- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3393

High Growth Tech Stocks And 2 Other Promising Picks

Reviewed by Simply Wall St

In recent weeks, global markets have been marked by a divergence in major stock indexes, with growth stocks driving record highs in the S&P 500 and Nasdaq Composite, while the Russell 2000 saw a decline following its previous outperformance. This environment has highlighted the potential of high-growth tech stocks as investors continue to favor sectors like consumer discretionary and information technology amidst mixed economic signals such as job growth rebounding and ongoing discussions around interest rate cuts by the Federal Reserve. In this context, identifying promising stocks involves looking for companies that exhibit strong innovation capabilities and adaptability to changing market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| CD Projekt | 24.93% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★☆☆

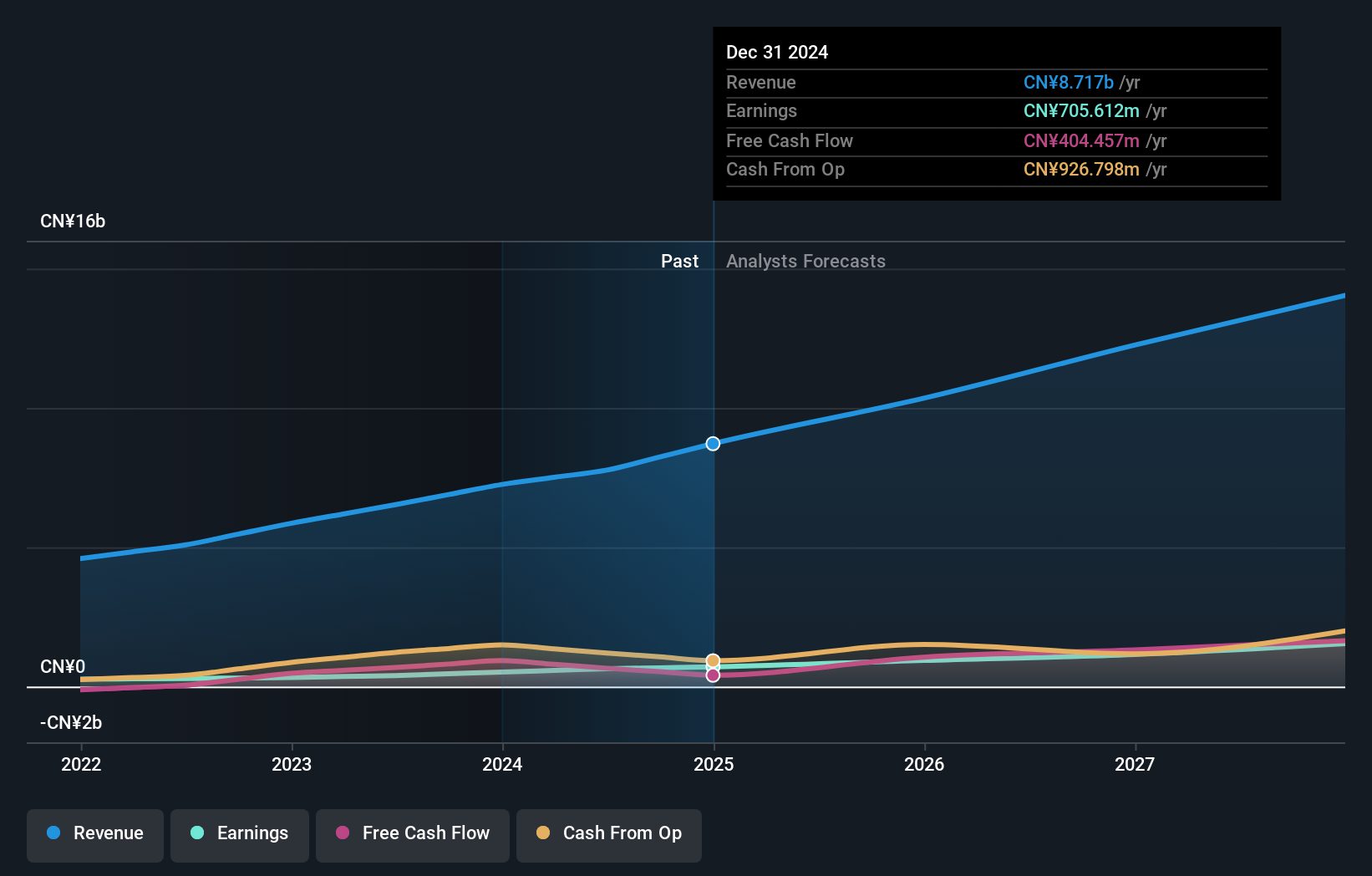

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries across various regions including the People’s Republic of China, Africa, the United States, Europe, and other parts of Asia; it has a market capitalization of approximately HK$6.50 billion.

Operations: The company generates revenue primarily through three segments: Power Advanced Metering Infrastructure (CN¥2.99 billion), Advanced Distribution Operations (CN¥2.51 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion).

Wasion Holdings, with its earnings growth of 61.9% over the past year, outpaces the electronic industry's average of 11.7%, highlighting its robust performance in a competitive sector. The company's revenue and earnings are projected to grow at 18.8% and 22.8% per year respectively, significantly above Hong Kong's market averages of 7.8% and 11.4%. This growth trajectory is supported by substantial R&D investments which have been integral in driving innovation and maintaining a competitive edge in high-tech markets. As Wasion continues to expand its technological capabilities, these strategic investments in research are likely to further enhance its market position and future profitability prospects.

- Navigate through the intricacies of Wasion Holdings with our comprehensive health report here.

Evaluate Wasion Holdings' historical performance by accessing our past performance report.

Sky ICT (SET:SKY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sky ICT Public Company Limited operates in the information and communication technology and system integration sectors in Thailand, with a market capitalization of THB17.17 billion.

Operations: Sky ICT focuses on two primary revenue streams: system integration services, generating THB972.20 million, and sales and services, including finance lease contracts, contributing THB5.02 billion. The company operates within the information and communication technology sector in Thailand.

Sky ICT's recent performance and strategic financial maneuvers showcase its robust position in the tech sector. With a significant 35.8% earnings growth over the past year outpacing its industry's average, and projected annual earnings growth at an impressive 33%, Sky ICT is evidently outperforming market expectations. Furthermore, anticipated revenue growth at 30.7% per year surpasses Thailand's market forecast of 6.5%, underscoring its dynamic market presence and potential for sustained expansion. The company also demonstrated proactive financial management through a recent fixed-income offering aimed at bolstering its long-term investment capabilities, reflecting a thoughtful approach to fueling further innovations and maintaining competitive advantage in rapidly evolving tech landscapes.

- Dive into the specifics of Sky ICT here with our thorough health report.

Examine Sky ICT's past performance report to understand how it has performed in the past.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

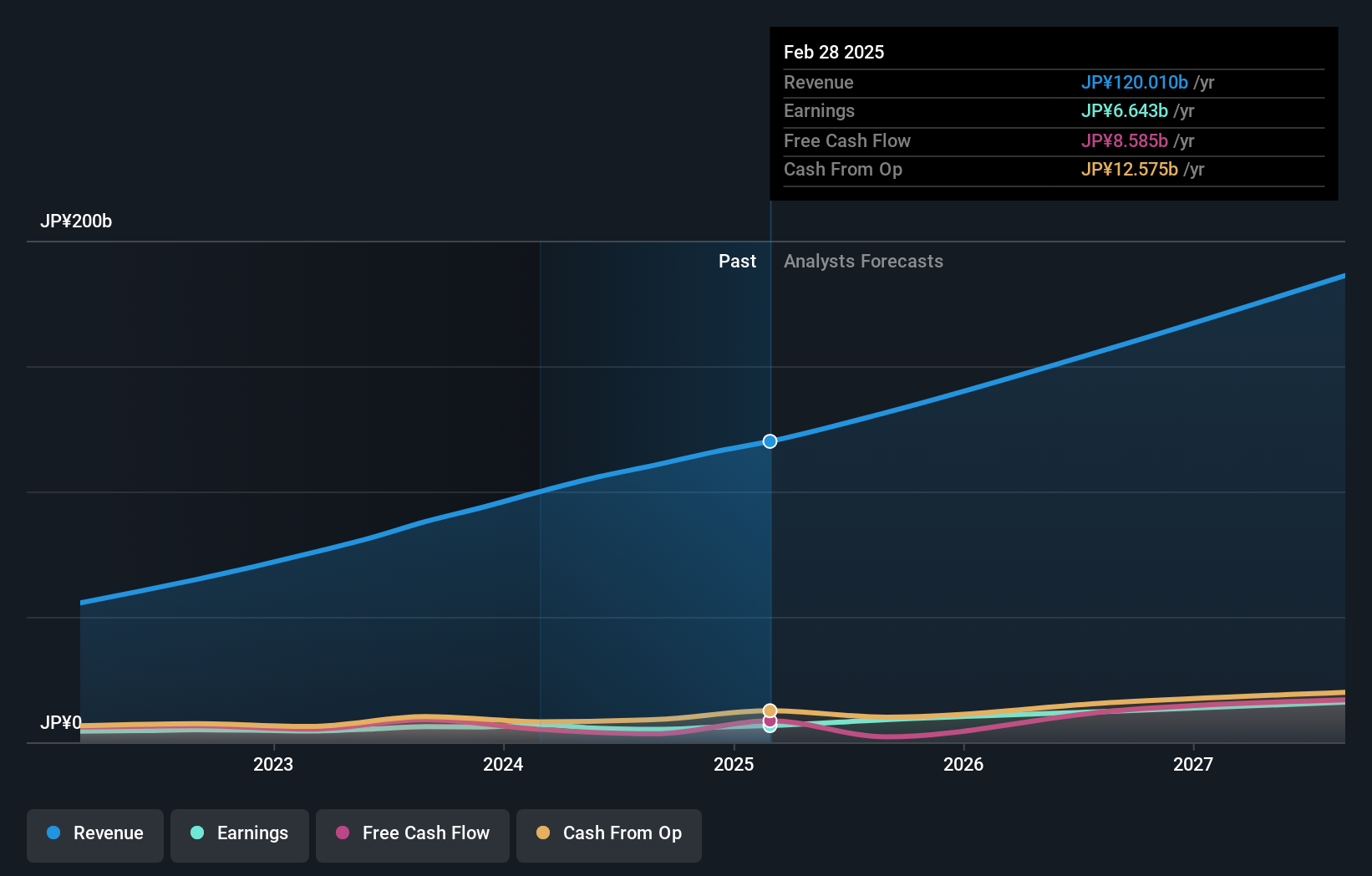

Overview: SHIFT Inc. is a Japanese company specializing in software quality assurance and testing solutions, with a market capitalization of ¥310 billion.

Operations: SHIFT Inc. derives its revenue primarily from Software Testing Related Services, contributing ¥71.34 billion, and Software Development Related Services, which adds ¥35.01 billion.

SHIFT's trajectory in the tech sector is underscored by its aggressive R&D investment, which has consistently outpaced industry norms. In 2024 alone, SHIFT allocated 29.5% of its revenue towards R&D efforts, aiming to refine and expand its software solutions—an investment significantly higher than many peers. This commitment to innovation is pivotal as it navigates a market where annual earnings are expected to surge by 29.5%, reflecting both the company's potential and the high stakes involved in maintaining technological leadership. Moreover, SHIFT recently executed a strategic share repurchase program, buying back shares worth ¥1 billion, which represents a proactive approach to managing capital allocation and enhancing shareholder value. This move complements their robust revenue growth forecast of 16.4% annually, outstripping Japan's broader market projection of just 4.1%. These financial maneuvers not only bolster SHIFT’s balance sheet but also reaffirm its resilience and adaptability in a competitive landscape increasingly dominated by cutting-edge tech developments.

- Delve into the full analysis health report here for a deeper understanding of SHIFT.

Review our historical performance report to gain insights into SHIFT's's past performance.

Taking Advantage

- Unlock our comprehensive list of 1292 High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wasion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3393

Wasion Holdings

An investment holding company, engages in the research and development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries in the People’s Republic of China, Africa, the United States, Europe, and rest of Asia.

Undervalued with solid track record and pays a dividend.