- Hong Kong

- /

- Healthcare Services

- /

- SEHK:3886

3 Promising Penny Stocks With Market Caps Below US$300M

Reviewed by Simply Wall St

As global markets experience a rebound, driven by cooling inflation and robust bank earnings in the U.S., investors are exploring diverse opportunities for growth. Penny stocks, often representing smaller or newer companies, remain an intriguing investment area despite their somewhat outdated terminology. These stocks can offer surprising value and potential for significant returns when backed by solid financials, making them worth considering for those willing to look beyond the major market players.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.14B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$41.79B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.97 | HK$628.44M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.944 | £150.76M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR425.99M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.425 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,726 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Koh Brothers Eco Engineering (Catalist:5HV)

Simply Wall St Financial Health Rating: ★★★★☆☆

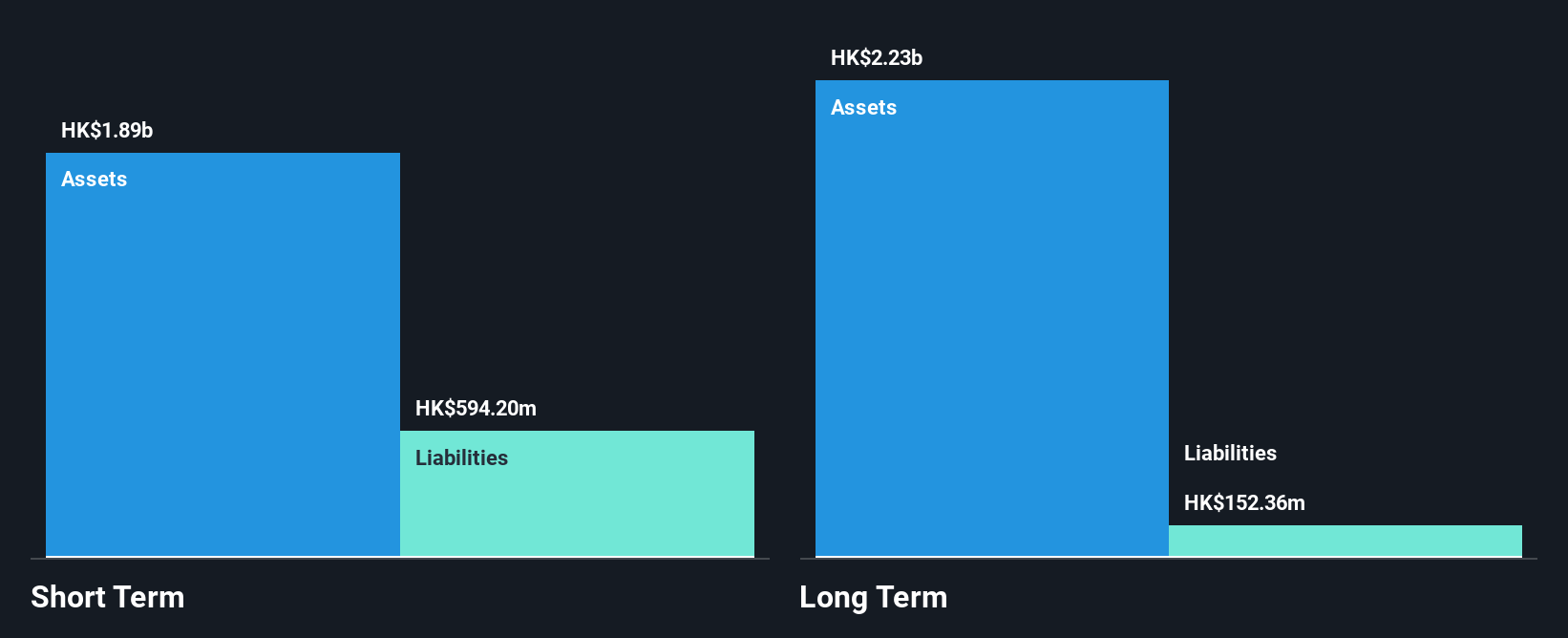

Overview: Koh Brothers Eco Engineering Limited is an investment holding company offering engineering, procurement, and construction services for infrastructure, water and wastewater treatment, building, bio-refinery, and renewable energy projects across Singapore, Malaysia, Indonesia, Africa, and internationally with a market cap of SGD115.54 million.

Operations: The company generates revenue through its Engineering and Construction segment, which accounts for SGD88.70 million, and its Bio-Refinery and Renewable Energy segment, contributing SGD64.88 million.

Market Cap: SGD115.54M

Koh Brothers Eco Engineering Limited, with a market cap of SGD115.54 million, operates in engineering and construction and bio-refinery sectors, generating revenues of SGD88.70 million and SGD64.88 million respectively. Despite its experienced board and management team, the company faces challenges due to its unprofitability and negative return on equity (-10.15%). While it has more cash than debt, its operating cash flow inadequately covers debt obligations (11%). The share price is highly volatile compared to other Singaporean stocks, though shareholders haven't faced significant dilution recently. Earnings have declined significantly over the past five years by 39.8% annually.

- Take a closer look at Koh Brothers Eco Engineering's potential here in our financial health report.

- Evaluate Koh Brothers Eco Engineering's historical performance by accessing our past performance report.

Infinity Logistics and Transport Ventures (SEHK:1442)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Infinity Logistics and Transport Ventures Limited is an investment holding company offering logistics services across several countries including China, Indonesia, Malaysia, and others, with a market cap of HK$701.76 million.

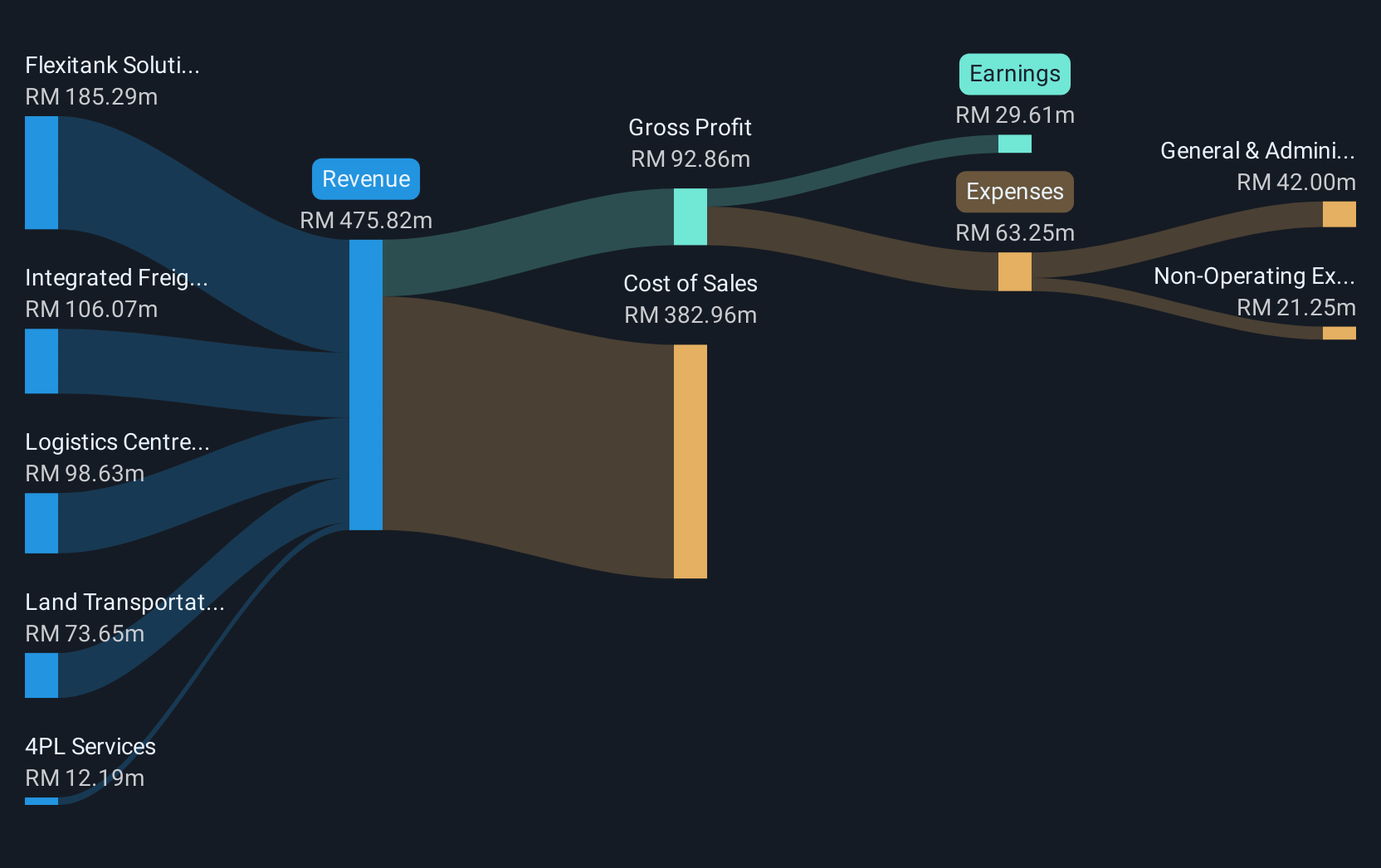

Operations: The company's revenue is primarily derived from five segments: Flexitank Solution and Related Services (MYR 154.03 million), Integrated Freight Forwarding Services (MYR 102.35 million), Logistics Centre and Related Services (MYR 85.12 million), Land Transportation Services (MYR 70.86 million), and 4PL Services (MYR 12.41 million).

Market Cap: HK$701.76M

Infinity Logistics and Transport Ventures Limited, with a market cap of HK$701.76 million, operates across various logistics segments primarily in Asia. Despite its experienced board and management team, the company faces challenges with negative earnings growth over the past year and a low return on equity of 6.2%. Profit margins have declined to 4.9% from last year's 8.7%, yet debt levels are well-managed with satisfactory interest coverage (3.3x) and a net debt to equity ratio of 20.7%. Recent board changes include appointing Datin Paduka TPr. Noraini Binti Roslan as an independent non-executive director, enhancing governance expertise in urban planning and sustainability initiatives.

- Click here and access our complete financial health analysis report to understand the dynamics of Infinity Logistics and Transport Ventures.

- Review our historical performance report to gain insights into Infinity Logistics and Transport Ventures' track record.

Town Health International Medical Group (SEHK:3886)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Town Health International Medical Group Limited is an investment holding company that provides healthcare and related services in the People’s Republic of China and Hong Kong, with a market cap of HK$1.96 billion.

Operations: The company's revenue is derived from Hong Kong Medical Services (HK$826.41 million), Hong Kong Managed Medical Network Business (HK$510.13 million), and Mainland Hospital Management and Medical Services (HK$533.79 million).

Market Cap: HK$1.96B

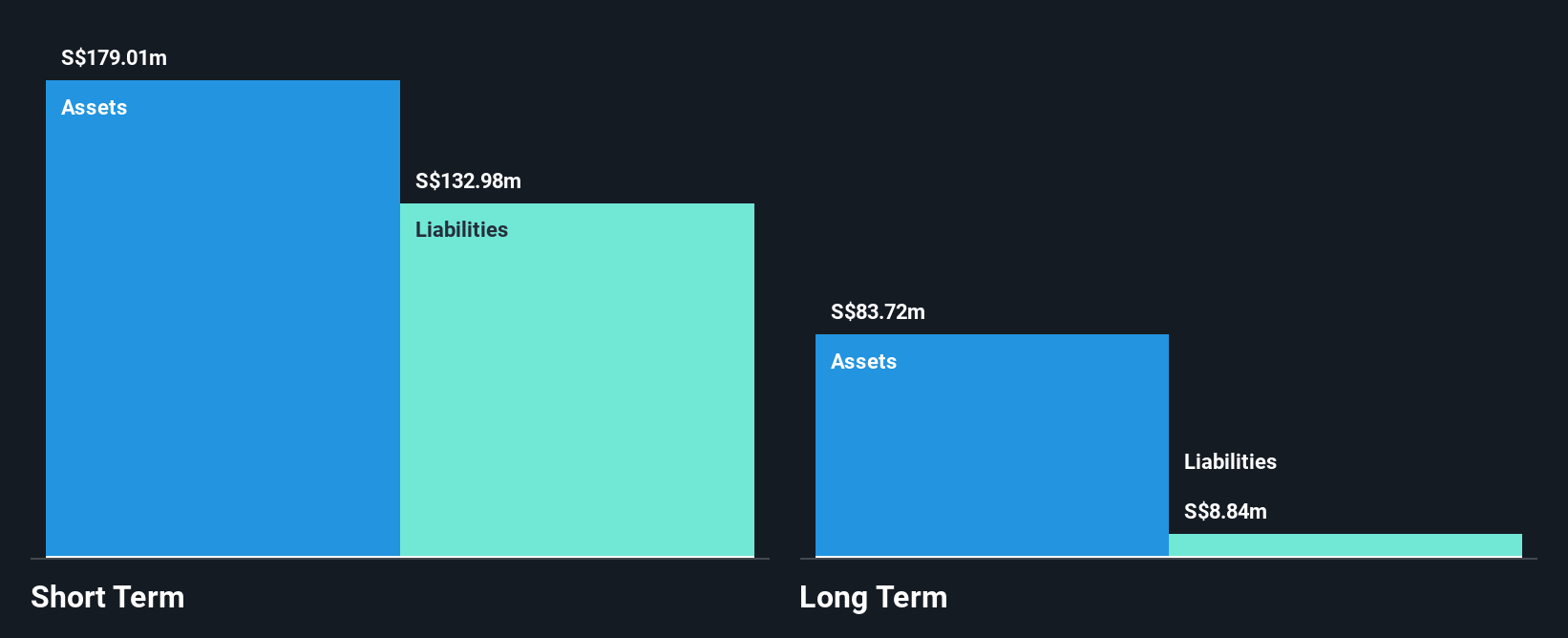

Town Health International Medical Group, with a market cap of HK$1.96 billion, has diverse revenue streams from Hong Kong and Mainland China. Despite its significant short-term assets (HK$1.9 billion) covering both short- and long-term liabilities, the company remains unprofitable with declining earnings over five years by 9.8% annually. Its debt to equity ratio has risen to 6.6%, but it holds more cash than total debt, ensuring a cash runway exceeding three years due to positive free cash flow growth. The new management team may face challenges given their limited tenure amidst ongoing volatility in earnings performance and negative return on equity (-6.42%).

- Navigate through the intricacies of Town Health International Medical Group with our comprehensive balance sheet health report here.

- Learn about Town Health International Medical Group's historical performance here.

Turning Ideas Into Actions

- Embark on your investment journey to our 5,726 Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Town Health International Medical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3886

Town Health International Medical Group

An investment holding company, provides healthcare and related services in the People’s Republic of China and Hong Kong.

Excellent balance sheet and fair value.