Qinqin Foodstuffs Group (Cayman) (HKG:1583) sheds HK$113m, company earnings and investor returns have been trending downwards for past five years

Statistically speaking, long term investing is a profitable endeavour. But unfortunately, some companies simply don't succeed. Zooming in on an example, the Qinqin Foodstuffs Group (Cayman) Company Limited (HKG:1583) share price dropped 63% in the last half decade. That is extremely sub-optimal, to say the least.

With the stock having lost 15% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Qinqin Foodstuffs Group (Cayman)

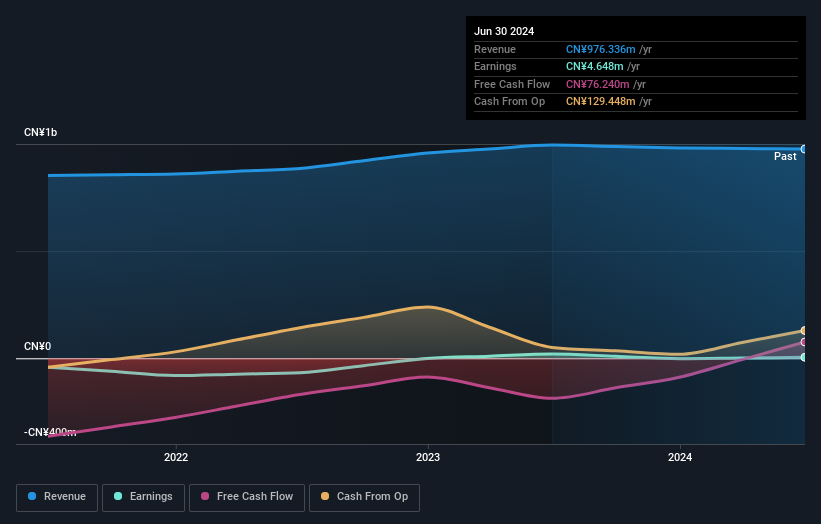

Given that Qinqin Foodstuffs Group (Cayman) only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last half decade, Qinqin Foodstuffs Group (Cayman) saw its revenue increase by 7.9% per year. That's a fairly respectable growth rate. The share price, meanwhile, has fallen 10% compounded, over five years. That suggests the market is disappointed with the current growth rate. A pessimistic market can create opportunities.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Qinqin Foodstuffs Group (Cayman) provided a TSR of 11% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 10% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Qinqin Foodstuffs Group (Cayman) better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Qinqin Foodstuffs Group (Cayman) (including 1 which shouldn't be ignored) .

Qinqin Foodstuffs Group (Cayman) is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

If you're looking to trade Qinqin Foodstuffs Group (Cayman), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qinqin Foodstuffs Group (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1583

Qinqin Foodstuffs Group (Cayman)

An investment holding company, manufactures, sells, and distributes food and snacks products in the People's Republic of China.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives