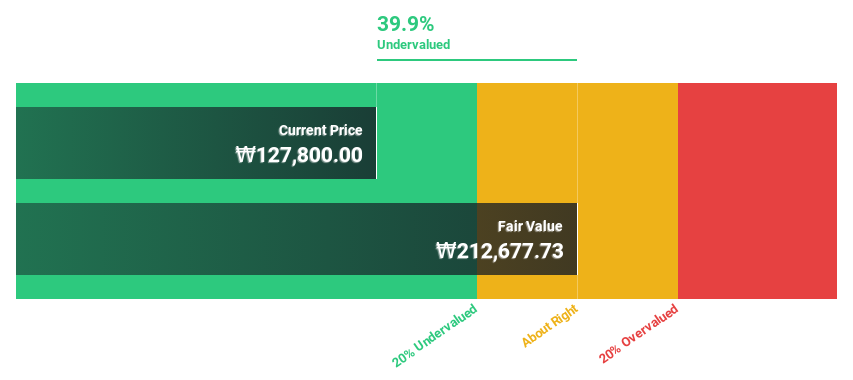

Estimated Discount To Fair Value: 41.3%

Yuhan Corporation is trading at ₩124,800, significantly below its estimated fair value of ₩212,677.73, presenting an undervaluation opportunity based on cash flows. Despite a decline in net income to KRW 70.69 billion for 2024 from KRW 136.20 billion the previous year and reduced profit margins of 3.4%, earnings are projected to grow at a robust rate of over 35% annually, outpacing the market's growth expectations and indicating potential for future profitability improvements.

- Our expertly prepared growth report on Yuhan implies its future financial outlook may be stronger than recent results.

- Take a closer look at Yuhan's balance sheet health here in our report.

Swire Properties (SEHK:1972)

Overview: Swire Properties Limited, with a market cap of HK$99.11 billion, develops, owns, and operates mixed-use commercial properties in Hong Kong, Mainland China, the United States, and internationally through its subsidiaries.

Operations: The company's revenue segments include Property Investment at HK$14.77 billion, Hotels at HK$854 million, and Property Trading at HK$81 million.

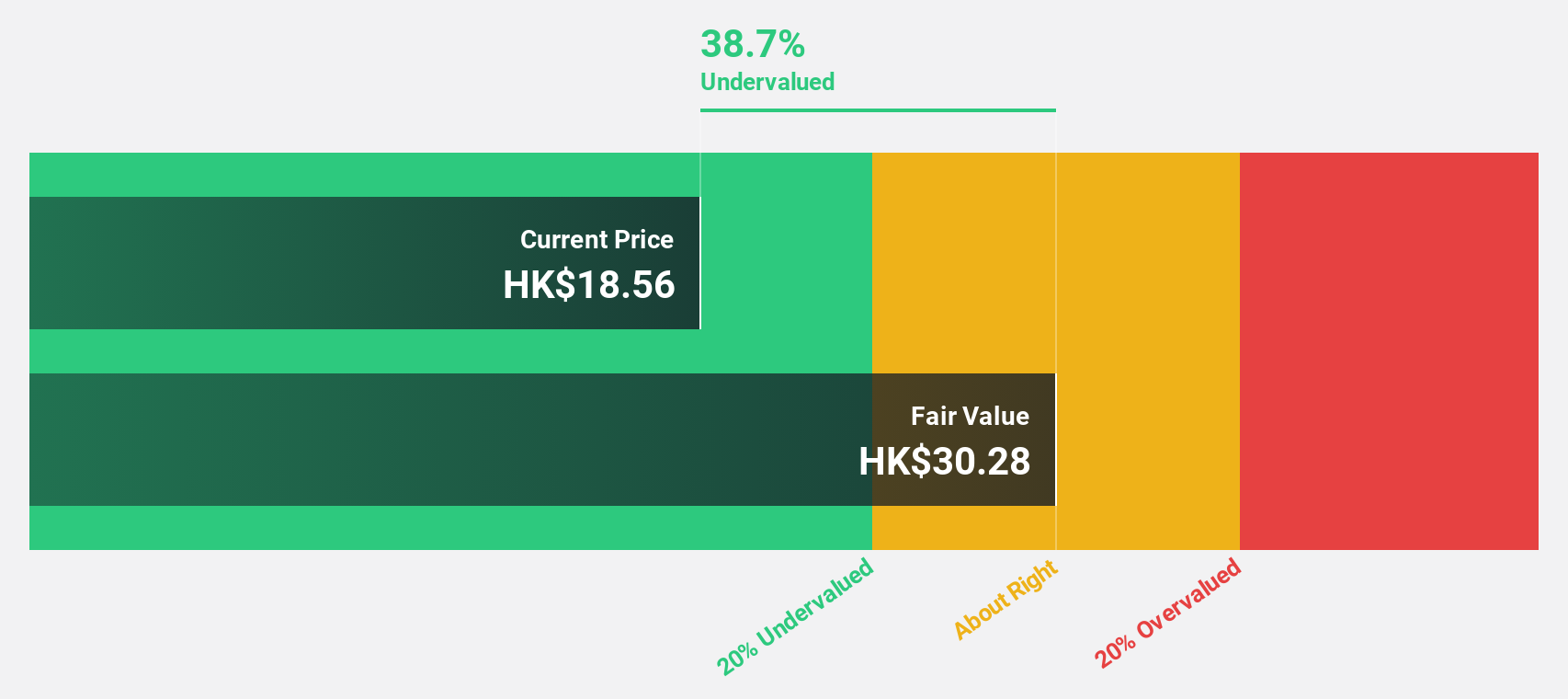

Estimated Discount To Fair Value: 43%

Swire Properties is trading at HK$17.14, significantly below its estimated fair value of HK$30.09, highlighting an undervaluation based on cash flows. Despite a net loss of HK$766 million for 2024 and dividends not being well-covered by earnings or free cash flows, earnings are forecast to grow 35% annually with expected profitability in three years. This growth rate surpasses the Hong Kong market's average revenue growth expectation and suggests potential for future value realization.

