Amidst the backdrop of global economic uncertainty and fluctuating indices, Asian markets have shown resilience, with China's recent stimulus measures and Japan's positive wage growth outlook providing some optimism. As investors navigate these dynamic conditions, identifying stocks with strong fundamentals and potential for growth becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| VICOM | NA | 3.60% | -2.15% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| Chudenko | NA | 4.57% | 0.97% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| Nikko | 44.54% | 5.86% | -5.45% | ★★★★★☆ |

| Wuhan Guide Technology | 10.56% | 10.17% | 21.41% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| Zhejiang Jinghua Laser TechnologyLtd | 31.04% | 4.49% | -1.72% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Impro Precision Industries (SEHK:1286)

Simply Wall St Value Rating: ★★★★★☆

Overview: Impro Precision Industries Limited offers casting products and precision machining parts across the Americas, Europe, and Asia with a market capitalization of HK$7.61 billion.

Operations: Impro Precision Industries generates revenue primarily from casting products and precision machining parts. The company's net profit margin stands at 10.5%, reflecting its efficiency in managing costs relative to its revenue streams.

Impro Precision Industries, a noteworthy player in the precision manufacturing sector, has shown robust financial health with a net income of HKD 644.3 million for 2024, up from HKD 585.09 million the previous year. The company reported sales of HKD 4.69 billion, reflecting steady growth from HKD 4.60 billion in the prior period. Earnings per share improved to HKD 0.341 from HKD 0.31, indicating enhanced profitability despite industry challenges such as increased debt levels over five years from a debt-to-equity ratio of 24% to 46%. Recent executive changes may further influence strategic direction and governance quality moving forward.

Dekon Food and Agriculture Group (SEHK:2419)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dekon Food and Agriculture Group (SEHK:2419) operates in the hog farming and feedlot sector, with a market capitalization of HK$13.03 billion.

Operations: Dekon Food and Agriculture Group generates revenue primarily from its hog farming and feedlot operations. The company's financial performance is highlighted by a net profit margin trend that provides insight into its profitability.

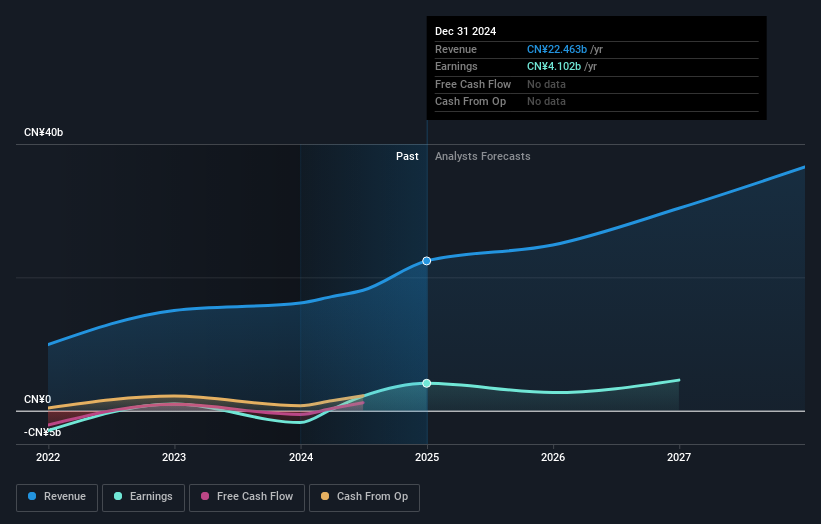

Dekon Food and Agriculture Group, a promising player in the market, has shown remarkable growth with its recent financial performance. The company reported sales of CNY 22.46 billion for 2024, a significant jump from CNY 16.16 billion the previous year. Net income surged to CNY 4.10 billion from a loss of CNY 1.78 billion, showcasing its turnaround to profitability this year. Trading at an attractive value, Dekon is estimated to be priced at 41% below fair value while maintaining high-quality earnings and strong interest coverage at 11 times EBIT over debt payments, indicating robust financial health and potential for future growth.

Dynapack International Technology (TPEX:3211)

Simply Wall St Value Rating: ★★★★★★

Overview: Dynapack International Technology Corporation is a company that manufactures and sells lithium-ion battery packs across Taiwan, the United States, and internationally, with a market capitalization of approximately NT$30.98 billion.

Operations: Dynapack generates revenue primarily from the production and sales of hammer battery packs, amounting to approximately NT$13.91 billion. The company's market capitalization is around NT$30.98 billion.

Dynapack International Technology, a small cap player in the electronics sector, has demonstrated impressive financial resilience. The company reported earnings growth of 239.2% over the past year, significantly outpacing the industry average of 12.5%. Its debt to equity ratio improved from 66.5% to a leaner 9.2% over five years, indicating prudent financial management. Despite sales dropping to TWD 13,911 million from TWD 17,230 million last year, net income surged to TWD 2,673 million compared to TWD 788 million previously. Basic earnings per share rose sharply from TWD 5.23 to TWD 17.59 amidst this backdrop of volatility and robust profit margins.

- Take a closer look at Dynapack International Technology's potential here in our health report.

Learn about Dynapack International Technology's historical performance.

Summing It All Up

- Explore the 2582 names from our Asian Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1286

Impro Precision Industries

Provides casting products and precision machining parts in the Americas, Europe, and Asia.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives