- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2172

Unveiling Three Undiscovered Gems In Hong Kong With Strong Potential

Reviewed by Simply Wall St

As global markets continue to show mixed results, with small-cap stocks outpacing large-cap growth shares, investors are increasingly looking towards lesser-known opportunities. In this context, the Hong Kong market presents a unique landscape where undiscovered gems can offer significant potential. Identifying strong stocks often involves evaluating their resilience amid economic fluctuations and their capacity for sustainable growth in evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Laopu Gold | 8.43% | 26.56% | 36.28% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd., together with its subsidiaries, engages in the research, development, production, and marketing of edible bird’s nest (EBN) products in the People’s Republic of China with a market cap of HK$6.99 billion.

Operations: The primary revenue streams for Xiamen Yan Palace Bird's Nest Industry Co., Ltd. include Direct Sales to Online Customers (CN¥824.40 million), Sales to Offline Distributors (CN¥509.04 million), and Direct Sales to Offline Customers (CN¥351.17 million).

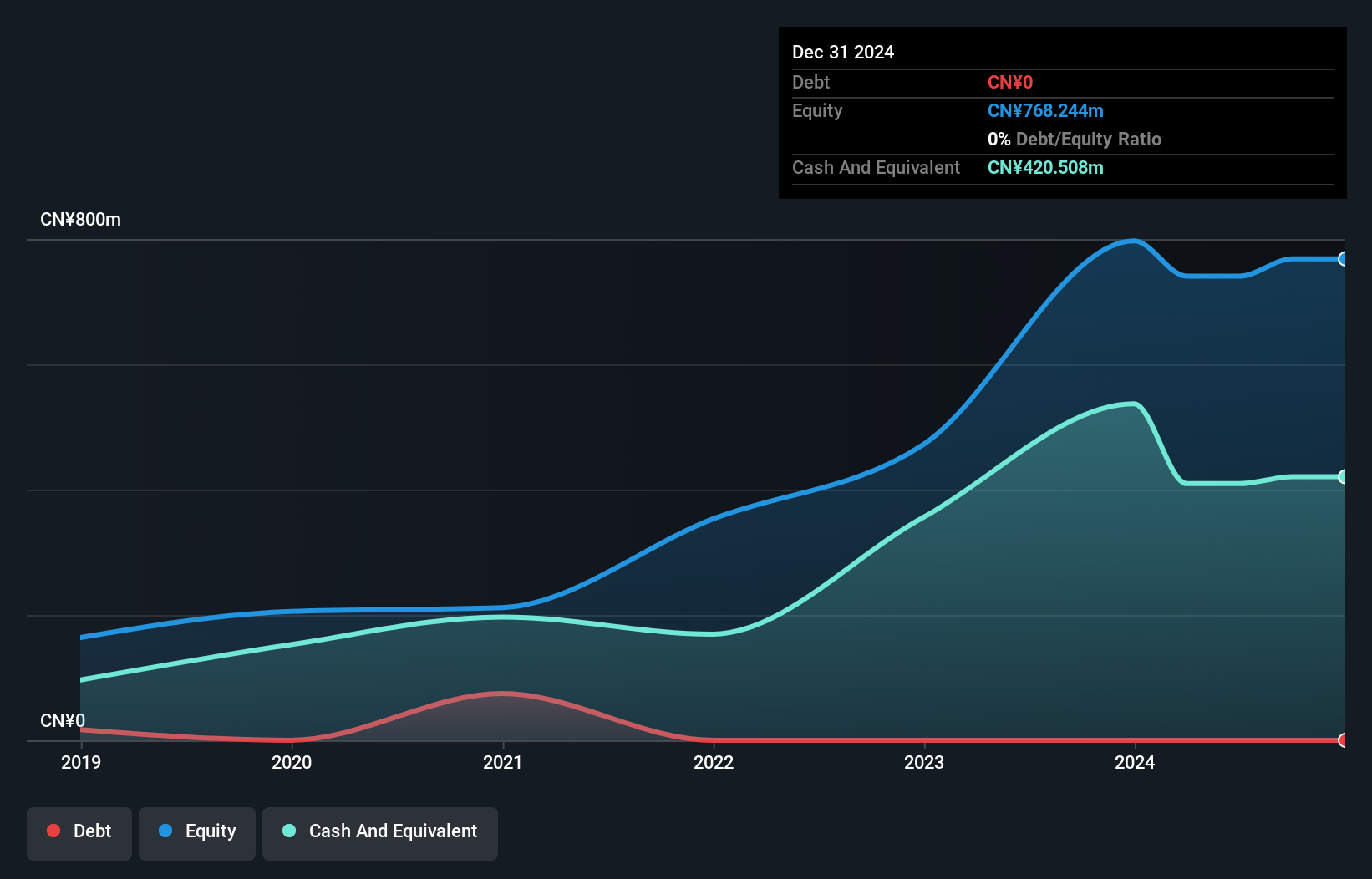

Xiamen Yan Palace Bird's Nest Industry, a small cap stock, has no debt and boasts high-quality non-cash earnings. Over the past year, its earnings growth of 4.9% surpassed the Food industry’s 4.1%. The company expects revenue between RMB 1.05 billion to RMB 1.09 billion for H1 2024, up by roughly 10-15% from last year, though net profit may drop by around 40-50%. Notably, a final dividend of RMB 2.15 per share was approved in May.

- Dive into the specifics of Xiamen Yan Palace Bird's Nest Industry here with our thorough health report.

Learn about Xiamen Yan Palace Bird's Nest Industry's historical performance.

MicroPort NeuroTech (SEHK:2172)

Simply Wall St Value Rating: ★★★★★★

Overview: MicroPort NeuroTech Limited focuses on the research, development, production, and sale of neuro-interventional medical devices in China and internationally, with a market cap of approximately HK$4.59 billion.

Operations: MicroPort NeuroTech Limited generates revenue primarily from the sale of surgical and medical equipment, amounting to CN¥665.62 million. The company's market cap is approximately HK$4.59 billion.

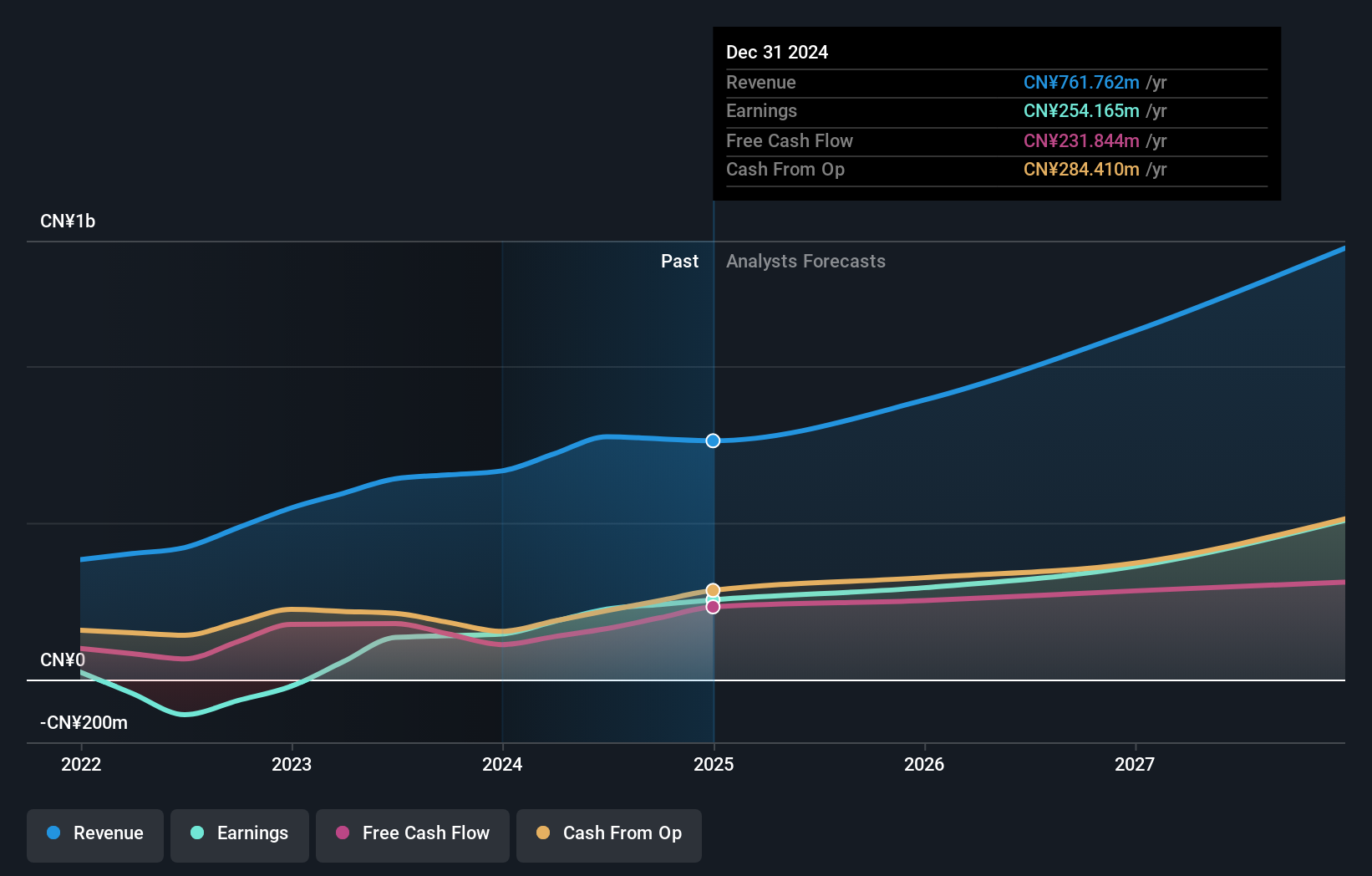

MicroPort NeuroTech, recently renamed MicroPort NeuroScientific Corporation, has shown significant growth. The company reported a net profit of RMB 130 million to RMB 150 million for the first half of 2024, up by approximately 124% to 158% from the previous year. Revenue is expected to reach RMB 400 million to RMB 410 million, marking a rise of around 34% to 37%. This debt-free entity trades at about half its estimated fair value and boasts high-quality earnings.

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for various global markets, with a market cap of HK$6.23 billion.

Operations: Wasion Holdings generates revenue primarily from three segments: Power Advanced Metering Infrastructure (CN¥2.67 billion), Advanced Distribution Operations (CN¥2.48 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.21 billion).

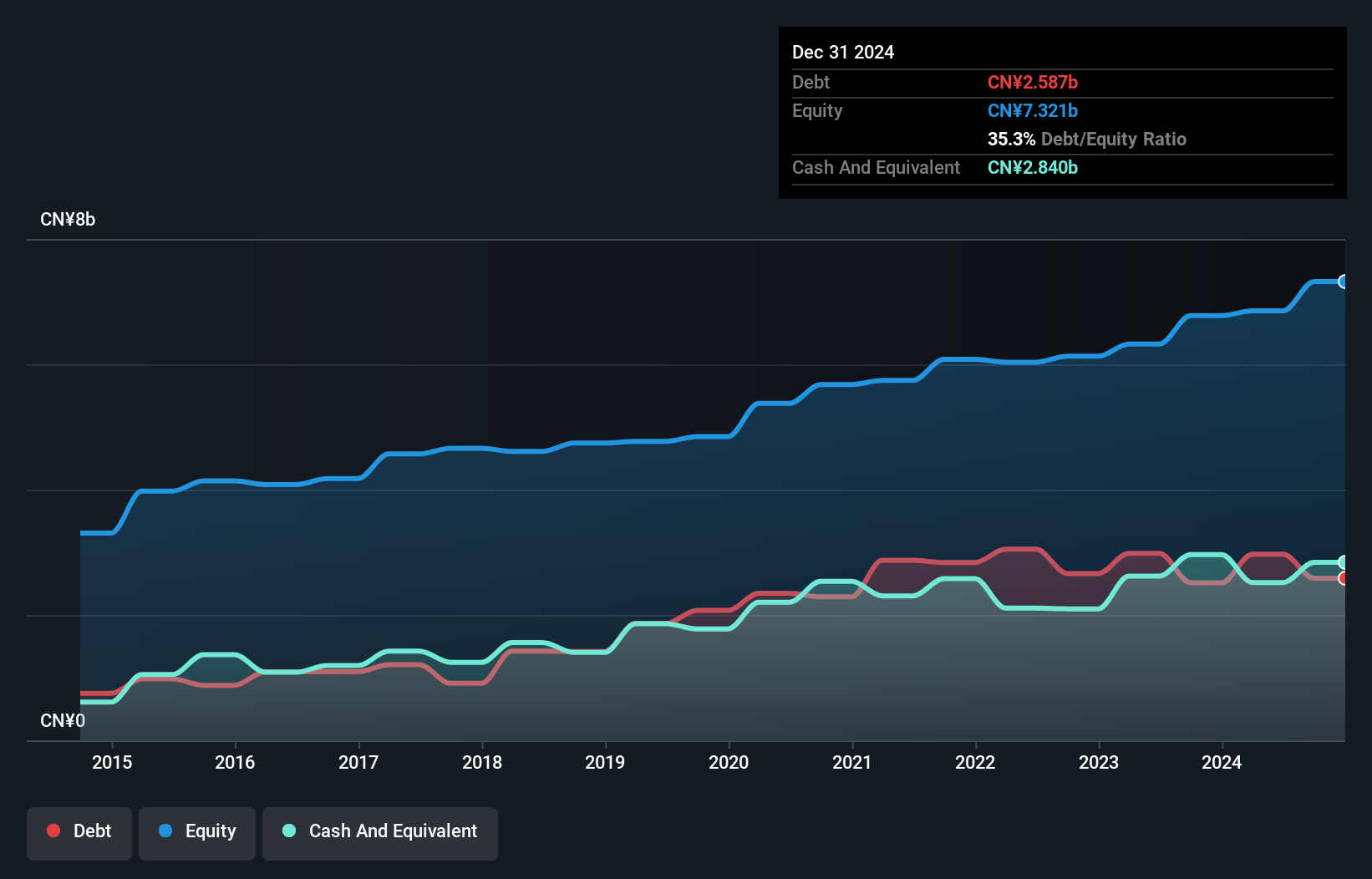

Wasion Holdings has been making significant strides in the smart meter industry, recently securing contracts worth EUR 31.62 million in Hungary and USD 15.16 million across Singapore and Malaysia. The company repurchased shares this year, indicating confidence in its value proposition. With earnings growth of 61% over the past year, Wasion's performance outpaced the Electronic industry’s -8.7%. Trading at 34% below estimated fair value and having high-quality earnings further underscore its potential as an investment opportunity.

- Delve into the full analysis health report here for a deeper understanding of Wasion Holdings.

Assess Wasion Holdings' past performance with our detailed historical performance reports.

Where To Now?

- Dive into all 176 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2172

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)