- Hong Kong

- /

- Medical Equipment

- /

- SEHK:9997

Here's Why Kangji Medical Holdings (HKG:9997) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Kangji Medical Holdings (HKG:9997). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Kangji Medical Holdings

How Fast Is Kangji Medical Holdings Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. Kangji Medical Holdings boosted its trailing twelve month EPS from CN¥0.30 to CN¥0.34, in the last year. This amounts to a 13% gain; a figure that shareholders will be pleased to see.

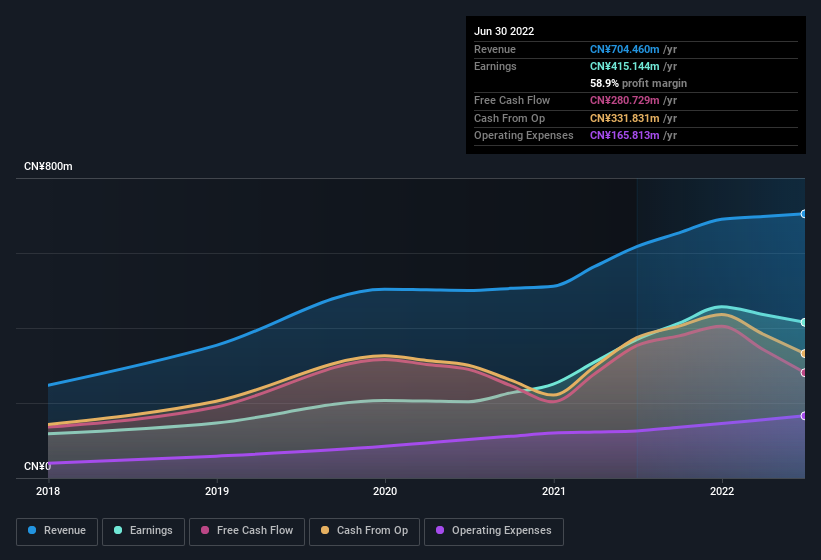

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the revenue front, Kangji Medical Holdings has done well over the past year, growing revenue by 14% to CN¥704m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Kangji Medical Holdings' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Kangji Medical Holdings Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Kangji Medical Holdings insiders own a significant number of shares certainly is appealing. To be exact, company insiders hold 53% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. at the current share price. This is an incredible endorsement from them.

Should You Add Kangji Medical Holdings To Your Watchlist?

As previously touched on, Kangji Medical Holdings is a growing business, which is encouraging. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. It is worth noting though that we have found 1 warning sign for Kangji Medical Holdings that you need to take into consideration.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kangji Medical Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9997

Kangji Medical Holdings

An investment holding company, designs, develops, manufactures, and sells minimally invasive surgical instruments and accessories in Mainland China and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives