- Hong Kong

- /

- Healthcare Services

- /

- SEHK:928

Benign Growth For Life Healthcare Group Limited (HKG:928) Underpins Stock's 43% Plummet

The Life Healthcare Group Limited (HKG:928) share price has fared very poorly over the last month, falling by a substantial 43%. For any long-term shareholders, the last month ends a year to forget by locking in a 61% share price decline.

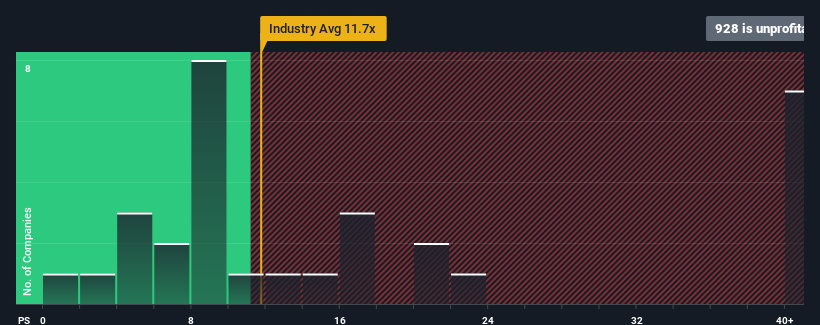

Following the heavy fall in price, Life Healthcare Group's price-to-earnings (or "P/E") ratio of -3x might make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 21x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's exceedingly strong of late, Life Healthcare Group has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Life Healthcare Group

Is There Any Growth For Life Healthcare Group?

The only time you'd be truly comfortable seeing a P/E as depressed as Life Healthcare Group's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 36% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Life Healthcare Group's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in Life Healthcare Group have plummeted and its P/E is now low enough to touch the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Life Healthcare Group revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Life Healthcare Group you should be aware of, and 1 of them is concerning.

If these risks are making you reconsider your opinion on Life Healthcare Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if King International Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:928

King International Investment

An investment holding company, provides genetic testing and health data analysis services in the People’s Republic of China and Hong Kong.

Adequate balance sheet low.

Market Insights

Community Narratives