- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1088

Top Hong Kong Dividend Stocks For July 2024

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, Hong Kong's stock market has shown resilience amidst regional uncertainties. This backdrop sets a compelling stage for investors looking to explore dividend-yielding stocks in Hong Kong, which can offer potential stability and income in these fluctuating times.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| CITIC Telecom International Holdings (SEHK:1883) | 9.37% | ★★★★★★ |

| China Construction Bank (SEHK:939) | 7.76% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.77% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.86% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 8.20% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 9.18% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.54% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.14% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.25% | ★★★★★☆ |

| Tian An China Investments (SEHK:28) | 4.94% | ★★★★★☆ |

Click here to see the full list of 90 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

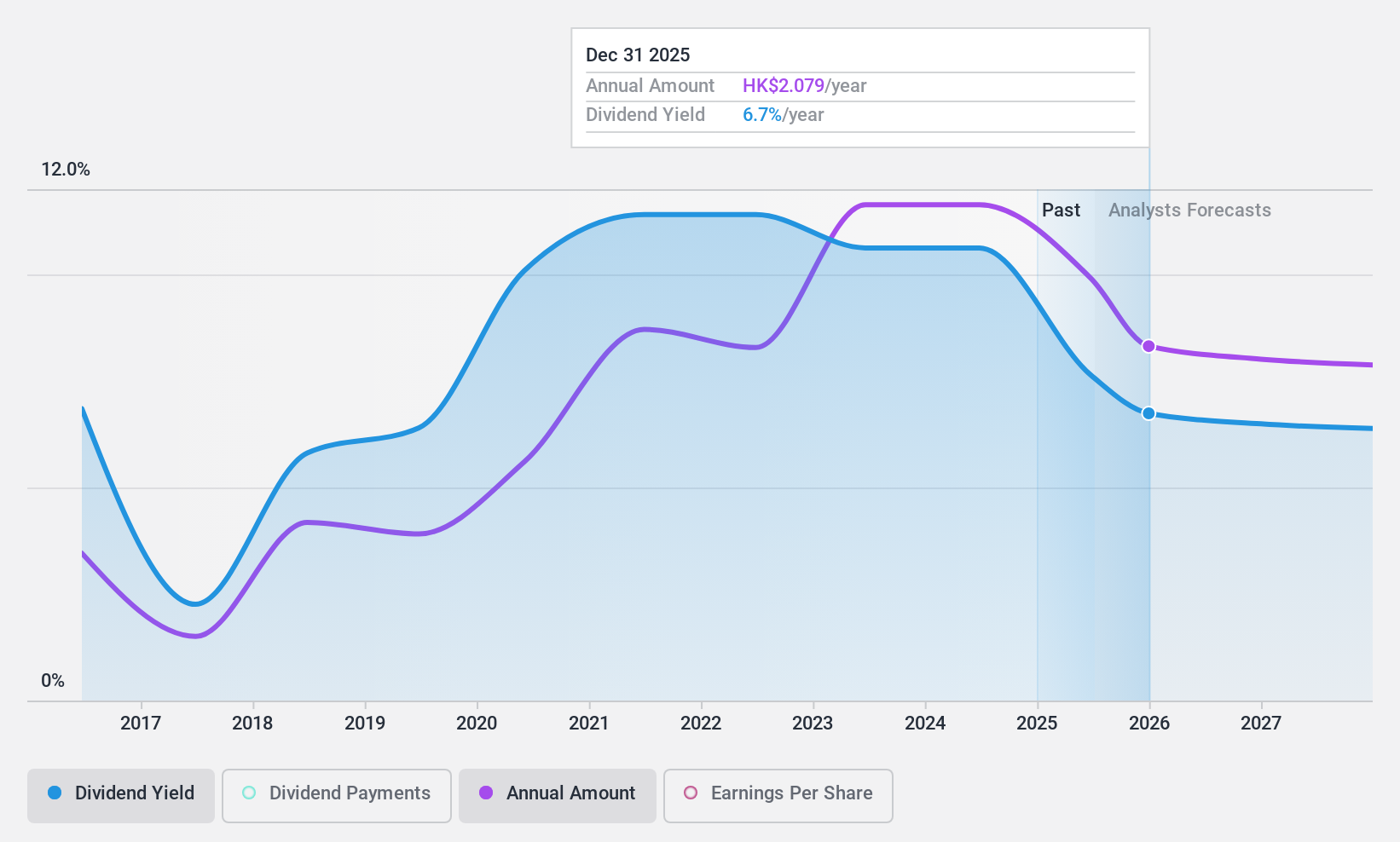

China Shenhua Energy (SEHK:1088)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Shenhua Energy Company Limited operates in coal production and sales, power generation, and transportation services via railways, ports, and shipping, as well as coal-to-olefins conversion, both domestically in the People’s Republic of China and internationally, with a market capitalization of approximately HK$931.83 billion.

Operations: China Shenhua Energy Company Limited generates revenue through various segments, including coal at CN¥273.67 billion, power at CN¥93.61 billion, railway at CN¥43.62 billion, port operations at CN¥6.84 billion, shipping at CN¥4.92 billion, and coal chemical businesses at CN¥6.08 billion.

Dividend Yield: 6.4%

China Shenhua Energy's dividend yield stands at 6.52%, lower than the top quartile of Hong Kong dividend stocks at 8.02%. Despite a decade of growth, dividends have been unstable and recently decreased to RMB 2.26 per share for FY2023, with payment scheduled for August 21, 2024. Dividends are supported by earnings and cash flows with payout ratios of 79.1% and 87% respectively, but volatility in payments raises concerns about reliability in future distributions.

- Navigate through the intricacies of China Shenhua Energy with our comprehensive dividend report here.

- The valuation report we've compiled suggests that China Shenhua Energy's current price could be inflated.

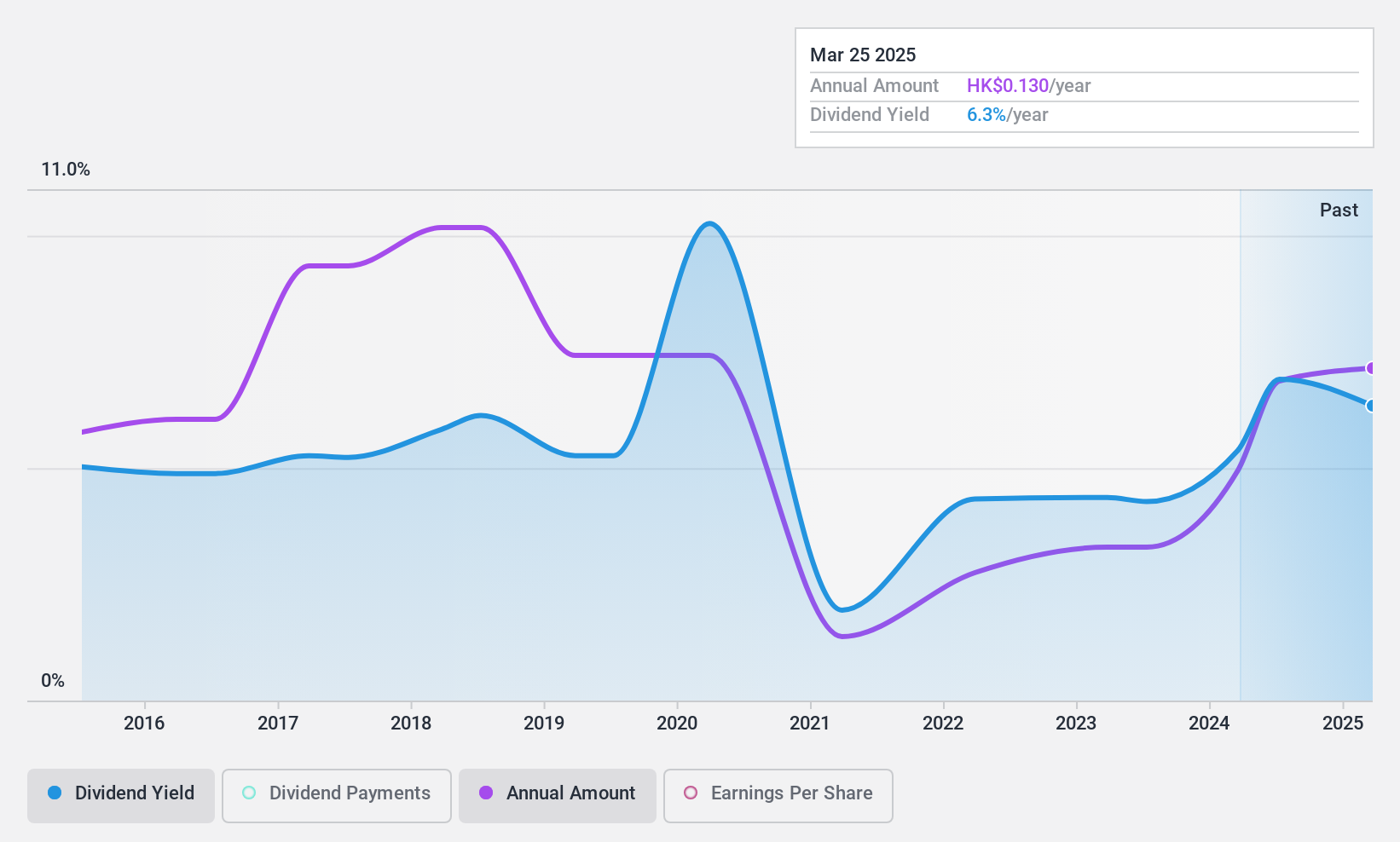

Pico Far East Holdings (SEHK:752)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pico Far East Holdings Limited operates in various sectors including exhibition, event, and brand activation; visual branding; museum and themed environments; and meeting architecture, with a market capitalization of approximately HK$2.34 billion.

Operations: Pico Far East Holdings Limited generates revenue through several key segments: HK$5.01 billion from exhibition, event, and brand activation; HK$454.95 million from visual branding activation; HK$444.37 million from museum and themed environments; and HK$162.78 million from meeting architecture activation.

Dividend Yield: 6.6%

Pico Far East Holdings recently increased its interim dividend to HK$0.055 per share, reflecting a positive earnings report with second-quarter sales rising to HK$2.94 billion and net income nearly doubling to HK$191.7 million. Despite a low yield of 6.61% relative to Hong Kong's top dividend payers, the company maintains a sustainable payout with a 48.6% earnings payout ratio and 38.1% from cash flows, indicating sound financial health for supporting ongoing dividends, although historical payments have shown volatility.

- Take a closer look at Pico Far East Holdings' potential here in our dividend report.

- The analysis detailed in our Pico Far East Holdings valuation report hints at an deflated share price compared to its estimated value.

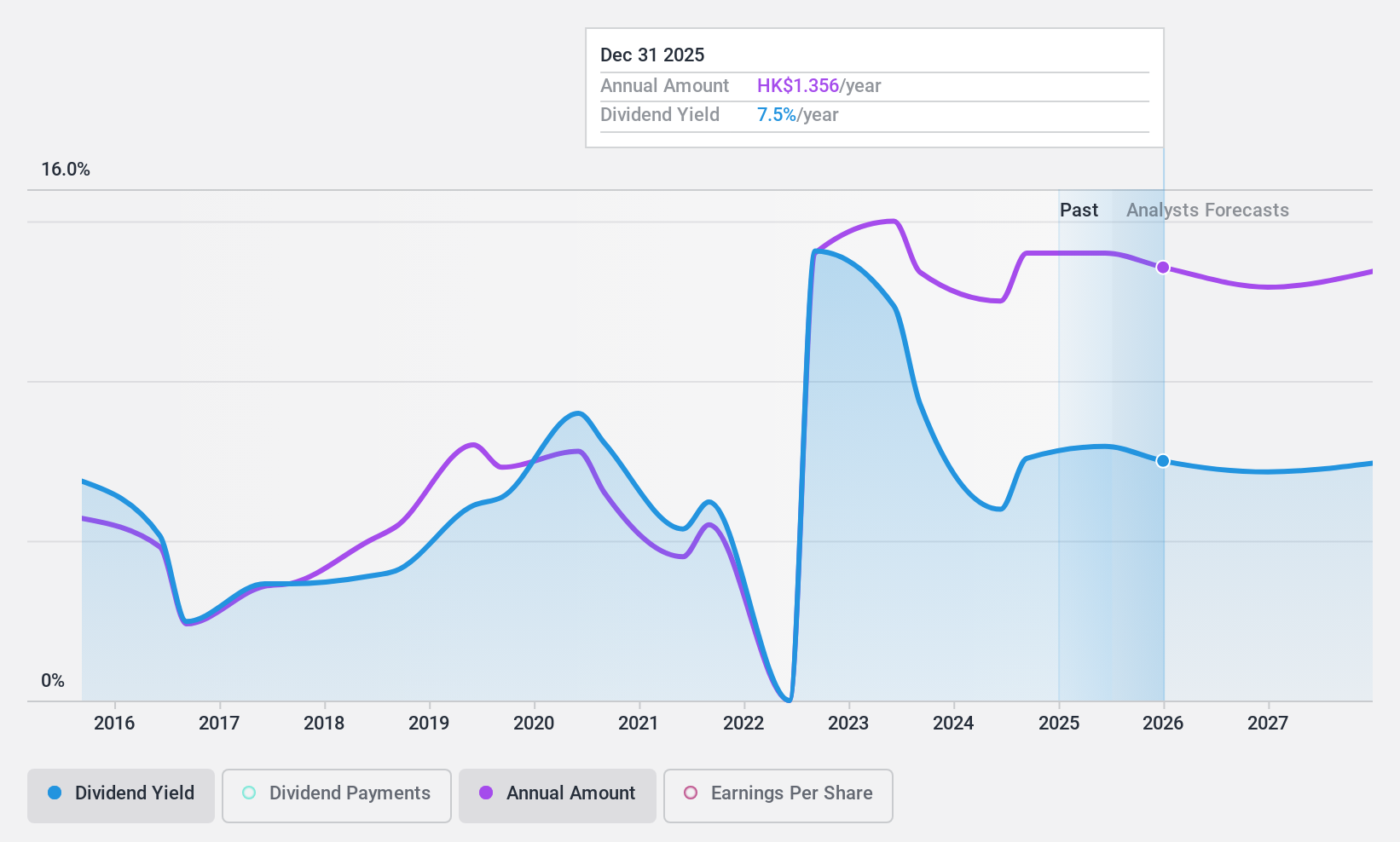

CNOOC (SEHK:883)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNOOC Limited is an investment holding company that specializes in the exploration, development, production, and sale of crude oil and natural gas, with a market capitalization of approximately HK$1.16 trillion.

Operations: CNOOC Limited primarily generates its revenue from the exploration, development, production, and sale of crude oil and natural gas.

Dividend Yield: 5.3%

CNOOC Limited, a major player in the energy sector, has demonstrated a commitment to expanding production with recent developments like the Wushi 23-5 and Enping 21-4 oilfields. Despite these expansions and a dividend yield of 5.3%, which is lower than the top quartile of Hong Kong dividend stocks at 8.02%, its dividends have shown volatility over the past decade. However, both earnings (41.1% payout ratio) and cash flows (59.4% cash payout ratio) adequately cover these dividends, suggesting financial prudence despite an unstable track record in dividend growth and expected earnings decline by an average of 1.5% annually over the next three years.

- Get an in-depth perspective on CNOOC's performance by reading our dividend report here.

- Our valuation report unveils the possibility CNOOC's shares may be trading at a discount.

Taking Advantage

- Dive into all 90 of the Top Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade China Shenhua Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1088

China Shenhua Energy

Engages in the production and sale of coal and power; railway, port, and shipping transportation; and coal-to-olefins businesses in the People’s Republic of China and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives