- Hong Kong

- /

- Infrastructure

- /

- SEHK:517

Discovering Hidden Potential in None's Undiscovered Gems with Strong Foundations

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. stock indexes climbing higher amid easing core inflation and robust bank earnings, investors are increasingly turning their attention to small-cap stocks, which have shown notable performance gains. In this environment of cautious optimism and shifting market dynamics, identifying stocks with strong foundations becomes crucial for uncovering hidden potential in the ever-evolving landscape of investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Sesoda | 71.33% | 11.54% | 15.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| China Electric Mfg | 13.74% | -13.57% | -32.70% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Nestlé Pakistan | 40.95% | 14.04% | 17.18% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

China Beststudy Education Group (SEHK:3978)

Simply Wall St Value Rating: ★★★★★★

Overview: China Beststudy Education Group specializes in offering after-school education services for K-12 students in China and has a market capitalization of HK$2.85 billion.

Operations: The primary revenue stream for China Beststudy Education Group comes from its K-12 after-school education services, generating CN¥617.90 million.

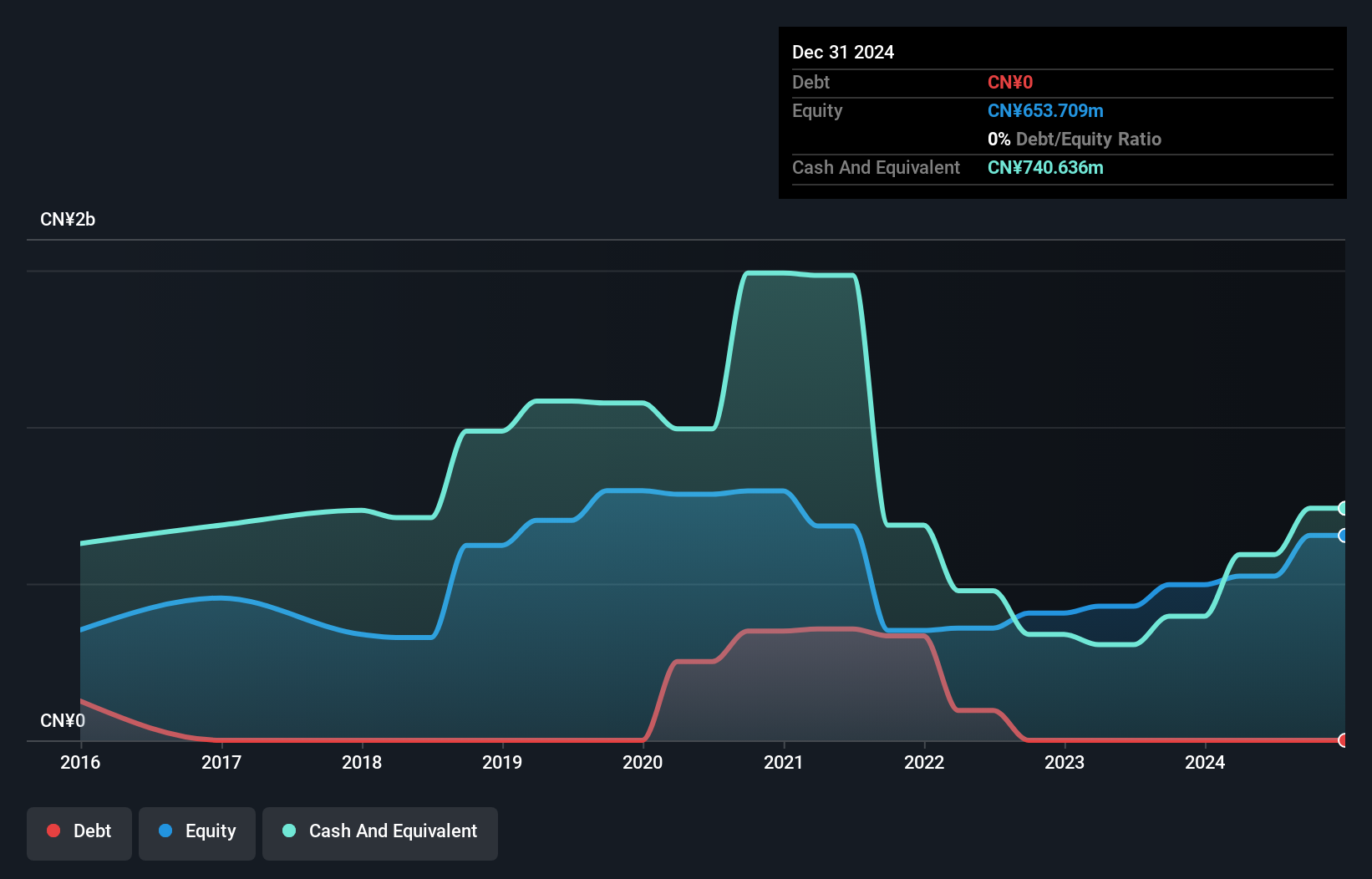

Beststudy, a small education player, is trading at a substantial discount of 96.4% below its estimated fair value, making it an intriguing prospect. Over the past year, earnings surged by 73.5%, outpacing the industry average of 5.5%. The company has maintained a debt-free status for five years and boasts high-quality earnings. Recently, Beststudy announced an ambitious three-year dividend plan to increase payouts up to 70% of net profit by 2026 while ensuring financial stability for growth needs. These moves reflect confidence in its financial health and prospects amid evolving market dynamics in education services.

- Click here and access our complete health analysis report to understand the dynamics of China Beststudy Education Group.

Understand China Beststudy Education Group's track record by examining our Past report.

COSCO SHIPPING International (Hong Kong) (SEHK:517)

Simply Wall St Value Rating: ★★★★★★

Overview: COSCO SHIPPING International (Hong Kong) Co., Ltd. is an investment holding company that offers a range of shipping services both in China and globally, with a market capitalization of approximately HK$6.11 billion.

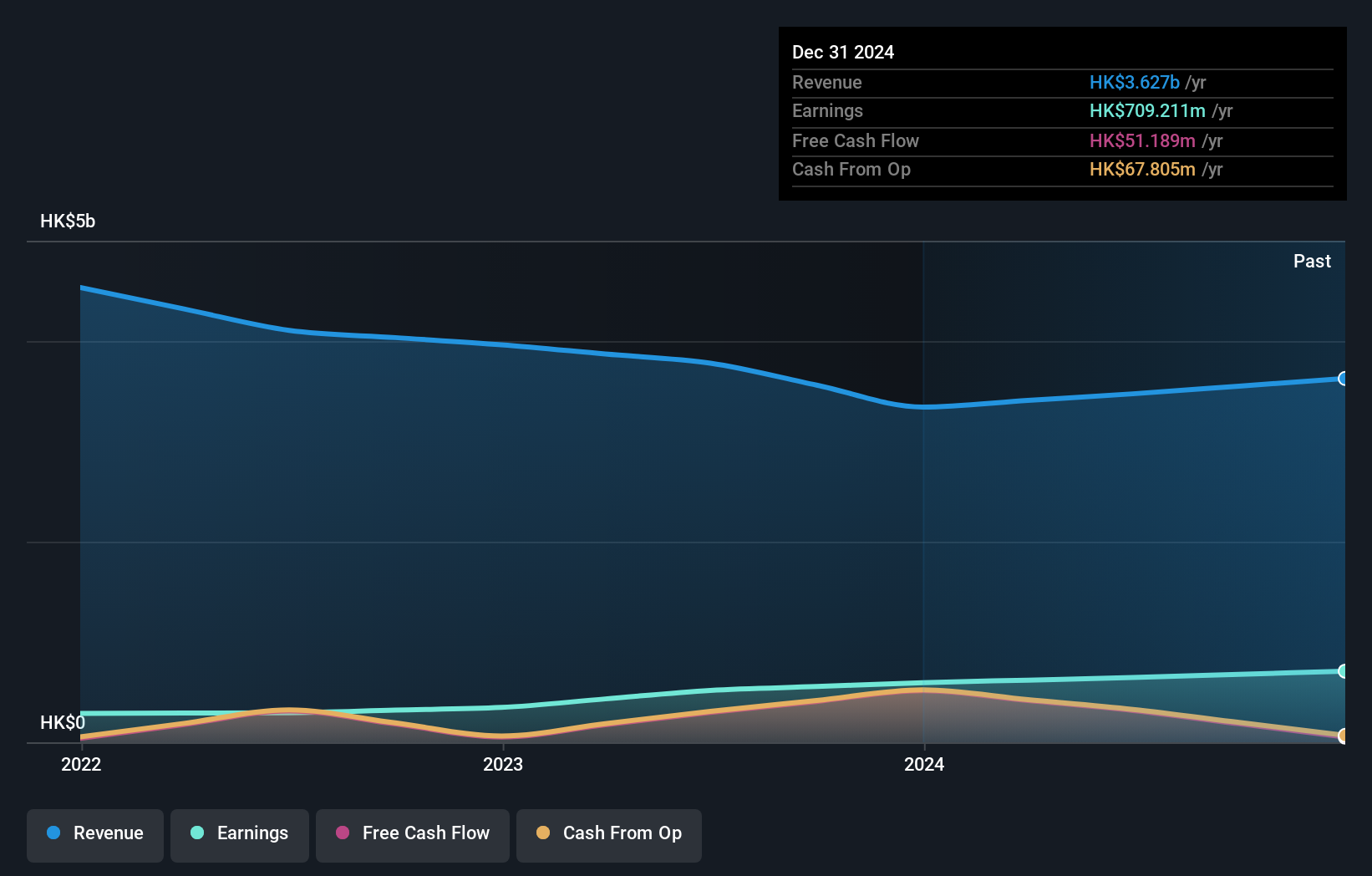

Operations: The company's primary revenue streams include marine equipment and spare parts, coatings, and insurance brokerage services, with marine equipment and spare parts generating HK$1.73 billion. Coatings contribute HK$992.94 million in revenue, while insurance brokerage adds HK$175.51 million. Ship trading agency services also form part of the revenue model with HK$99.97 million in earnings.

COSCO SHIPPING International (Hong Kong) stands out with its impressive earnings growth of 24.8% over the past year, surpassing the Infrastructure industry's 6.7%. The company is debt-free, a notable shift from five years ago when it had a debt-to-equity ratio of 0.8%, indicating improved financial health and stability. With a price-to-earnings ratio of 9.7x, it's trading slightly below the Hong Kong market average of 9.9x, suggesting potential value for investors seeking opportunities in smaller companies within this sector. Additionally, its high-quality earnings and positive free cash flow underscore robust operational efficiency and financial management.

Hangzhou Juheshun New MaterialLTD (SHSE:605166)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hangzhou Juheshun New Material Co., LTD, along with its subsidiaries, focuses on the research and development, manufacture, and sale of polyamide-6 chips across various global markets including China, Europe, South America, Oceania, Southeast Asia, and more; it has a market capitalization of approximately CN¥3.65 billion.

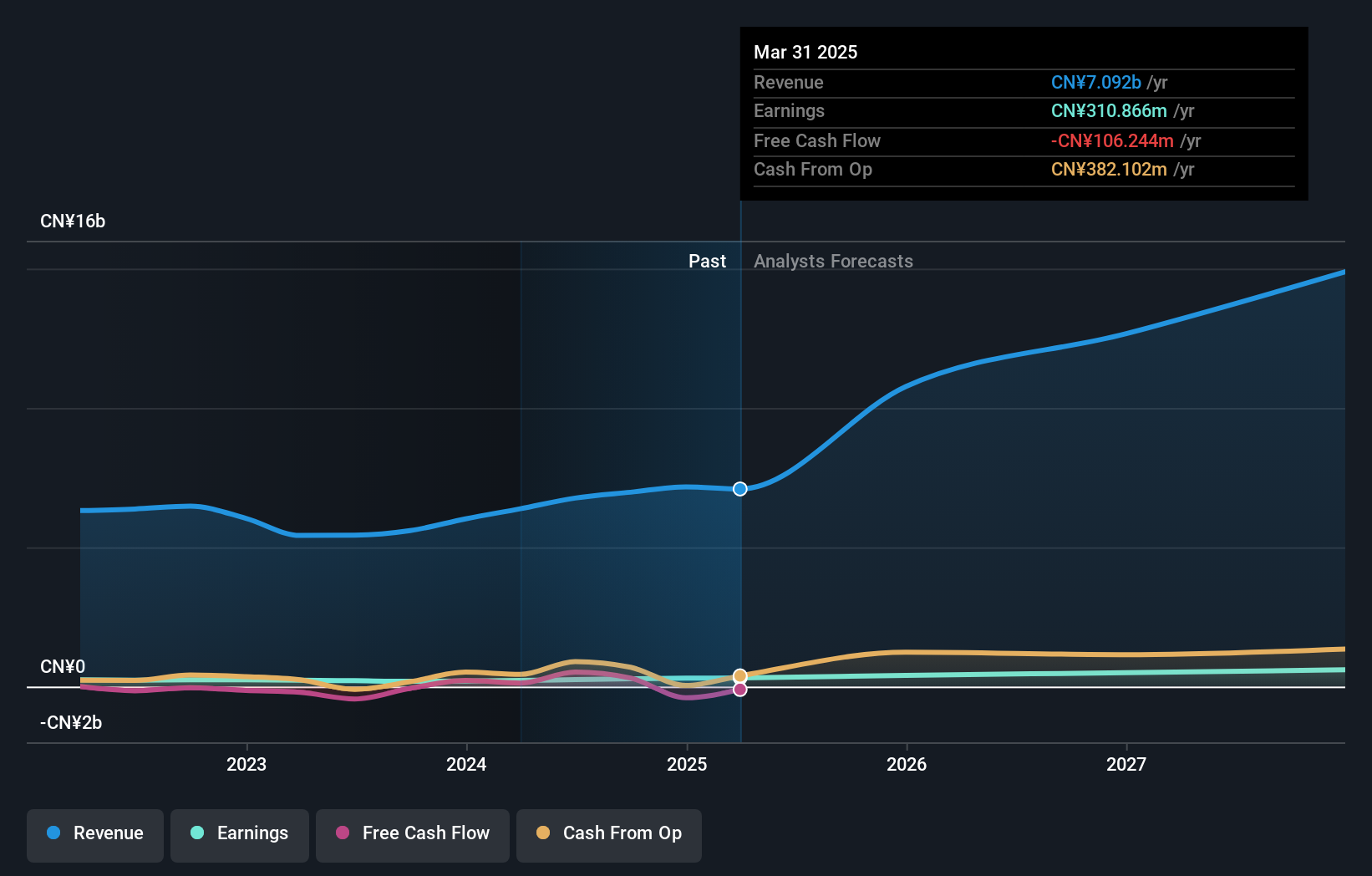

Operations: Juheshun generates its revenue primarily from the production and sale of nylon chips, amounting to approximately CN¥6.97 billion. The company's financial performance is characterized by a focus on this core product line across various international markets.

Hangzhou Juheshun New Material Co., with its strong earnings growth of 48.9% over the past year, outpaced the chemicals industry average of -5.3%. The company is trading at a significant discount, 83.4% below its estimated fair value, indicating good relative value in comparison to peers. Despite an increase in debt-to-equity ratio from 14.5% to 41.9% over five years, it holds more cash than total debt, ensuring financial stability and interest coverage without concern. Moreover, a share repurchase program worth up to CNY 20 million has been announced to optimize capital structure by cancelling shares within a year.

- Unlock comprehensive insights into our analysis of Hangzhou Juheshun New MaterialLTD stock in this health report.

Learn about Hangzhou Juheshun New MaterialLTD's historical performance.

Next Steps

- Explore the 4647 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:517

COSCO SHIPPING International (Hong Kong)

An investment holding company, provides shipping services in Hong Kong, the People’s Republic of China, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)