- Hong Kong

- /

- Healthcare Services

- /

- SEHK:673

Shareholders Will Probably Not Have Any Issues With China Health Group Limited's (HKG:673) CEO Compensation

Key Insights

- China Health Group to hold its Annual General Meeting on 18th of September

- Total pay for CEO Ho Chung includes HK$1.20m salary

- The overall pay is comparable to the industry average

- Over the past three years, China Health Group's EPS fell by 2.1% and over the past three years, the total shareholder return was 74%

Despite strong share price growth of 74% for China Health Group Limited (HKG:673) over the last few years, earnings growth has been disappointing, which suggests something is amiss. The upcoming AGM on 18th of September may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

Check out our latest analysis for China Health Group

How Does Total Compensation For Ho Chung Compare With Other Companies In The Industry?

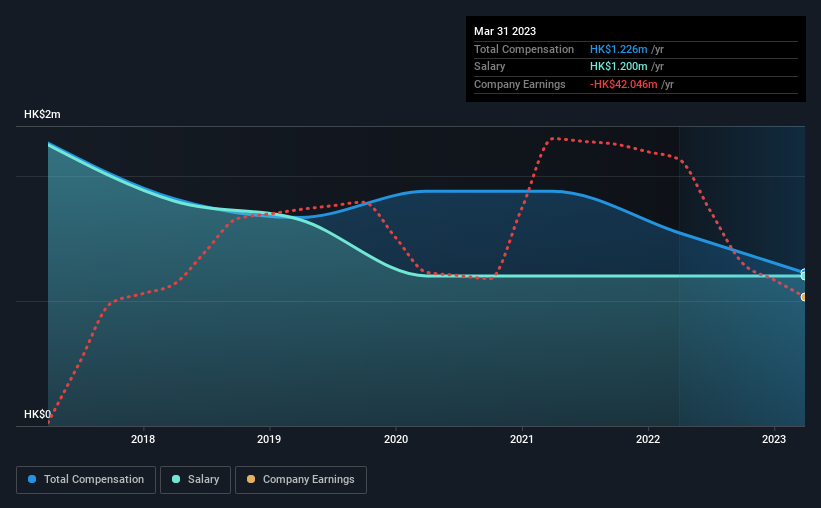

Our data indicates that China Health Group Limited has a market capitalization of HK$434m, and total annual CEO compensation was reported as HK$1.2m for the year to March 2023. Notably, that's a decrease of 21% over the year before. We note that the salary portion, which stands at HK$1.20m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Hong Kong Healthcare industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.7m. So it looks like China Health Group compensates Ho Chung in line with the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$1.2m | HK$1.2m | 98% |

| Other | HK$26k | HK$346k | 2% |

| Total Compensation | HK$1.2m | HK$1.5m | 100% |

On an industry level, around 80% of total compensation represents salary and 20% is other remuneration. China Health Group has gone down a largely traditional route, paying Ho Chung a high salary, giving it preference over non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at China Health Group Limited's Growth Numbers

Over the last three years, China Health Group Limited has shrunk its earnings per share by 2.1% per year. It saw its revenue drop 29% over the last year.

A lack of EPS improvement is not good to see. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has China Health Group Limited Been A Good Investment?

Boasting a total shareholder return of 74% over three years, China Health Group Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Ho receives almost all of their compensation through a salary. Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 4 warning signs (and 1 which shouldn't be ignored) in China Health Group we think you should know about.

Important note: China Health Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:673

China Health Group

An investment holding company, engages in the distribution and services of medical equipment and consumables in the People’s Republic of China.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion