- Hong Kong

- /

- Personal Products

- /

- SEHK:1455

Fourace Industries Group Holdings' (HKG:1455) Shareholders Will Receive A Smaller Dividend Than Last Year

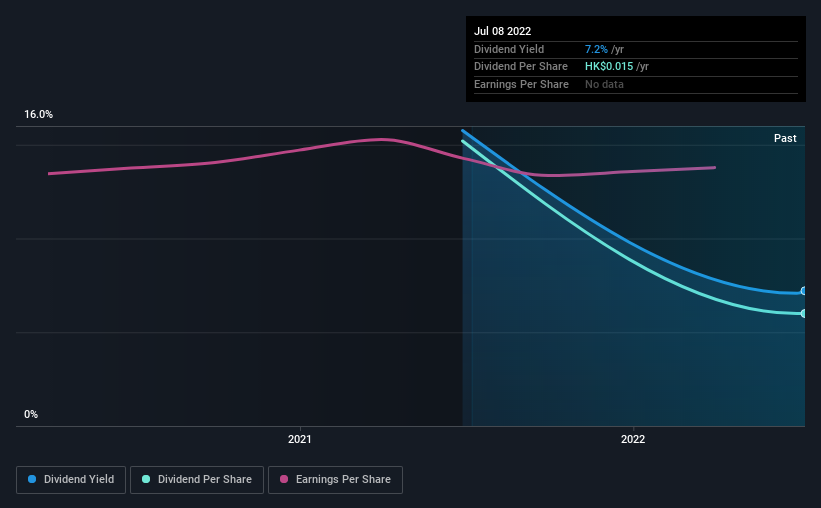

Fourace Industries Group Holdings Limited (HKG:1455) is reducing its dividend to HK$0.015 on the 31st of August. However, the dividend yield of 7.2% is still a decent boost to shareholder returns.

View our latest analysis for Fourace Industries Group Holdings

Fourace Industries Group Holdings' Earnings Easily Cover the Distributions

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. However, Fourace Industries Group Holdings' earnings easily cover the dividend. This means that most of what the business earns is being used to help it grow.

EPS is set to fall by 9.8% over the next 12 months if recent trends continue. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 36%, which is definitely feasible to continue.

Fourace Industries Group Holdings Doesn't Have A Long Payment History

Without a track record of dividend payments, we can't make a judgement on how stable it has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Dividend Growth May Be Hard To Come By

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Over the last 12 months, earnings are down by 9.8%. While this is not ideal, one year is a short time in business, and we wouldn't want to get too hung up on this. We do note though, one year is too short a time to be drawing strong conclusions about a company's future prospects.

Our Thoughts On Fourace Industries Group Holdings' Dividend

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 3 warning signs for Fourace Industries Group Holdings that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1455

Fourace Industries Group Holdings

Engages in the design, development, manufacture, and sale of personal care and lifestyle electrical appliances in the United States, Japan, Europe, the People's Republic of China, and rest of the Asia Pacific.

Flawless balance sheet and slightly overvalued.