- Hong Kong

- /

- Real Estate

- /

- SEHK:606

Catena Media Leads The Charge Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

In a week marked by mixed performances across major U.S. stock indexes, the S&P 500 and Nasdaq Composite reached record highs, while the Russell 2000 Index experienced a decline. Amid these market dynamics, investors are increasingly exploring opportunities in lesser-known segments such as penny stocks. Despite their vintage name, penny stocks—often representing smaller or newer companies—can offer surprising value and potential for growth when backed by strong financials. This article will explore three promising penny stocks that stand out for their financial resilience and long-term potential in today’s diverse market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$143.12M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$43.17B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$65.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £1.04 | £164.05M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,705 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Catena Media (OM:CTM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Catena Media plc, along with its subsidiaries, offers affiliation marketing services for online sports betting and casino operators across North America, the Asia Pacific, and Latin America, with a market cap of SEK358.58 million.

Operations: The company's revenue is generated from two main segments: Casino, contributing €37.16 million, and Sports, accounting for €16.80 million.

Market Cap: SEK358.58M

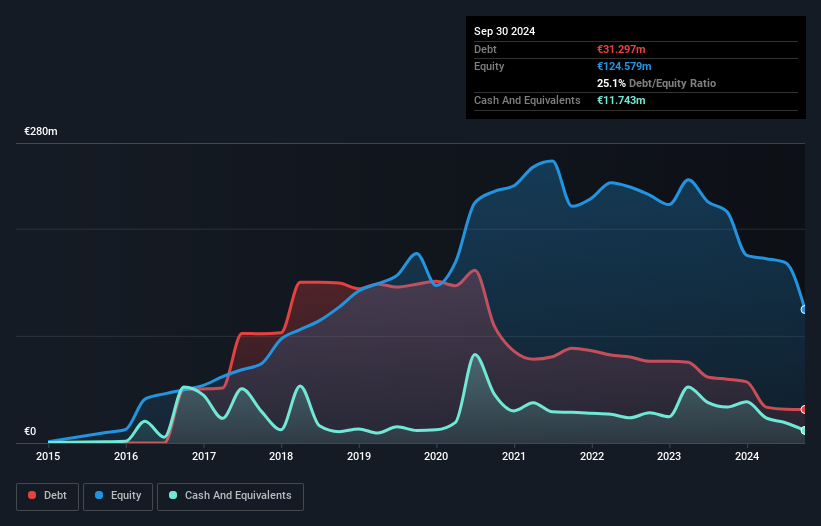

Catena Media's recent performance highlights both challenges and strategic shifts. The company reported a significant net loss of €41.69 million for Q3 2024, compared to a smaller loss the previous year, with revenue dropping from €15.85 million to €10.7 million. Despite this, Catena Media is actively restructuring by streamlining its content teams to focus on product development and diversify revenue streams, aiming for annual cost savings of approximately €2.2 million starting November 2024. Recent board changes bring experienced leaders like Martin Zetterlund and Stephen Taylor-Matthews, potentially strengthening governance amid ongoing financial pressures and high share price volatility.

- Unlock comprehensive insights into our analysis of Catena Media stock in this financial health report.

- Assess Catena Media's future earnings estimates with our detailed growth reports.

SCE Intelligent Commercial Management Holdings (SEHK:606)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SCE Intelligent Commercial Management Holdings Limited offers property management services for commercial and residential properties in the People’s Republic of China, with a market cap of HK$503.10 million.

Operations: The company generates revenue primarily from Residential Property Management Services, amounting to CN¥812.12 million, and Commercial Property Management and Operational Services, which contribute CN¥437.80 million.

Market Cap: HK$503.1M

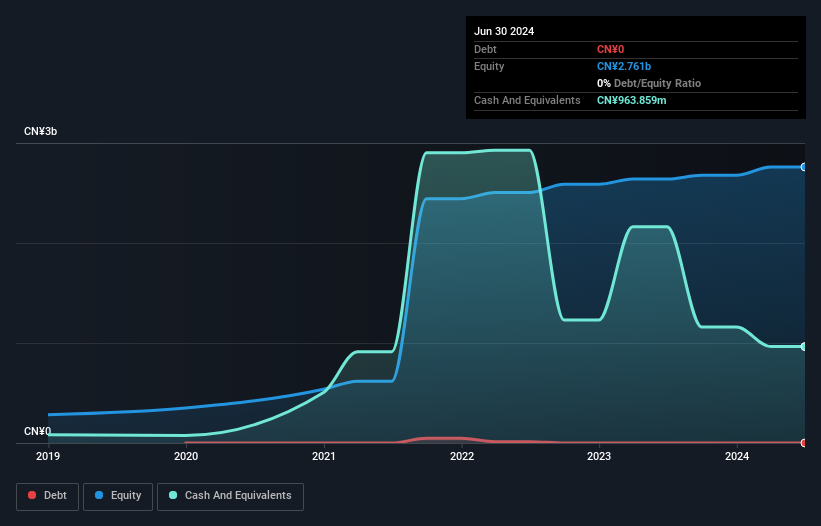

SCE Intelligent Commercial Management Holdings Limited, with a market cap of HK$503.10 million, primarily generates revenue from Residential Property Management Services (CN¥812.12 million) and Commercial Property Management and Operational Services (CN¥437.80 million). The company is debt-free, eliminating concerns over interest payments and showcasing strong financial stability with short-term assets (CN¥2.4 billion) exceeding both short-term liabilities (CN¥791.4 million) and long-term liabilities (CN¥3.2 million). Despite stable weekly volatility at 12%, SCE's earnings growth has been negative recently (-5.7%), although it achieved an annual profit growth rate of 8.6% over the past five years, supported by high-quality earnings and experienced management.

- Click here to discover the nuances of SCE Intelligent Commercial Management Holdings with our detailed analytical financial health report.

- Explore historical data to track SCE Intelligent Commercial Management Holdings' performance over time in our past results report.

China Regenerative Medicine International (SEHK:8158)

Simply Wall St Financial Health Rating: ★★★★☆☆

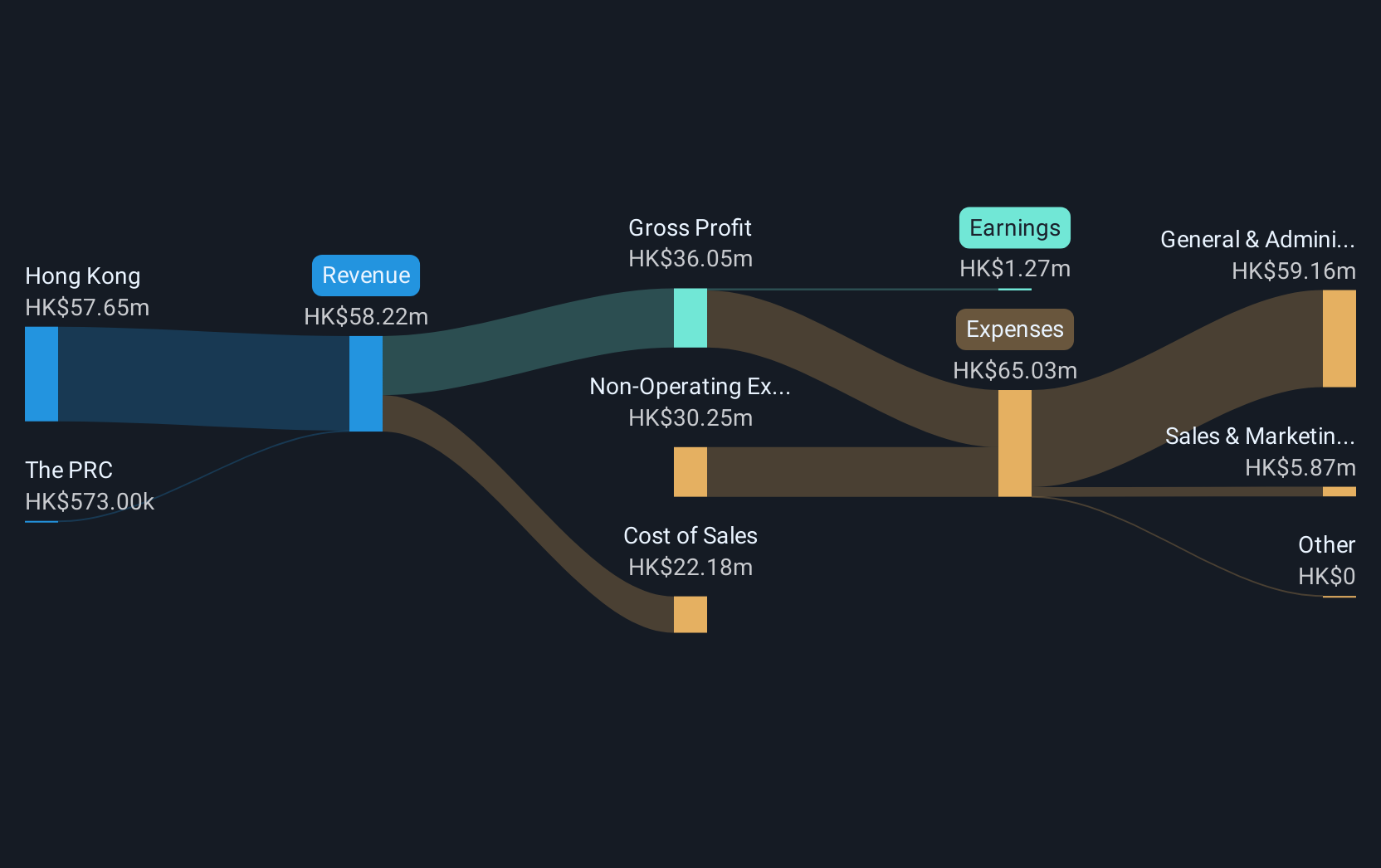

Overview: China Regenerative Medicine International Limited is an investment holding company that provides healthcare products and services in Hong Kong and the People's Republic of China, with a market cap of approximately HK$146.04 million.

Operations: The company generates revenue of HK$53.48 million from its operations in Hong Kong.

Market Cap: HK$146.04M

China Regenerative Medicine International Limited, with a market cap of HK$146.04 million, is currently unprofitable but has managed to reduce its losses by 68.1% annually over the past five years. The company faces high volatility, with weekly fluctuations increasing significantly over the last year. Its debt-to-equity ratio has also risen sharply to 164%, indicating financial leverage concerns. Despite these challenges, it trades at a considerable discount to its estimated fair value and maintains a strong cash position with sufficient runway for more than three years due to positive and growing free cash flow.

- Click to explore a detailed breakdown of our findings in China Regenerative Medicine International's financial health report.

- Gain insights into China Regenerative Medicine International's past trends and performance with our report on the company's historical track record.

Next Steps

- Navigate through the entire inventory of 5,705 Penny Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:606

SCE Intelligent Commercial Management Holdings

Provides property management services for commercial and residential properties in the People’s Republic of China.

Flawless balance sheet and good value.