- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1691

JS Global Lifestyle Leads Our Top 3 Penny Stock Selections

Reviewed by Simply Wall St

As global markets continue to show mixed performance, with major indexes hitting record highs while others lag behind, investors are keenly watching economic indicators and central bank policies. In this context, penny stocks remain an intriguing segment for those seeking growth opportunities in smaller or newer companies. Despite being considered a somewhat outdated term, penny stocks can still represent significant potential when backed by strong financial fundamentals. Here, we explore three such stocks that combine balance sheet strength with promising prospects for investors looking to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$143.12M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$43.17B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$65.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £1.04 | £164.05M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,700 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

JS Global Lifestyle (SEHK:1691)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: JS Global Lifestyle Company Limited is involved in the R&D, design, production, marketing, distribution, and sale of small household appliances across Mainland China, North America, Europe, and other international markets with a market cap of HK$4.90 billion.

Operations: The company's revenue is primarily derived from its Joyoung segment, contributing $1.33 billion, and Sharkninja Apac segment, adding $304.02 million.

Market Cap: HK$4.9B

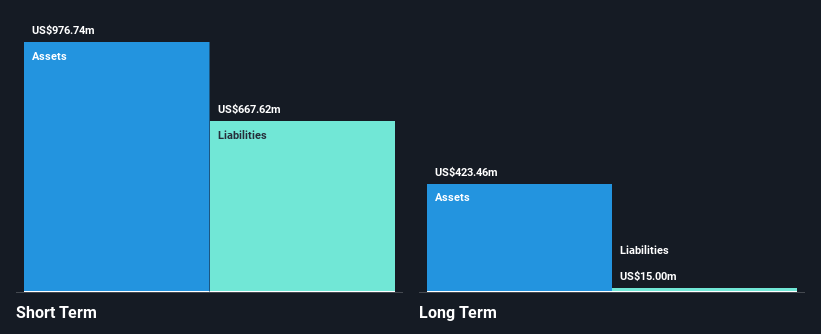

JS Global Lifestyle, with a market cap of HK$4.90 billion, operates debt-free and has strong asset coverage over its liabilities. The company derives significant revenue from its Joyoung and Sharkninja Apac segments, totaling US$1.63 billion. Despite stable weekly volatility and no recent shareholder dilution, JS Global has faced declining profits over the past five years and a notable drop in net profit margins from 5.3% to 2.5%. Earnings are forecasted to grow by 30% annually, although recent growth was negative due to large one-off gains impacting financial results. The management team is experienced with an average tenure of 5.5 years.

- Click to explore a detailed breakdown of our findings in JS Global Lifestyle's financial health report.

- Examine JS Global Lifestyle's earnings growth report to understand how analysts expect it to perform.

Lepu Biopharma (SEHK:2157)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lepu Biopharma Co., Ltd. is a biopharmaceutical company engaged in the discovery, development, and commercialization of cancer targeted therapy and immunotherapy drugs in China and internationally, with a market cap of HK$4.58 billion.

Operations: The company generates revenue of CN¥205.08 million from its pharmaceutical product sales and new drug research and development activities.

Market Cap: HK$4.58B

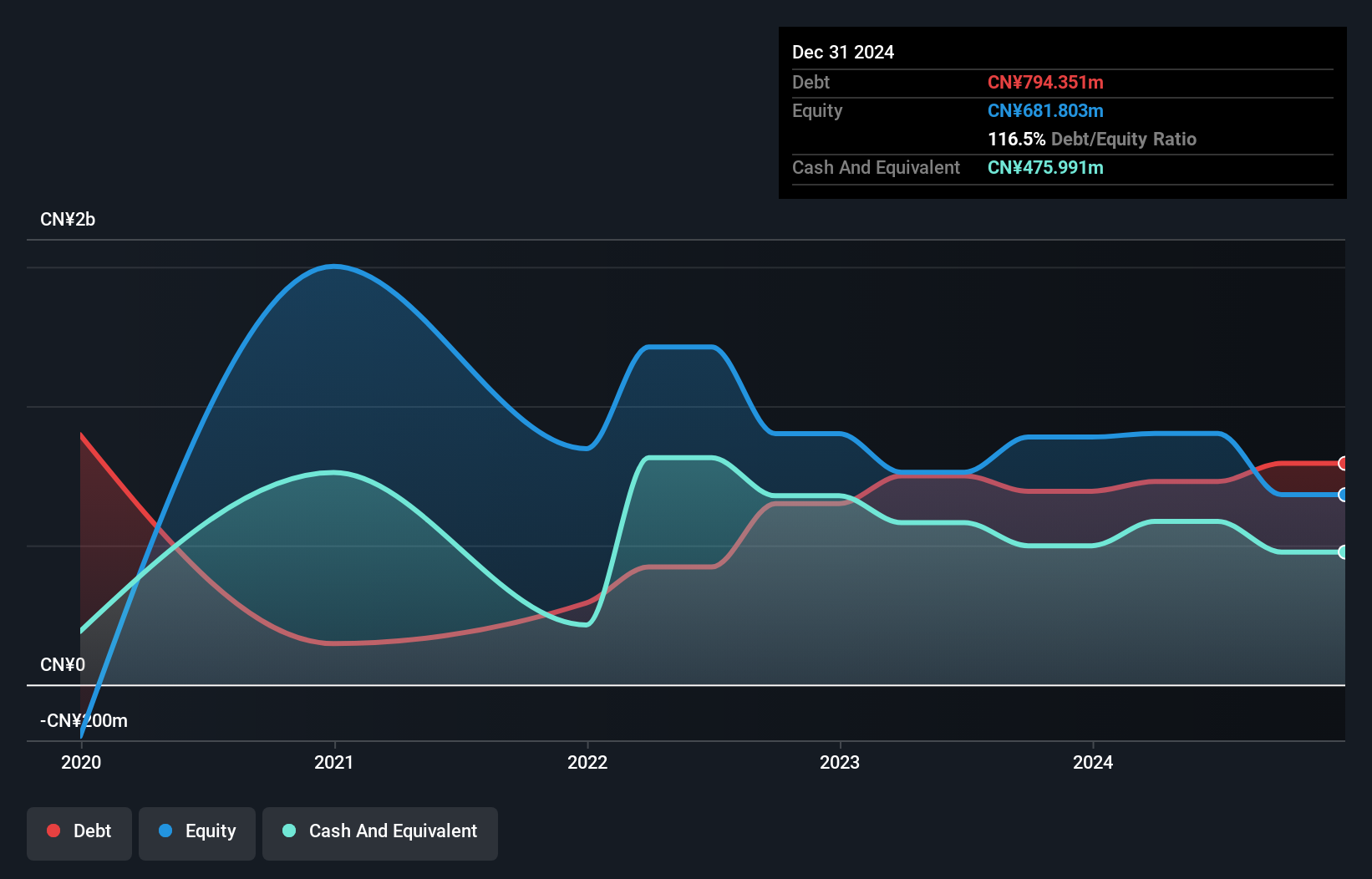

Lepu Biopharma, with a market cap of HK$4.58 billion, is navigating the challenging biotech sector with some promising developments despite being currently unprofitable. The company generates CN¥205.08 million in revenue from its pharmaceutical products and R&D activities but faces short-term liabilities exceeding its short-term assets by CN¥241.7 million. Recent advancements include receiving priority review status for MRG003, an innovative cancer treatment drug candidate, from both Chinese and U.S. regulatory bodies, highlighting potential future growth opportunities. Although shareholders experienced dilution last year, Lepu maintains a satisfactory net debt to equity ratio of 15.9%.

- Take a closer look at Lepu Biopharma's potential here in our financial health report.

- Explore Lepu Biopharma's analyst forecasts in our growth report.

MicroTech Medical (Hangzhou) (SEHK:2235)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MicroTech Medical (Hangzhou) Co., Ltd. focuses on the research, development, manufacture, and sale of medical devices for diabetes monitoring, treatment, and management both in China and internationally with a market cap of HK$1.97 billion.

Operations: The company generates revenue of CN¥293.23 million from its segment dedicated to the research, development, manufacturing, and sales of medical devices.

Market Cap: HK$1.97B

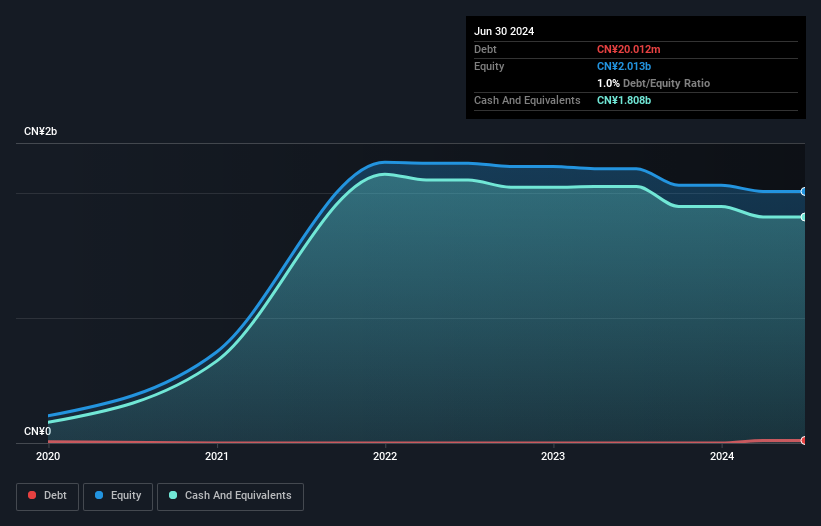

MicroTech Medical (Hangzhou) has a market cap of HK$1.97 billion and generates CN¥293.23 million in revenue from its medical devices segment, yet remains unprofitable with a negative return on equity of -7.16%. The company's short-term assets significantly exceed both its short- and long-term liabilities, indicating strong liquidity. It holds more cash than debt, ensuring financial stability with a cash runway extending beyond three years even if free cash flow continues to decline at historical rates. Recent share buybacks totaling HKD 22.86 million suggest confidence in future prospects without significant shareholder dilution over the past year.

- Navigate through the intricacies of MicroTech Medical (Hangzhou) with our comprehensive balance sheet health report here.

- Learn about MicroTech Medical (Hangzhou)'s future growth trajectory here.

Turning Ideas Into Actions

- Access the full spectrum of 5,700 Penny Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1691

JS Global Lifestyle

Engages in the research and development, design, production, marketing, distribution, and sale of small household appliances in Mainland China, North America, Europe, and internationally.

Flawless balance sheet with moderate growth potential.