United Energy Group Leads The Charge With These 3 Penny Stocks

Reviewed by Simply Wall St

Global markets have recently experienced a positive shift, with cooling inflation and strong bank earnings propelling stocks higher, particularly in the energy sector. Amid these developments, investors are increasingly interested in smaller or newer companies that may offer growth opportunities. Although the term "penny stocks" might seem outdated, it still refers to companies that can provide significant value when backed by solid financial health and potential for growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.984 | £156.82M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.67 | £418.56M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.75M | ★★★★☆☆ |

| Starflex (SET:SFLEX) | THB2.56 | THB1.99B | ★★★★☆☆ |

Click here to see the full list of 5,701 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

United Energy Group (SEHK:467)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: United Energy Group Limited is an investment holding company involved in upstream oil, natural gas, and other energy-related operations across South Asia, the Middle East, and North Africa with a market cap of approximately HK$9.95 billion.

Operations: The company's revenue is primarily derived from its Exploration and Production segment, which generated HK$10.47 billion, followed by the Trading segment with HK$5.34 billion.

Market Cap: HK$9.95B

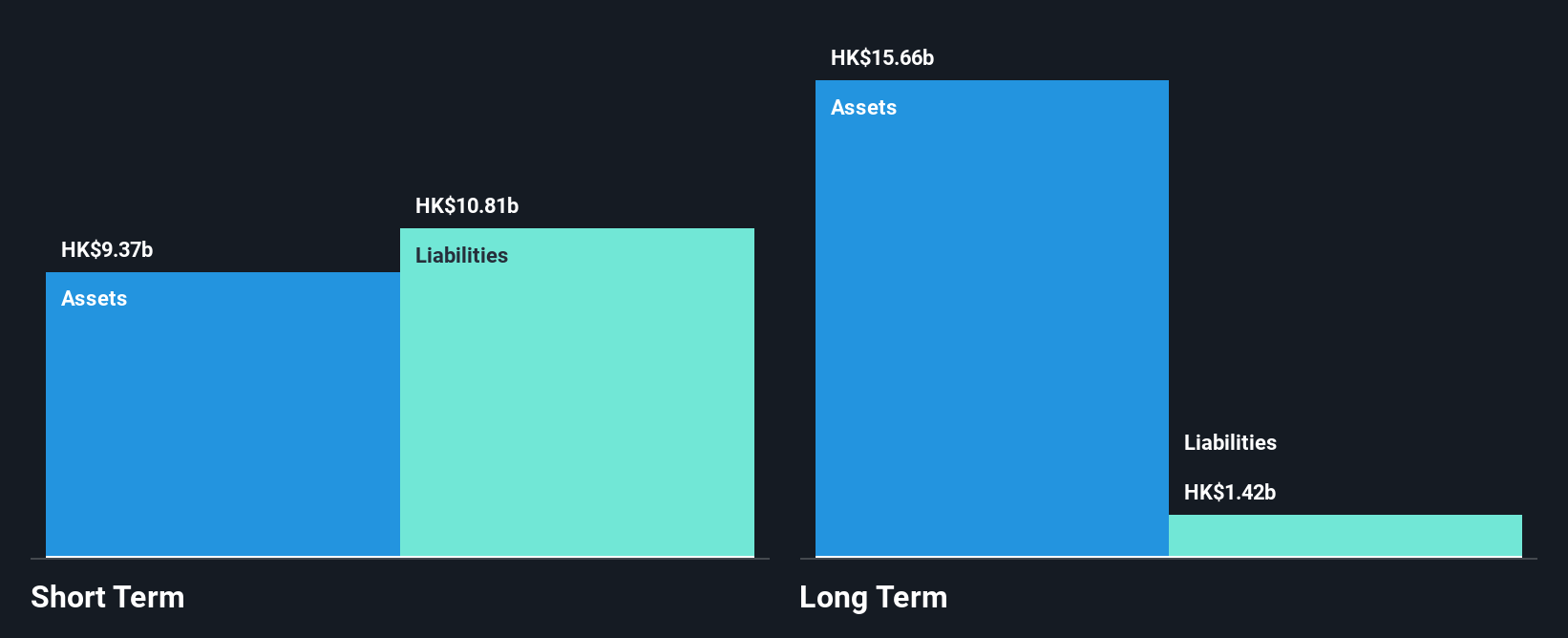

United Energy Group Limited, with a market cap of approximately HK$9.95 billion, primarily generates revenue from its Exploration and Production segment (HK$10.47 billion). Despite being unprofitable and having a negative Return on Equity (-17.09%), the company has reduced its debt to equity ratio significantly over five years and maintains strong cash flow coverage for its debt. Its seasoned management team and board bring stability, while short-term assets exceed both short- and long-term liabilities. Trading at 71.5% below estimated fair value, it presents potential value but remains risky due to ongoing losses increasing annually by 23%.

- Navigate through the intricacies of United Energy Group with our comprehensive balance sheet health report here.

- Assess United Energy Group's future earnings estimates with our detailed growth reports.

Guangdong DFP New Material Group (SHSE:601515)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guangdong DFP New Material Group Co., Ltd. operates in the new material industry and has a market cap of approximately CN¥7.13 billion.

Operations: Guangdong DFP New Material Group Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥7.13B

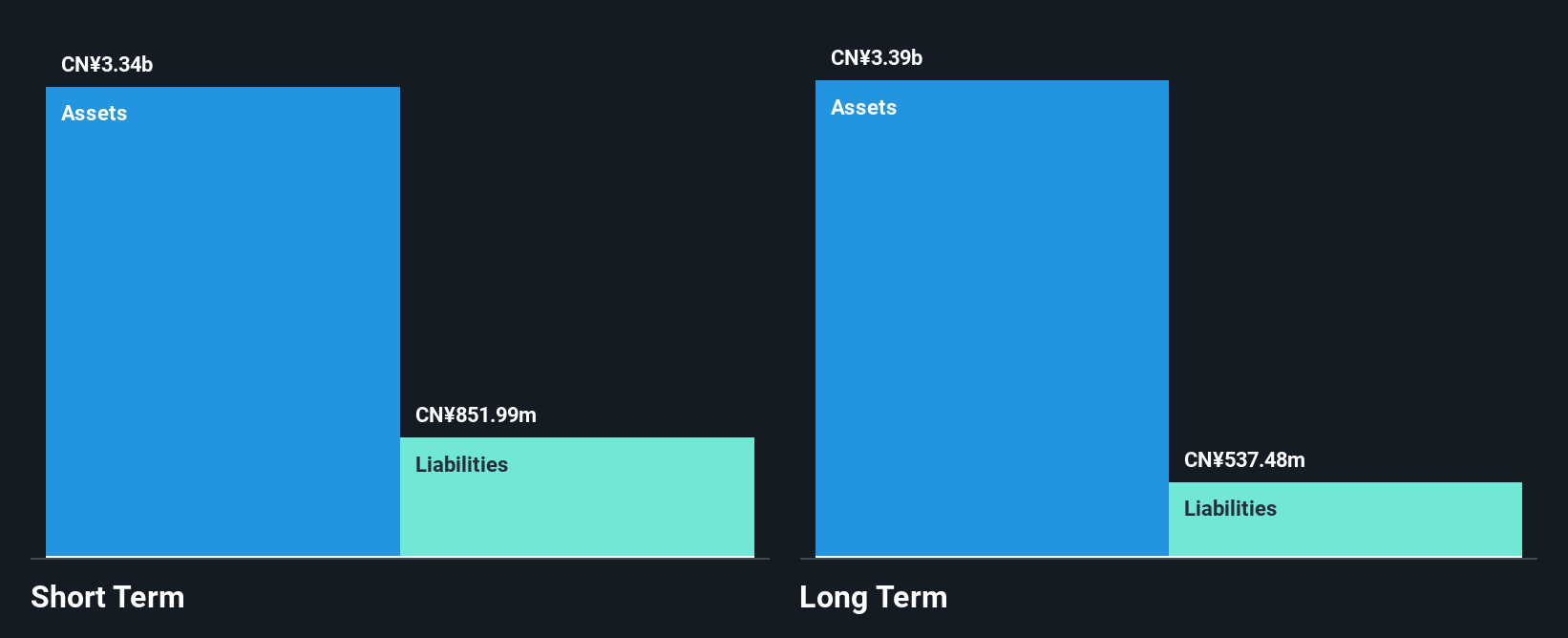

Guangdong DFP New Material Group, with a market cap of CN¥7.13 billion, reported a significant decline in sales and revenue for the nine months ending September 2024, resulting in a net loss of CN¥190.35 million. Despite being unprofitable with negative Return on Equity (-5.76%), the company holds more cash than total debt and has reduced its debt to equity ratio over five years from 19.6% to 8.4%. Short-term assets significantly exceed liabilities, suggesting financial stability despite current losses. Earnings are forecasted to grow substantially by consensus estimates, indicating potential future improvement amidst high volatility and risk factors.

- Get an in-depth perspective on Guangdong DFP New Material Group's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Guangdong DFP New Material Group's future.

Leo Group (SZSE:002131)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Leo Group Co., Ltd. operates in China through its subsidiaries by researching, developing, manufacturing, and selling pumps and garden machinery products with a market cap of CN¥24.87 billion.

Operations: Leo Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥24.87B

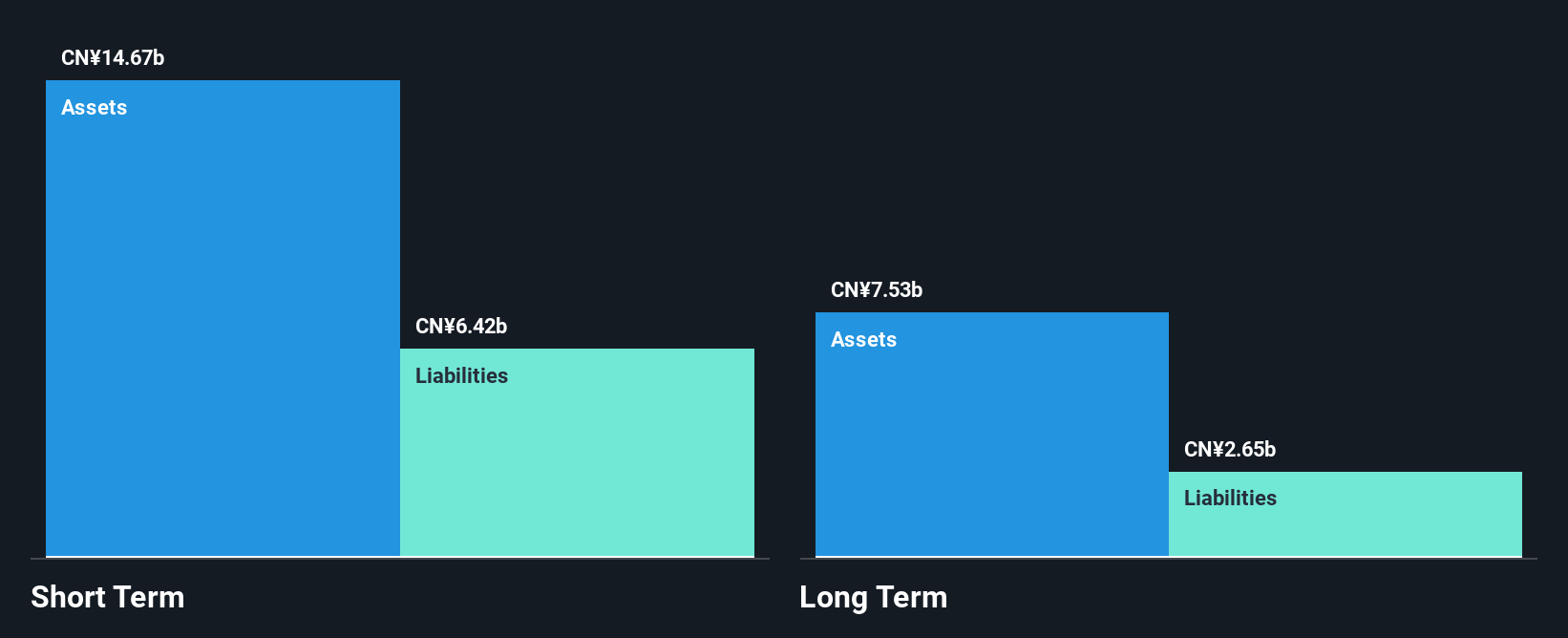

Leo Group Co., Ltd., with a market cap of CN¥24.87 billion, reported sales of CN¥15.85 billion for the nine months ending September 2024, but faced a net loss of CN¥159.55 million compared to a net income the previous year. Despite being unprofitable and experiencing increased losses over five years, Leo Group's short-term assets exceed both its short-term and long-term liabilities significantly, providing some financial cushion. The company holds more cash than total debt; however, negative operating cash flow raises concerns about debt coverage. High share price volatility persists amid an inexperienced management team averaging 1.4 years in tenure.

- Click to explore a detailed breakdown of our findings in Leo Group's financial health report.

- Evaluate Leo Group's historical performance by accessing our past performance report.

Summing It All Up

- Access the full spectrum of 5,701 Penny Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002131

Leo Group

Through its subsidiaries, researches, develops, manufactures, and sells pumps and garden machinery products in China.

Adequate balance sheet low.