- Hong Kong

- /

- Medical Equipment

- /

- SEHK:6609

Even With A 42% Surge, Cautious Investors Are Not Rewarding Shanghai HeartCare Medical Technology Corporation Limited's (HKG:6609) Performance Completely

Shanghai HeartCare Medical Technology Corporation Limited (HKG:6609) shares have had a really impressive month, gaining 42% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

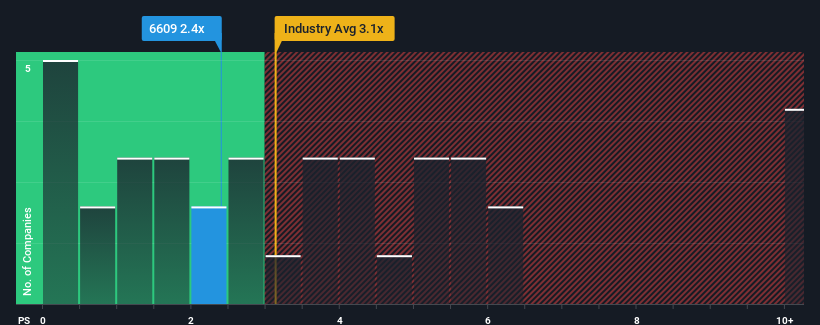

In spite of the firm bounce in price, it would still be understandable if you think Shanghai HeartCare Medical Technology is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in Hong Kong's Medical Equipment industry have P/S ratios above 3.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Shanghai HeartCare Medical Technology

How Has Shanghai HeartCare Medical Technology Performed Recently?

Shanghai HeartCare Medical Technology could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai HeartCare Medical Technology will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Shanghai HeartCare Medical Technology's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 36% over the next year. That's shaping up to be materially higher than the 32% growth forecast for the broader industry.

In light of this, it's peculiar that Shanghai HeartCare Medical Technology's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Shanghai HeartCare Medical Technology's P/S?

Despite Shanghai HeartCare Medical Technology's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Shanghai HeartCare Medical Technology's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Shanghai HeartCare Medical Technology that you should be aware of.

If you're unsure about the strength of Shanghai HeartCare Medical Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6609

Shanghai HeartCare Medical Technology

Researches, develops, manufacture, and sells neuro-interventional medical devices in Mainland China.

Flawless balance sheet with moderate growth potential.