Global markets recently faced a challenging week, with major indexes mostly finishing lower amid busy earnings reports and economic data releases. Despite these fluctuations, investors continue to explore opportunities in various segments of the market, including penny stocks. Although the term 'penny stock' might seem outdated, it still represents smaller or newer companies that can offer significant growth potential when supported by strong financial health. Let's examine three such stocks that combine balance sheet strength with promising prospects for future gains.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.22 | THB1.8B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.815 | £207.57M | ★★★★★★ |

Click here to see the full list of 5,775 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

China Dongxiang (Group) (SEHK:3818)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Dongxiang (Group) Co., Ltd. designs, develops, markets, and sells sport-related apparel, footwear, and accessories in China and internationally with a market cap of approximately HK$2.17 billion.

Operations: The company generates its revenue primarily from the China-Apparel segment, amounting to CN¥1.74 billion.

Market Cap: HK$2.17B

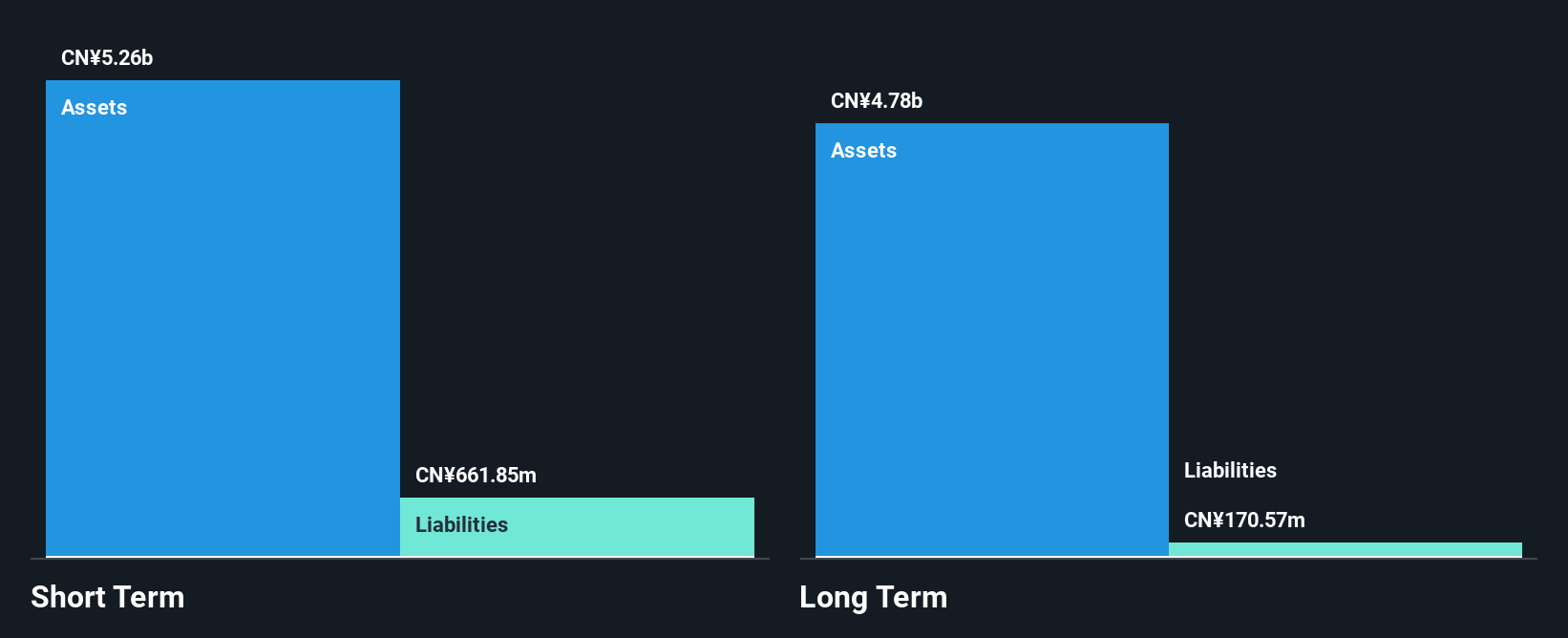

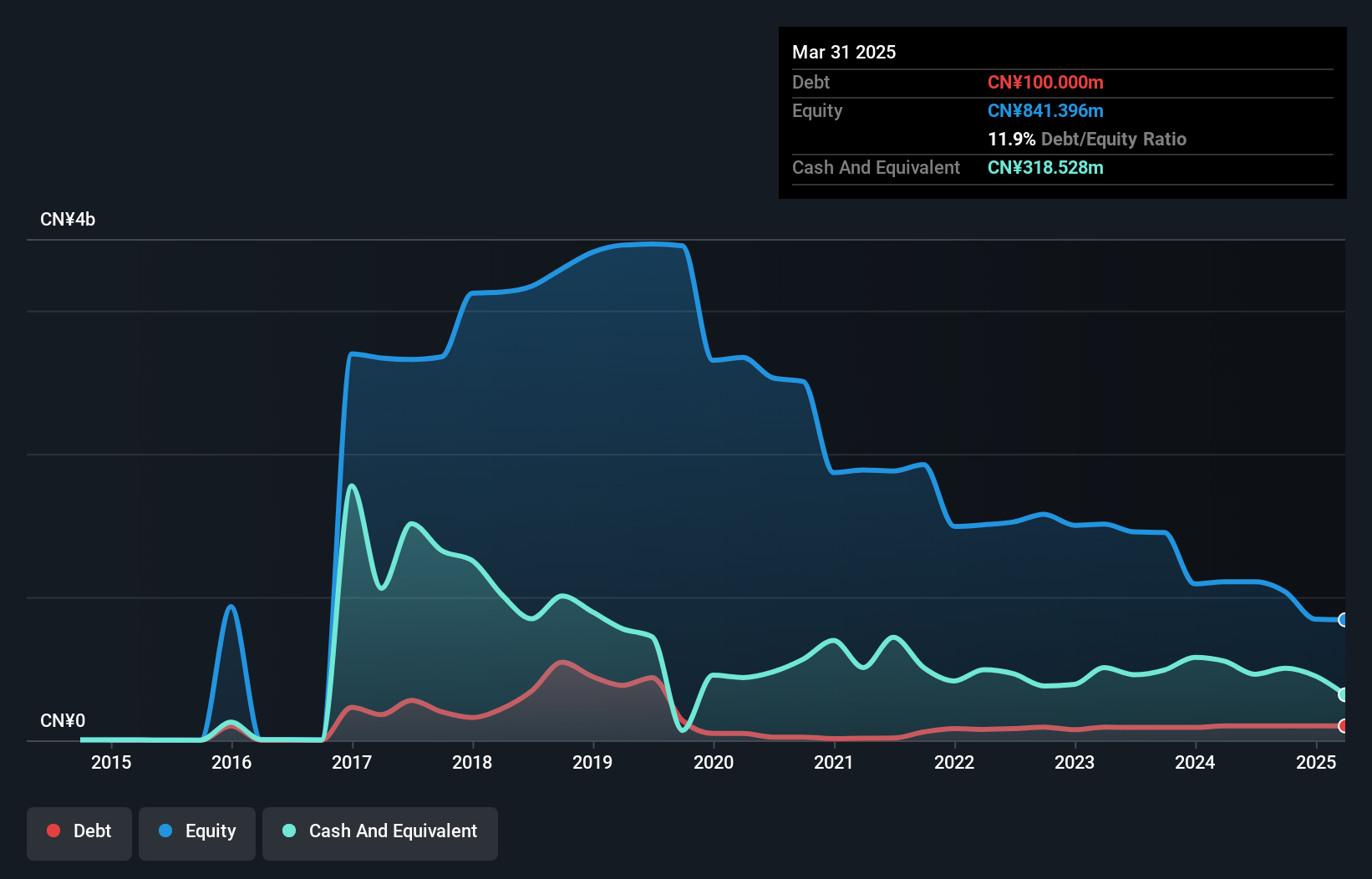

China Dongxiang (Group) Co., Ltd. faces challenges typical of penny stocks, such as high volatility and recent declines in same-store sales for its Kappa-branded stores. The company remains debt-free, with short-term assets significantly exceeding liabilities, suggesting a strong balance sheet despite being unprofitable with negative return on equity. Recent changes include a switch to Deloitte as auditors and board member resignations, indicating shifts in governance. While dividends are not well-covered by earnings, the company has avoided shareholder dilution over the past year. Earnings are forecasted to grow substantially, though historical losses have been significant.

- Click here to discover the nuances of China Dongxiang (Group) with our detailed analytical financial health report.

- Assess China Dongxiang (Group)'s future earnings estimates with our detailed growth reports.

Arrail Group (SEHK:6639)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Arrail Group Limited operates dental hospitals and clinics in China with a market cap of HK$1.57 billion.

Operations: The company's revenue is derived from two segments: Arrail Dental, contributing CN¥784.79 million, and Rytime Dental, generating CN¥960.99 million.

Market Cap: HK$1.57B

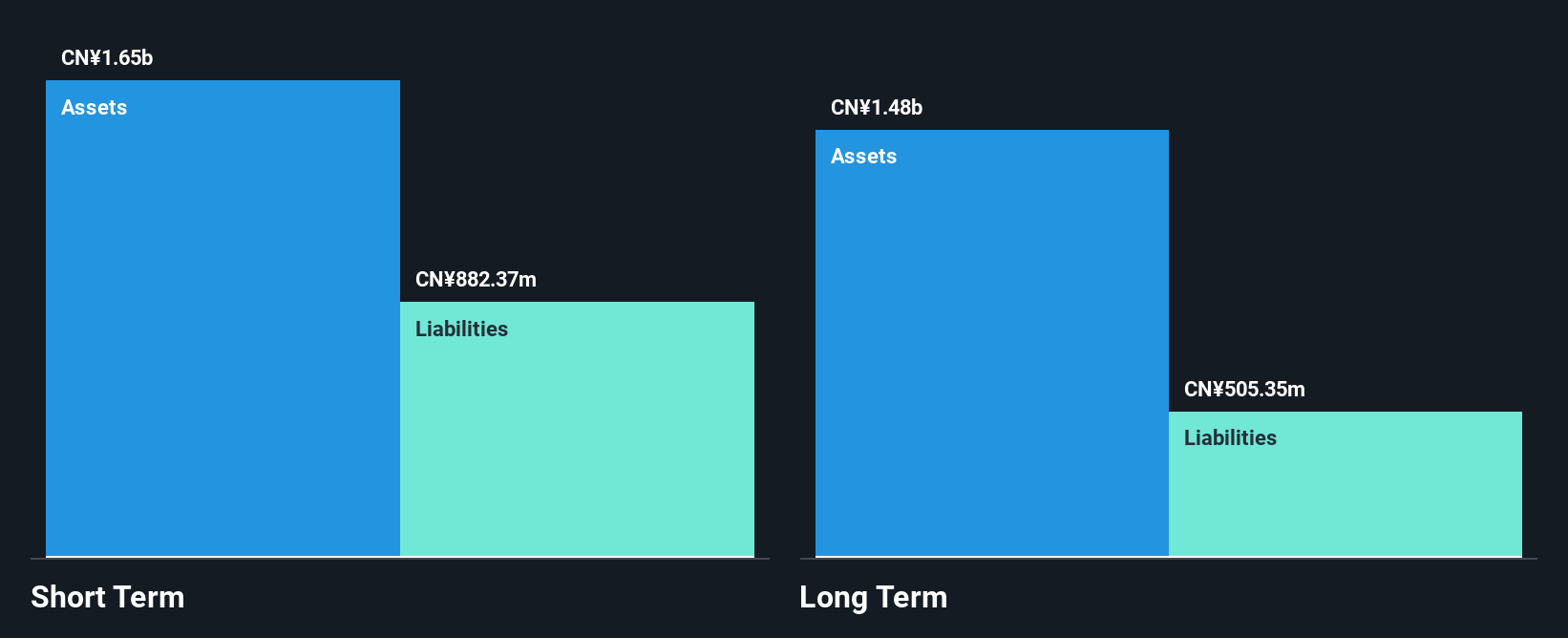

Arrail Group has shown significant financial improvement, becoming profitable this year with a market cap of HK$1.57 billion. Despite low return on equity at 0.7%, the company's debt is well-covered by operating cash flow, and it holds more cash than total debt, indicating strong liquidity. Recent share buyback initiatives could enhance net asset value per share and earnings per share, reflecting shareholder-friendly policies. However, interest payments are not well covered by EBIT, suggesting potential risk in managing interest obligations. The board's seasoned experience adds governance stability amid recent executive changes and amendments to company bylaws.

- Dive into the specifics of Arrail Group here with our thorough balance sheet health report.

- Explore Arrail Group's analyst forecasts in our growth report.

H&R Century Union (SZSE:000892)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: H&R Century Union Corporation operates in China, focusing on drama series production and artist brokerage, with a market cap of CN¥3.20 billion.

Operations: H&R Century Union Corporation has not reported any revenue segments.

Market Cap: CN¥3.2B

H&R Century Union Corporation, with a market cap of CN¥3.20 billion, operates in China's entertainment sector but remains unprofitable despite reducing losses over the past five years. The company reported sales of CN¥153.38 million for the nine months ending September 2024, down from CN¥298.67 million a year earlier, and incurred a net loss of CN¥53.94 million. Positively, its short-term assets significantly exceed both short and long-term liabilities, and it holds more cash than total debt, ensuring liquidity stability. The management team is experienced with an average tenure of 4.9 years; however, the board's shorter tenure suggests recent changes in governance structures.

- Unlock comprehensive insights into our analysis of H&R Century Union stock in this financial health report.

- Explore historical data to track H&R Century Union's performance over time in our past results report.

Seize The Opportunity

- Navigate through the entire inventory of 5,775 Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3818

China Dongxiang (Group)

Engages in the design, development, marketing, and sale of sport-related apparel, footwear, and accessories in the People’s Republic of China and internationally.

Flawless balance sheet very low.

Market Insights

Community Narratives