- According our earnings growth report, there's an indication that Swire Properties might be ready to expand.

- Unlock comprehensive insights into our analysis of Swire Properties stock in this financial health report.

Giant Biogene Holding (SEHK:2367)

Overview: Giant Biogene Holding Co., Ltd. is an investment holding company focused on the research, development, manufacture, and sale of bioactive material-based beauty and health products in China, with a market cap of HK$72.05 billion.

Operations: The company generates revenue from its biotechnology segment, amounting to CN¥4.46 billion.

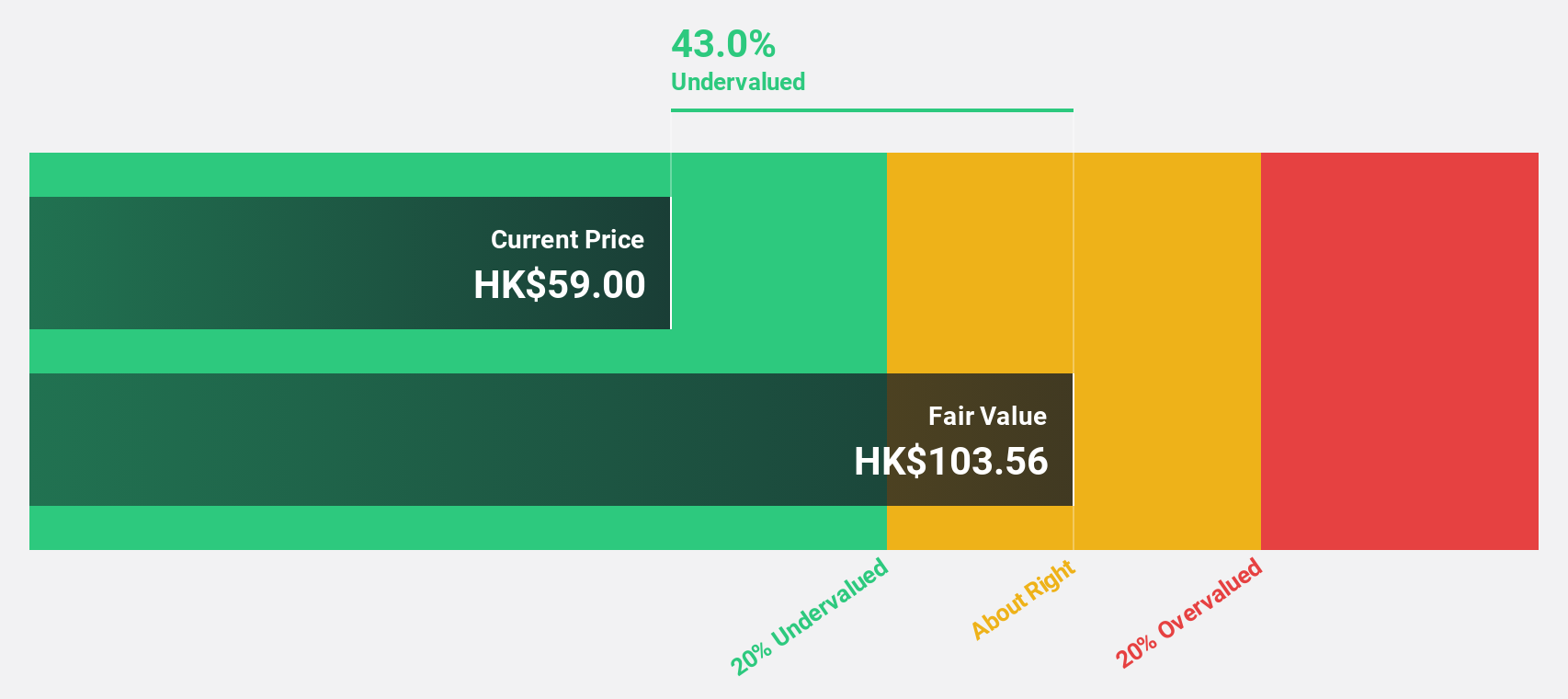

Estimated Discount To Fair Value: 27.8%

Giant Biogene Holding, trading at HK$70.85, is undervalued based on cash flows with a fair value estimate of HK$98.08. The stock trades 27.8% below this estimate and earnings are expected to grow significantly over the next three years at 23.87% annually, outpacing the Hong Kong market's average growth rate of 11.6%. Revenue is forecast to grow at 19.6% per year, further supporting its potential for value realization despite slower than ideal revenue growth rates.

- Upon reviewing our latest growth report, Giant Biogene Holding's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Giant Biogene Holding's balance sheet health report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 276 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1972

Swire Properties

Develops, owns, and operates mixed-use, primarily commercial properties in Hong Kong, Mainland China, the United States, and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives