- Hong Kong

- /

- Oil and Gas

- /

- SEHK:883

Assessing CNOOC Stock After Recent Oil Price Pullback and Earnings Growth Projections

Reviewed by Bailey Pemberton

Are you eyeing CNOOC as your next big portfolio move? It is no wonder, given how much attention this stock has attracted from investors weighing energy exposure in today’s uncertain markets. CNOOC might not be making wild headlines every week, but its stock price tells quite a story: steady, sometimes dramatic, and never boring. Over the last five years, the stock has delivered a jaw-dropping 320.8% return, and even the three-year mark boasts a 150.7% climb. Recently, momentum has cooled a bit, with a modest 0.1% gain over the past week and a dip of 6.5% in the last month. Year-to-date, CNOOC sits nearly where it began, and, over the past year, the move has been a more subdued 0.9% up. Much of this recent leveling out traces back to shifting oil market sentiment and changes in how investors perceive risk in energy producers more generally, as global supply concerns and geopolitical factors weigh on long-term demand forecasts.

But what about valuation? Here is where things get interesting. CNOOC currently earns a value score of 5 out of 6, meaning it checks the box as undervalued in 5 of the 6 main measures analysts use. That is not just good, it is rare. So, what exactly do those valuation checks look like, and is there a better way to cut through the noise and find true value? Let’s dig into the traditional approaches, and later, we will explore a smarter way to size up CNOOC’s worth.

Why CNOOC is lagging behind its peers

Approach 1: CNOOC Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) analysis is a widely used valuation tool that estimates a company’s intrinsic value by projecting its future free cash flows and then discounting those cash flows back to their value today. For CNOOC, this approach provides a transparent look at how future performance might impact what the business is worth right now.

Currently, CNOOC generates trailing twelve-month free cash flow of CN¥97.4 billion. Analyst estimates cover the next five years, seeing steady growth, and after that, projections are extrapolated. By 2029, free cash flow is expected to reach CN¥119.3 billion, with further increases anticipated in the following years. Over the ten-year projection period, free cash flow is forecasted to increase meaningfully each year, illustrating optimism about the company’s long-term earning power.

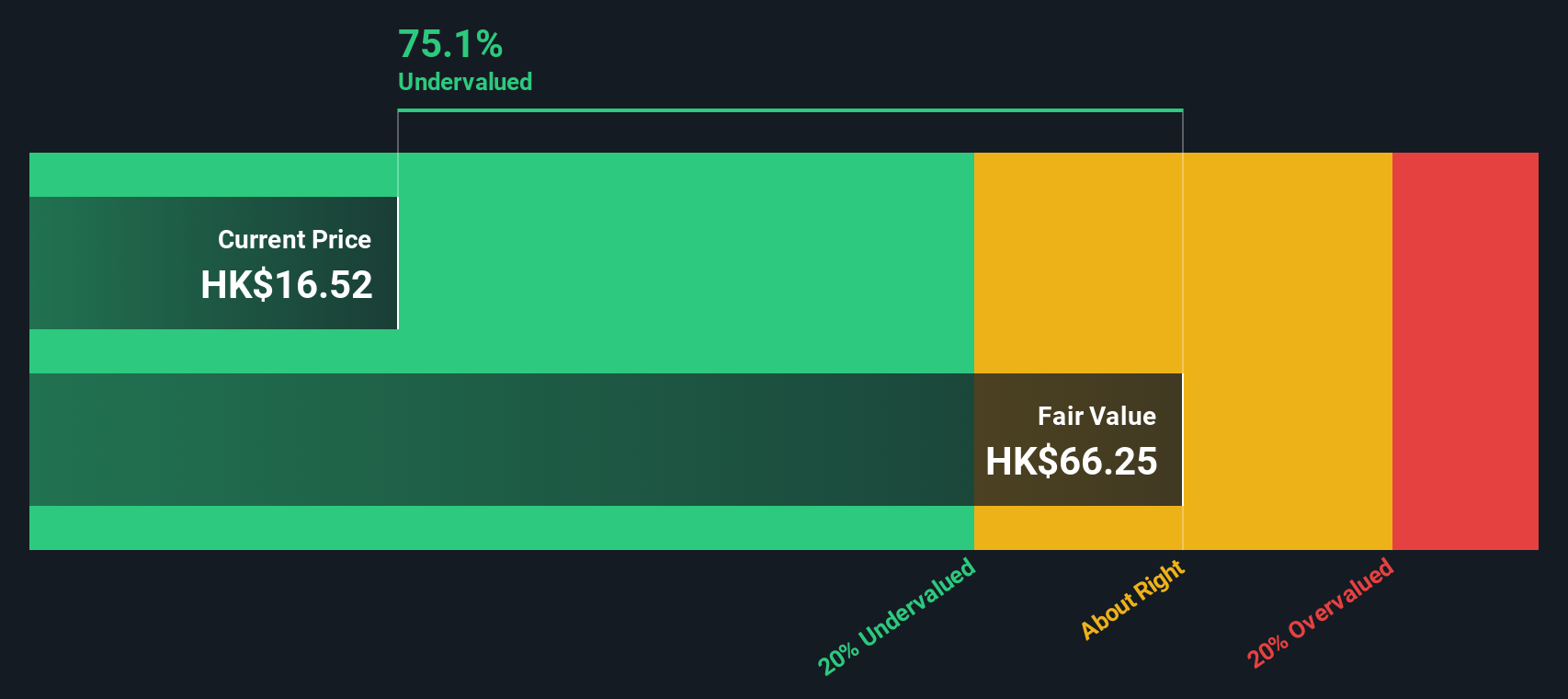

Based on this two-stage free cash flow to equity model, the estimated intrinsic value of CNOOC is HK$65.06 per share. With a calculated discount indicating the stock trades at a 71% discount to this intrinsic value, CNOOC appears substantially undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CNOOC is undervalued by 71.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CNOOC Price vs Earnings

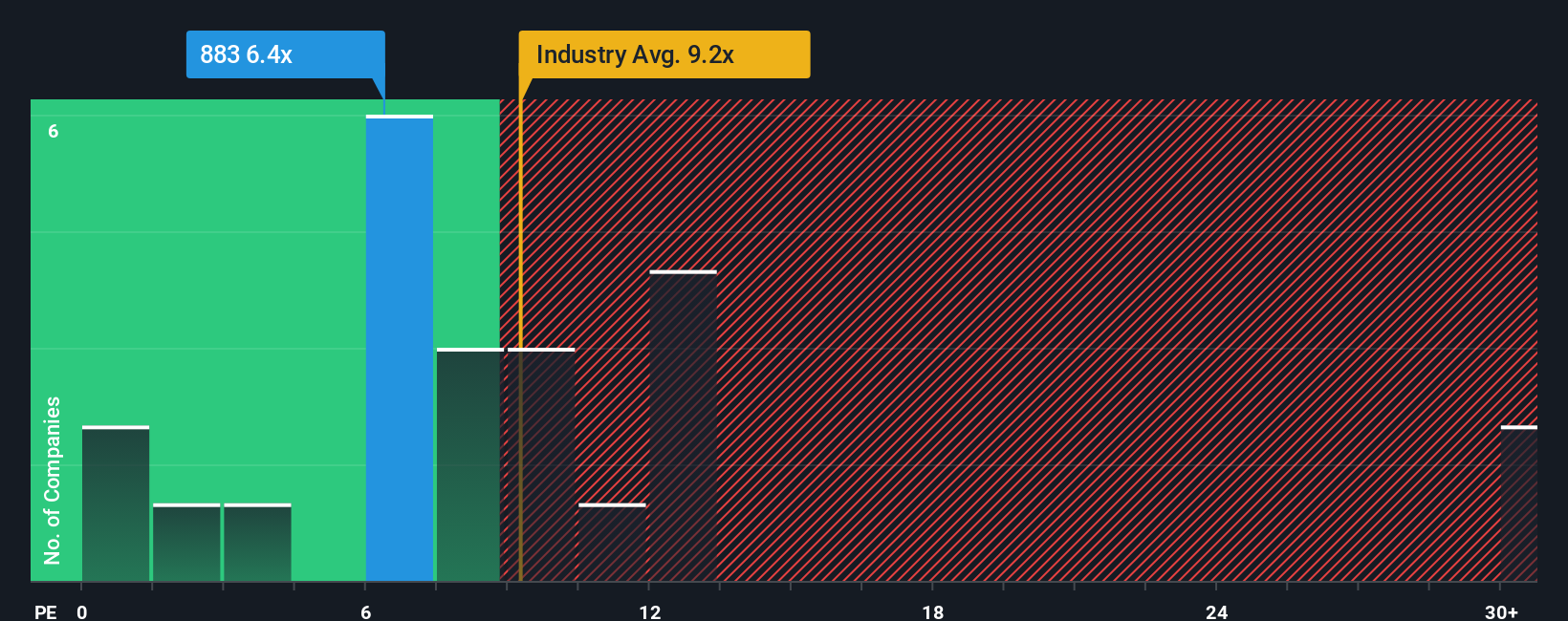

For established, consistently profitable companies like CNOOC, the price-to-earnings (PE) ratio is a time-tested and practical way for investors to gauge value. The PE multiple helps you assess how much the market is willing to pay today for each dollar of earnings the company generates. Growth expectations and risk perception have a major impact on what a “normal” or “fair” PE should be. Faster-growing, lower-risk companies typically merit higher multiples, while slower-growing or riskier firms might trade at a discount.

CNOOC’s PE ratio currently sits at 6.4x, which stands in stark contrast to both the industry average of 12.9x and the typical peer’s 10.7x. At first glance, this suggests the stock is trading at a substantial discount compared to its competitors and sector norms.

To provide a more nuanced view, Simply Wall St’s proprietary “Fair Ratio” is calculated based on a host of factors unique to each company, such as CNOOC’s earnings growth outlook, profit margins, risk profile, industry trends, and market cap. This approach is more sophisticated than simple industry or peer comparisons because it integrates key financial and risk variables that peers alone cannot capture. For CNOOC, the Fair Ratio comes out at 12.0x, which is almost exactly double its actual PE.

Since CNOOC’s PE is well below its Fair Ratio, this second measure also points to a significant undervaluation, strengthening the case for potential upside in the stock price.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CNOOC Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story, your personal view about what will drive CNOOC’s future success, paired with specific financial forecasts for revenue, earnings, and profit margins, which together generate an estimate of fair value. On Simply Wall St’s Community page, building a Narrative is as easy as entering your own assumptions about CNOOC’s future, allowing you to see how this story translates directly into an up-to-date fair value, and whether the current share price represents an opportunity to buy or sell.

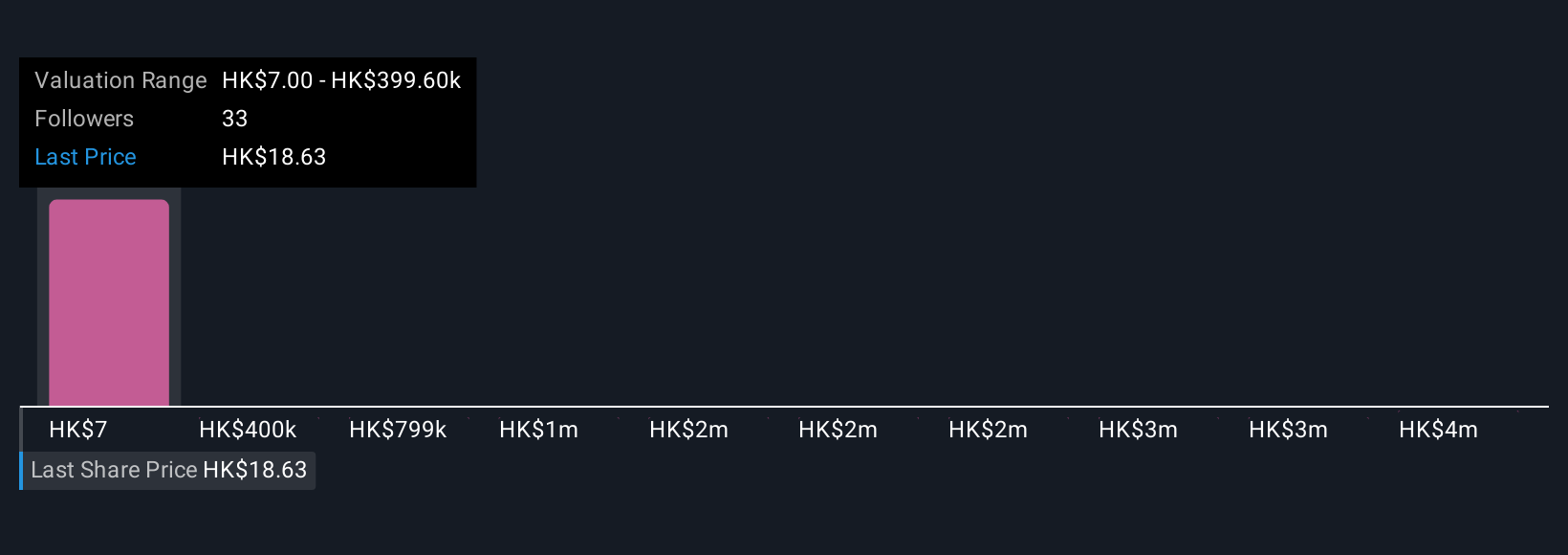

The power of Narratives is that they connect the "why" behind your investment to the actual math, and update live as new data (like news or results) comes in, so your decision-making always reflects the latest landscape. For example, one investor confident in China’s ongoing energy demand and disciplined capital spending might estimate a fair value of HK$27.64, while another more cautious about global oil risks and energy transition could land as low as HK$10.61. Narratives empower you to invest with conviction, using your scenario, your numbers, and your perspective.

Do you think there's more to the story for CNOOC? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:883

CNOOC

An investment holding company, engages in the exploration, development, production, and sale of crude oil and natural gas in worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives