China Resources Beer (SEHK:291): Assessing Valuation Following Leadership Reshuffle

Reviewed by Kshitija Bhandaru

China Resources Beer (Holdings) (SEHK:291) has made sweeping changes to its leadership team, appointing Mr. Jin Hanquan as executive director and president, Mr. Li Nan as a non-executive director, and Ms. Yang Hongxia as chief financial officer. These moves could reshape the company’s operations and influence its market direction.

See our latest analysis for China Resources Beer (Holdings).

Fresh faces at the top may be stirring optimism around China Resources Beer, but the 1-day share price return of 1.39% has yet to reverse a longer-term downtrend. The 1-year total shareholder return remains deep in the red at -15.5%. Still, the stock’s 14.1% year-to-date share price gain hints that momentum could be turning as investors weigh both leadership changes and broader sector recovery.

If leadership shakeups catch your attention, it could be the perfect moment to discover fast growing stocks with high insider ownership.

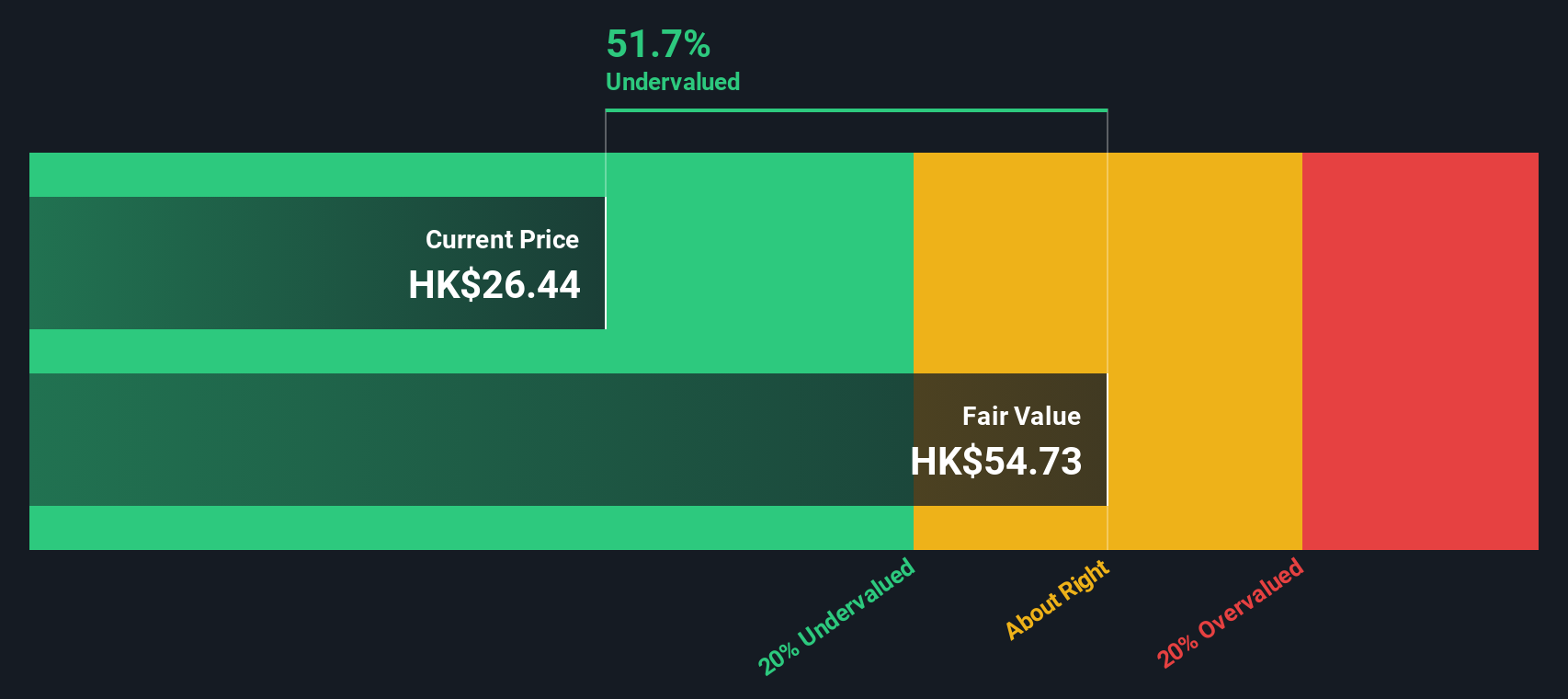

With fresh leadership and some signs of renewed momentum, is China Resources Beer undervalued after last year’s declines, or is the recent optimism already reflecting all the future growth investors can expect?

Price-to-Earnings of 14.1x: Is it justified?

China Resources Beer is trading at a price-to-earnings ratio of 14.1, which puts it well below both industry peers and its historical fair value. With the last close at HK$27.68, investors may be questioning if the current discount truly reflects the company's growth prospects or if the market is overlooking something crucial.

The price-to-earnings (P/E) ratio measures the company's current share price relative to its earnings per share. For beverage companies, the P/E ratio is a key benchmark, reflecting not just profitability but also future expectations around stable revenue streams and sector resilience.

At 14.1x earnings, China Resources Beer is valued notably lower than the Asian Beverage industry average (19.3x) and the peer average (33.5x). This indicates that investors are not pricing in strong future growth relative to similar companies in the region. However, the estimated fair price-to-earnings ratio for the company, based on regression analysis, is 16.2x. This suggests that the stock could reasonably achieve a higher valuation if certain assumptions play out.

Explore the SWS fair ratio for China Resources Beer (Holdings)

Result: Price-to-Earnings of 14.1x (UNDERVALUED)

However, slow annual growth rates in revenue and net income, along with lingering multi-year share price declines, could limit any near-term rerating for China Resources Beer.

Find out about the key risks to this China Resources Beer (Holdings) narrative.

Another View: Discounted Cash Flow Suggests Deeper Value

While the price-to-earnings ratio points to good value, our DCF model tells an even more dramatic story. China Resources Beer’s shares are trading at a 49% discount to our intrinsic value estimate of HK$54.71, according to forecasted future cash flows. Could the market be missing hidden upside, or are risks keeping a lid on value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Resources Beer (Holdings) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Resources Beer (Holdings) Narrative

If you have your own take on these figures or want to dig deeper, you can shape your own investment story in just a few minutes, and Do it your way.

A great starting point for your China Resources Beer (Holdings) research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors seize every edge. If you’re ready to find tomorrow’s winners today, don’t miss these proven opportunities that countless investors keep an eye on:

- Uncover solid income streams as you review these 19 dividend stocks with yields > 3% with yields above 3% and reliable records.

- Capitalize on emerging trends by checking out these 24 AI penny stocks at the forefront of artificial intelligence innovation and rapid market growth.

- Power up your portfolio’s long-term potential with these 889 undervalued stocks based on cash flows to spot hidden gems still trading at attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:291

China Resources Beer (Holdings)

An investment holding company, manufactures, distributes, and sells alcoholic beverages in Mainland China.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives