- Hong Kong

- /

- Communications

- /

- SEHK:1523

High Growth Tech And 2 Other Prominent Stocks with Strong Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced mixed performances, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs while the Russell 2000 saw a decline. Amid this backdrop, growth stocks have notably outperformed value stocks, driven by gains in sectors such as consumer discretionary and information technology. In such an environment, identifying a good stock often involves looking for companies with strong growth potential and robust fundamentals that can thrive despite broader market fluctuations or economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.38% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1294 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market capitalization of HK$5.38 billion.

Operations: The company generates revenue primarily from the sales of software-defined wide area network (SD-WAN) routers, with mobile-first connectivity contributing $59.87 million and fixed-first connectivity accounting for $15.19 million. Additionally, it earns from software licenses and warranty and support services, which bring in $31.86 million.

Plover Bay Technologies has demonstrated a robust financial trajectory, with its net profit for the ten months ending October 2024 surpassing the previous year's total by at least 10%, driven by increased sales of SD-WAN router products and new connectivity solutions. This growth is underpinned by a strategic focus on R&D, which is evident from their investment trends, aligning with an industry-wide emphasis on innovation to stay competitive. The appointment of Ms. Chiu Chi Ying as an executive Director adds legal and intellectual property expertise to the board, potentially enhancing corporate governance and strategic planning capabilities. With earnings forecasted to grow annually at 17.3%—outpacing the Hong Kong market average—Plover Bay is positioning itself strongly within the tech sector despite not being the fastest-growing company in high-growth tech. The company's commitment to research and development (R&D) not only fuels product innovation but also aligns with broader industry trends where significant R&D spending is critical for maintaining technological leadership. Plover Bay's recent performance and strategic appointments suggest it may continue to leverage its R&D capabilities effectively, ensuring sustained growth and competitiveness in a rapidly evolving technology landscape.

- Get an in-depth perspective on Plover Bay Technologies' performance by reading our health report here.

Gain insights into Plover Bay Technologies' past trends and performance with our Past report.

Bonree Data Technology (SHSE:688229)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bonree Data Technology Co., Ltd specializes in providing application performance management services for enterprises in China and has a market capitalization of CN¥2.13 billion.

Operations: The company focuses on delivering application performance management services to enterprises across China. Its revenue model is primarily driven by these specialized services, with a notable emphasis on optimizing enterprise software performance.

Bonree Data Technology is navigating a challenging landscape with its recent financial performance showing a reduction in net loss to CNY 63.16 million from CNY 74.98 million year-over-year, alongside an increase in revenue to CNY 105.12 million, up from CNY 95.13 million. This growth trajectory is supported by significant R&D investments, aligning with industry trends that prioritize innovation for competitive advantage; the company's R&D expenses are crucial in driving the forecasted annual earnings growth of 88%. Moreover, despite current unprofitability and market volatility, Bonree's revenue is expected to grow at an impressive rate of 25.5% per year, outpacing the broader Chinese market's growth rate of 13.8%. These figures underscore the company’s potential pivot towards profitability and sustained growth amidst evolving tech landscapes.

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$99.33 billion.

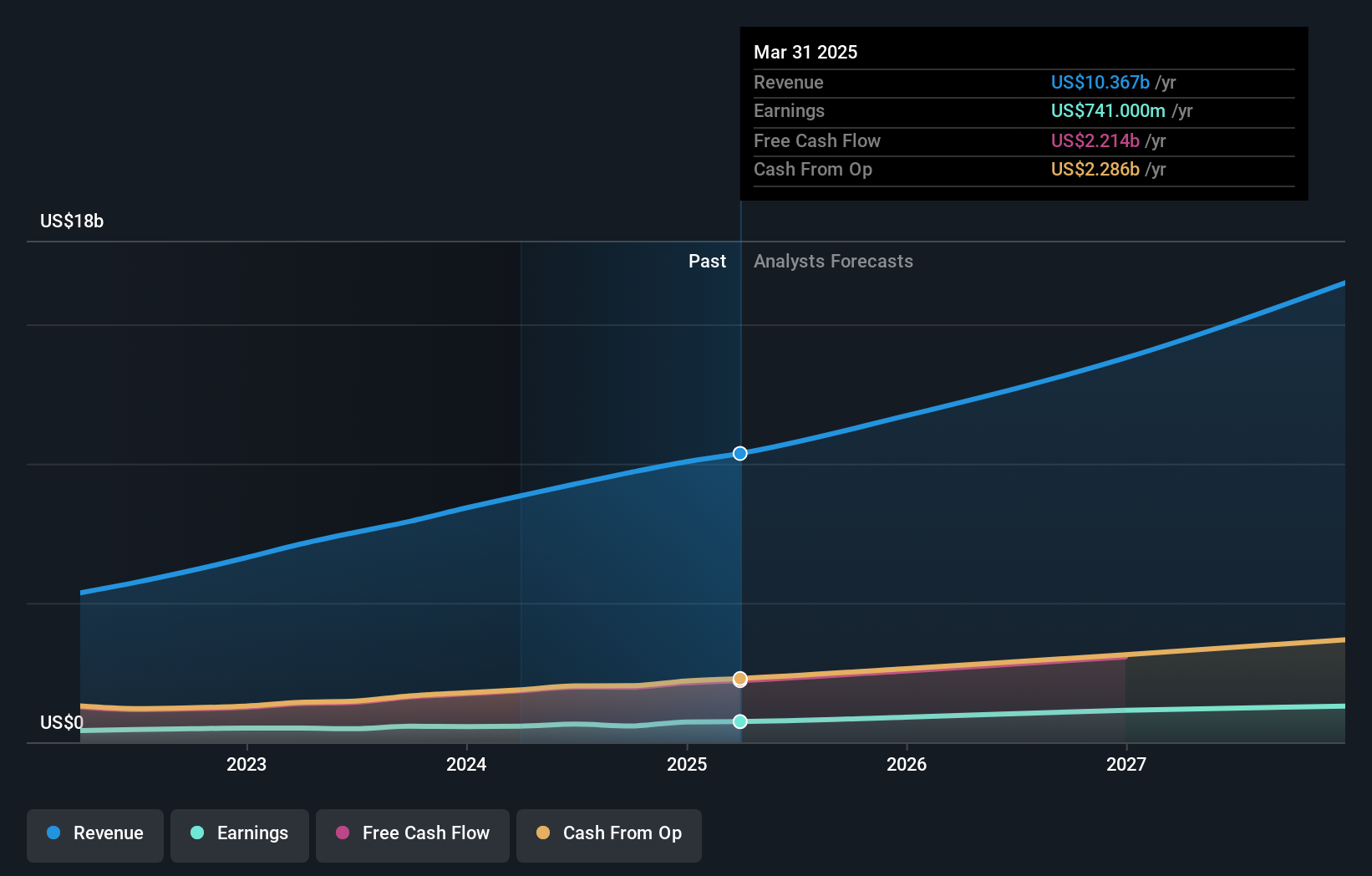

Operations: Constellation Software generates revenue primarily from its software and programming segment, which accounts for $9.68 billion. The company focuses on acquiring and managing vertical market software businesses across various regions.

Constellation Software demonstrates a robust trajectory in the tech sector, with its revenue surging by 15.9% annually, outpacing the Canadian market's growth of 7.6%. This performance is underpinned by strategic R&D investments, which are not only substantial but pivotal for future innovations and competitiveness within the software industry. In particular, R&D expenses have been effectively aligned to foster anticipated earnings growth of 27.9% per year. Additionally, the company's recent involvement in potential acquisitions, such as the bid for Linx S.A., underscores its proactive approach in expanding market influence and enhancing product offerings through strategic mergers and acquisitions.

- Click here and access our complete health analysis report to understand the dynamics of Constellation Software.

Understand Constellation Software's track record by examining our Past report.

Key Takeaways

- Unlock our comprehensive list of 1294 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1523

Plover Bay Technologies

An investment holding company, designs, develops, and markets software defined wide area network routers.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives