- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A108230

TOPTEC Joins 2 Leading Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by positive sentiment around domestic policy and geopolitical developments, investors are increasingly seeking stable income sources amid fluctuating economic indicators. In this context, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive option for those looking to enhance their portfolios in today's market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.20% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.91% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.31% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.86% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

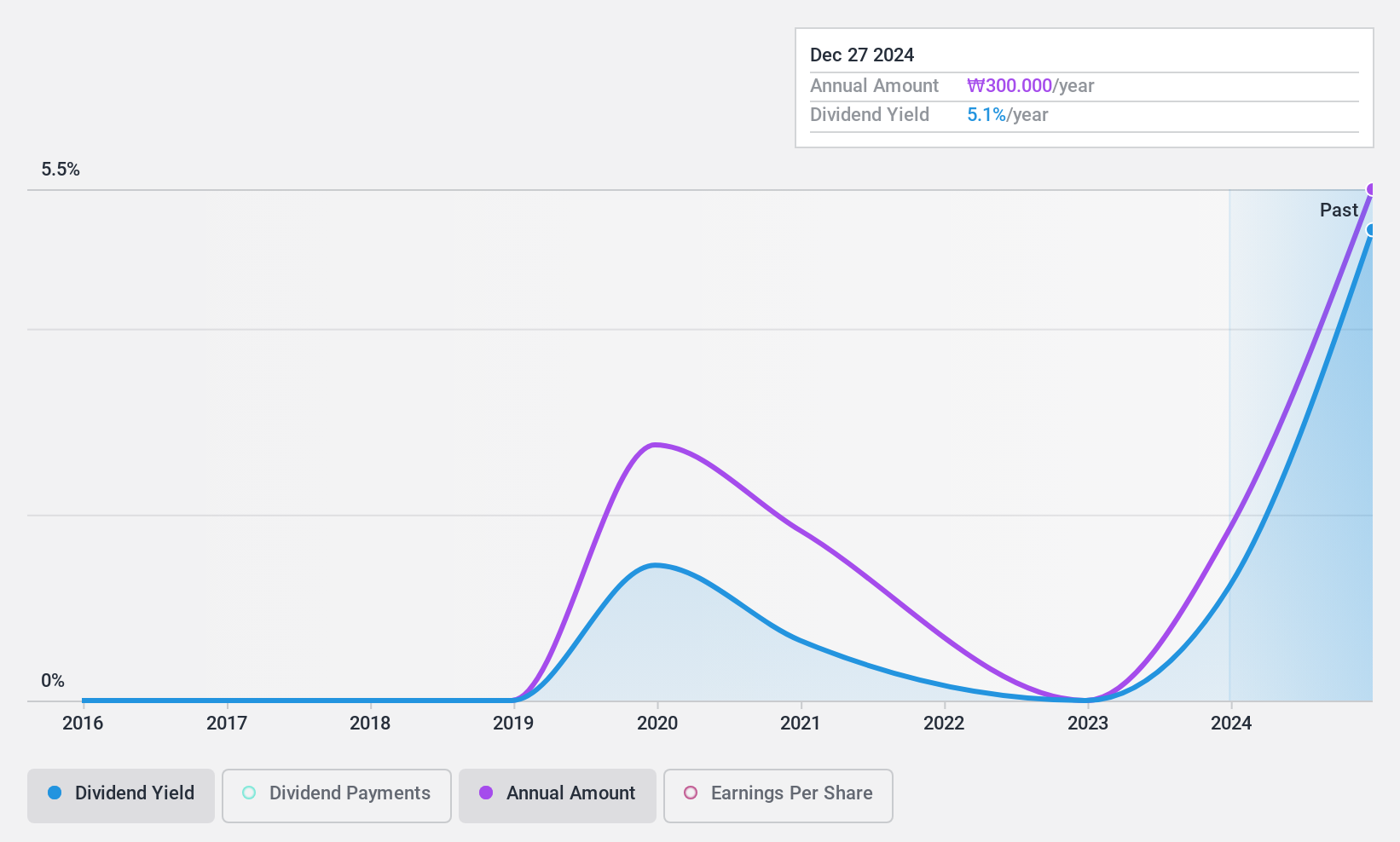

TOPTEC (KOSDAQ:A108230)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TOPTEC Co., Ltd. operates in the secondary batteries, smart factories, and displays/semiconductors sectors both in South Korea and internationally, with a market cap of ₩167.60 billion.

Operations: TOPTEC Co., Ltd.'s revenue is derived from its operations in secondary batteries, smart factories, and displays/semiconductors across domestic and international markets.

Dividend Yield: 6.5%

TOPTEC's dividend yield of 6.47% ranks in the top 25% of Korean market payers, yet its dividend history is unstable and volatile, with significant annual drops. Despite only five years of payments, dividends are well-covered by earnings (payout ratio: 15.2%) and cash flows (cash payout ratio: 10.9%). Recent earnings growth indicates potential for continued coverage, but investors should note the unreliable payment history when considering this stock for dividends.

- Delve into the full analysis dividend report here for a deeper understanding of TOPTEC.

- Our comprehensive valuation report raises the possibility that TOPTEC is priced lower than what may be justified by its financials.

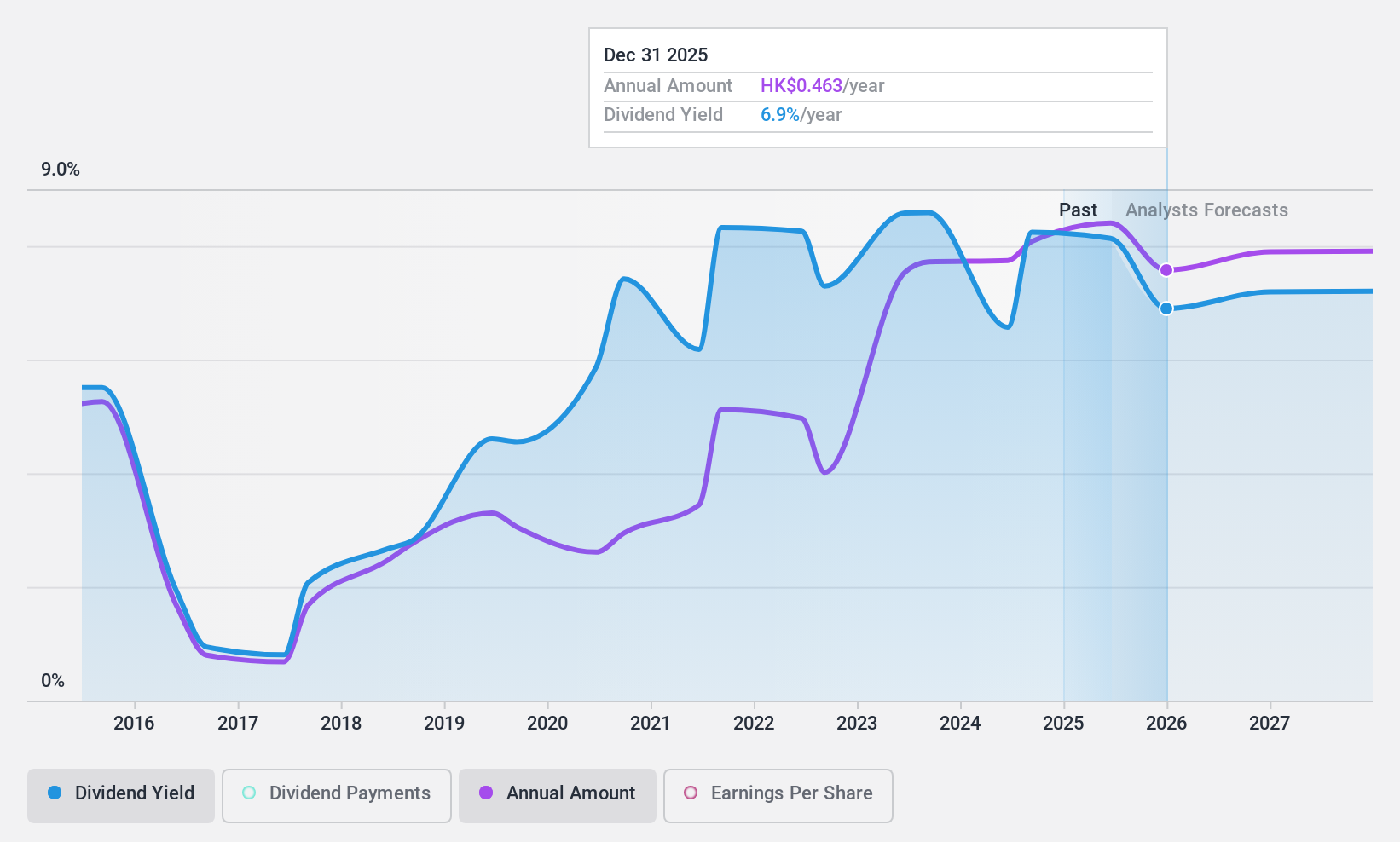

PetroChina (SEHK:857)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PetroChina Company Limited, along with its subsidiaries, operates in a variety of petroleum-related products and services both in Mainland China and internationally, with a market cap of approximately HK$1.52 trillion.

Operations: PetroChina's revenue segments include Marketing (CN¥2.47 billion), Natural Gas Sales (CN¥593.33 million), Oil, Gas and New Energy (CN¥923.02 million), and Refining and Chemicals and New Materials (CN¥1.24 billion).

Dividend Yield: 8.2%

PetroChina's dividend yield is among the top 25% in the Hong Kong market, supported by a reasonable payout ratio of 50.8%. Despite this, its dividend history has been volatile with significant annual drops over the past decade. The company's dividends are covered by both earnings and cash flows, ensuring sustainability in payments. Recent agreements like the renewed Refined Oil Framework Agreement may influence future performance, but past earnings growth remains modest at 1%.

- Take a closer look at PetroChina's potential here in our dividend report.

- According our valuation report, there's an indication that PetroChina's share price might be on the cheaper side.

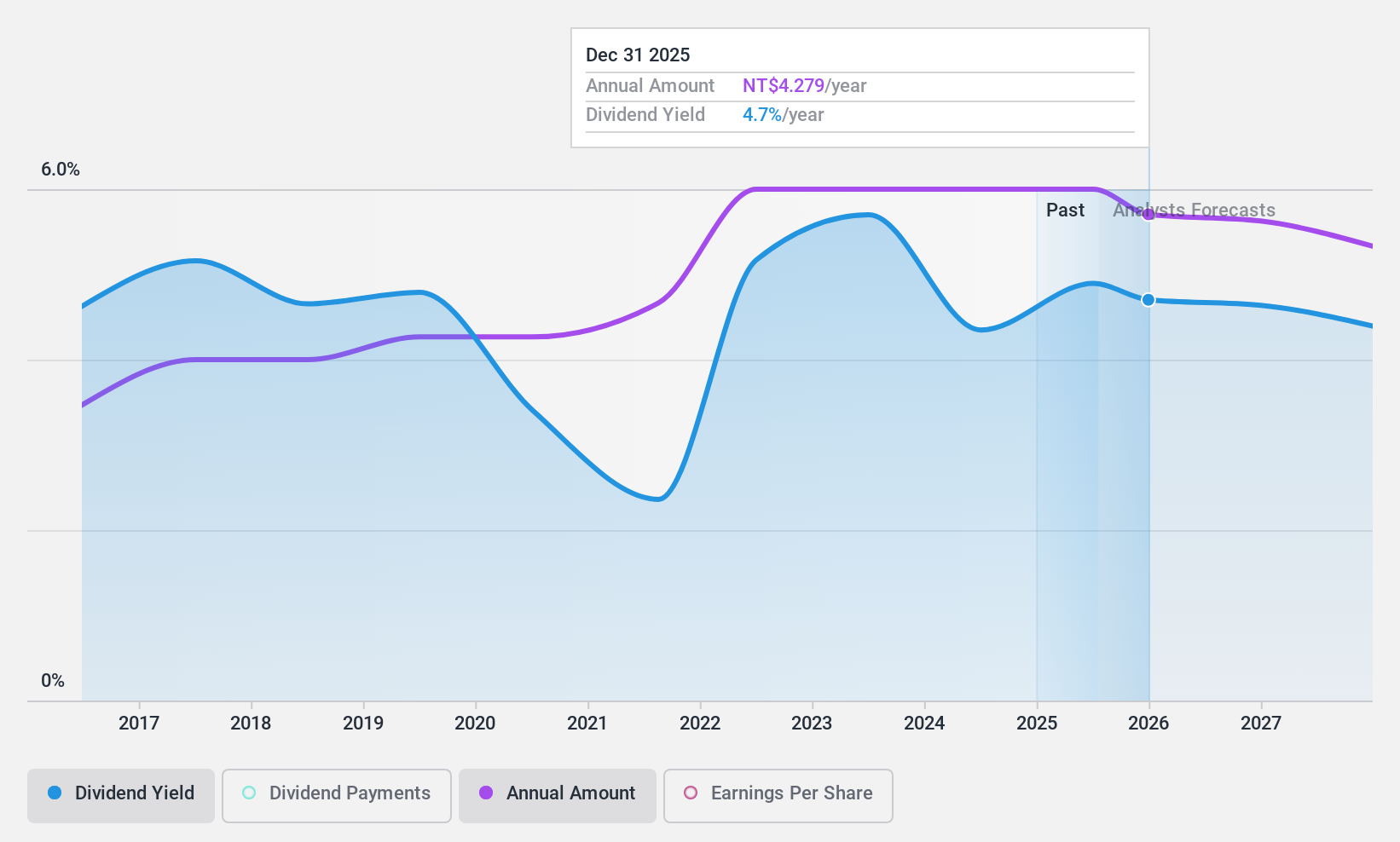

Vanguard International Semiconductor (TPEX:5347)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vanguard International Semiconductor Corporation, along with its subsidiaries, is involved in the manufacturing, selling, packaging, testing, and computer-aided design of integrated circuits and other semiconductor devices both in Taiwan and globally; it has a market cap of approximately NT$167.35 billion.

Operations: Vanguard International Semiconductor's revenue primarily comes from Wafer Manufacturing Conformity, amounting to NT$42.18 billion.

Dividend Yield: 4.8%

Vanguard International Semiconductor's dividend yield ranks in the top 25% of Taiwan's market, but its high payout ratio of 97.2% raises concerns about sustainability. Dividends have been stable and growing over the past decade, yet they are not well covered by earnings or cash flows. The company's recent strategic alliances, including a joint venture with NXP Semiconductors and investment in Episil Technologies, aim to enhance future growth prospects despite current shareholder dilution.

- Click to explore a detailed breakdown of our findings in Vanguard International Semiconductor's dividend report.

- According our valuation report, there's an indication that Vanguard International Semiconductor's share price might be on the expensive side.

Taking Advantage

- Access the full spectrum of 1947 Top Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOPTEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A108230

TOPTEC

Engages in the secondary batteries, smart factories, and displays/semiconductors businesses in South Korea and internationally.

Solid track record with excellent balance sheet and pays a dividend.