China Evergrande New Energy Vehicle Group (HKG:708) shareholders are still up 872% over 5 years despite pulling back 22% in the past week

China Evergrande New Energy Vehicle Group Limited (HKG:708) shareholders might understandably be very concerned that the share price has dropped 74% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been spectacular. To be precise, the stock price is 872% higher than it was five years ago, a wonderful performance by any measure. So we don't think the recent decline in the share price means its story is a sad one. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain. We love happy stories like this one. The company should be really proud of that performance!

While the stock has fallen 22% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for China Evergrande New Energy Vehicle Group

Given that China Evergrande New Energy Vehicle Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years China Evergrande New Energy Vehicle Group saw its revenue grow at 60% per year. Even measured against other revenue-focussed companies, that's a good result. Arguably, this is well and truly reflected in the strong share price gain of 58%(per year) over the same period. Despite the strong run, top performers like China Evergrande New Energy Vehicle Group have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

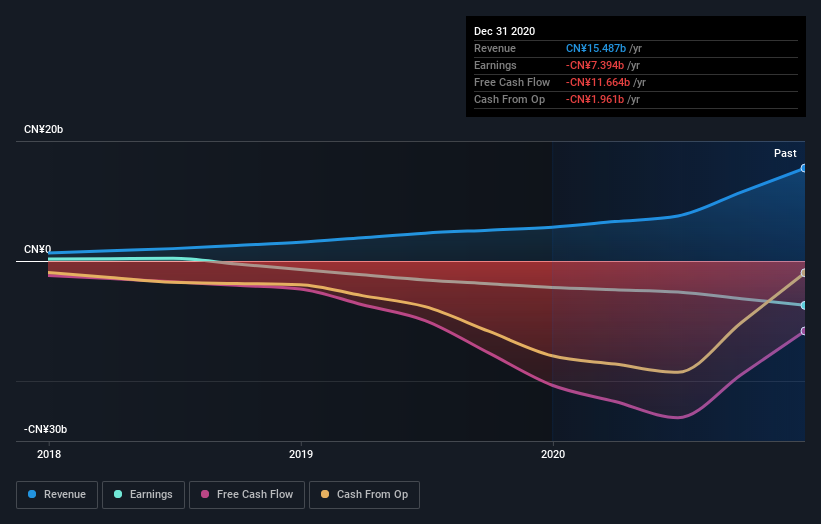

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on China Evergrande New Energy Vehicle Group's earnings, revenue and cash flow.

A Different Perspective

Investors in China Evergrande New Energy Vehicle Group had a tough year, with a total loss of 65%, against a market gain of about 5.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 58% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for China Evergrande New Energy Vehicle Group (of which 2 can't be ignored!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:708

China Evergrande New Energy Vehicle Group

An investment holding company, engages in the technology research and development, manufacturing, sales, and servicing of new energy vehicles in the People’s Republic of China and Europe.

Moderate and overvalued.

Market Insights

Community Narratives