- China

- /

- Construction

- /

- SHSE:603929

None Highlights These 3 Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, cooling inflation and robust bank earnings have provided a boost to major U.S. stock indexes, with value stocks notably outperforming growth shares. As small-cap stocks, represented by indices like the S&P MidCap 400 and Russell 2000, also show significant gains, investors are increasingly interested in identifying lesser-known companies that could benefit from these favorable conditions. In this context, discovering promising stocks involves looking for those with solid fundamentals and potential for growth within sectors that are currently thriving or poised to benefit from broader economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.18% | 50.86% | 65.05% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of approximately SEK11.61 billion.

Operations: Rusta generates revenue primarily from its operations in Sweden (SEK6.49 billion), Norway (SEK2.43 billion), and other markets (SEK2.39 billion).

Rusta, a promising player in the market, has shown robust performance with earnings growth of 21.7% over the past year, outpacing the industry average. Its interest payments are well covered by EBIT at 3.5 times, indicating strong financial health. The company trades significantly below its estimated fair value by 68.4%, suggesting potential undervaluation. Rusta's net debt to equity ratio stands at a satisfactory 1.1%, reflecting prudent financial management amidst recent executive changes with Claus Juel-Jensen joining the board in January 2025, potentially steering future strategic directions positively for this dynamic entity.

- Click here to discover the nuances of Rusta with our detailed analytical health report.

Review our historical performance report to gain insights into Rusta's's past performance.

L&K Engineering (Suzhou)Ltd (SHSE:603929)

Simply Wall St Value Rating: ★★★★★★

Overview: L&K Engineering (Suzhou) Co., Ltd. offers specialized engineering technical services in China with a market capitalization of CN¥5.90 billion.

Operations: L&K Engineering (Suzhou) Co., Ltd. generates revenue through specialized engineering technical services in China. The company's financial performance includes a market capitalization of CN¥5.90 billion.

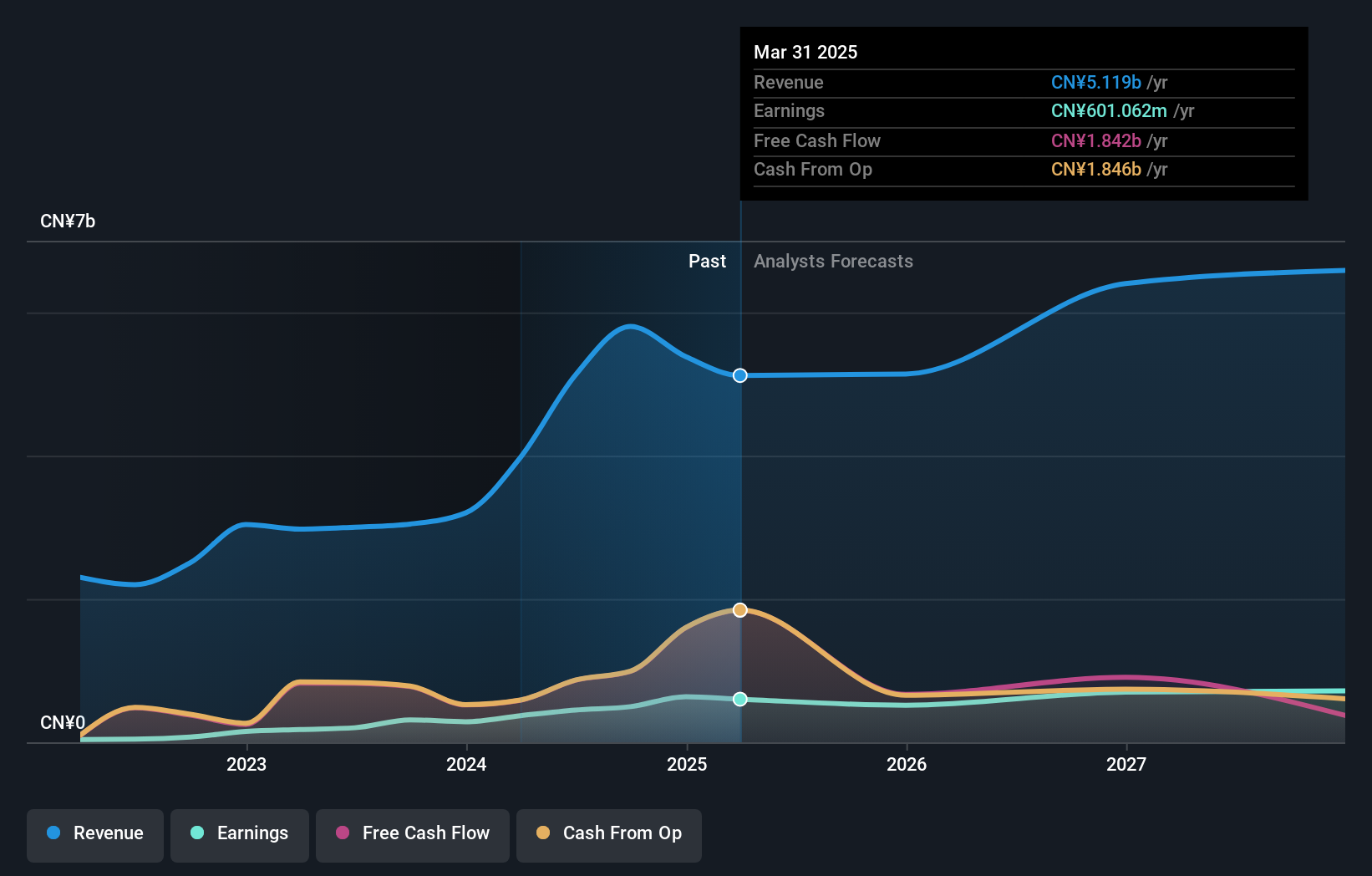

L&K Engineering (Suzhou) Co., Ltd. has shown strong performance, with earnings growth of 59.2% over the past year, significantly outpacing the construction industry's -3.9%. The company reported sales of CNY 4.42 billion for the first nine months of 2024, up from CNY 1.82 billion a year ago, and net income rose to CNY 439 million from CNY 229 million in the same period last year. Trading at about 43% below its estimated fair value and being debt-free enhances its appeal as an investment opportunity in a competitive market landscape.

Jiangsu Xiehe ElectronicLtd (SHSE:605258)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Xiehe Electronic Co., Ltd. specializes in the research, development, and production of various types of printed circuit boards, including rigid, flexible, and rigid-flex combinations in China, with a market capitalization of CN¥2.89 billion.

Operations: Xiehe Electronic generates revenue through the production and sale of single, double-sided, and multi-layer printed circuit boards. The company focuses on rigid, flexible, and rigid-flex combinations within China.

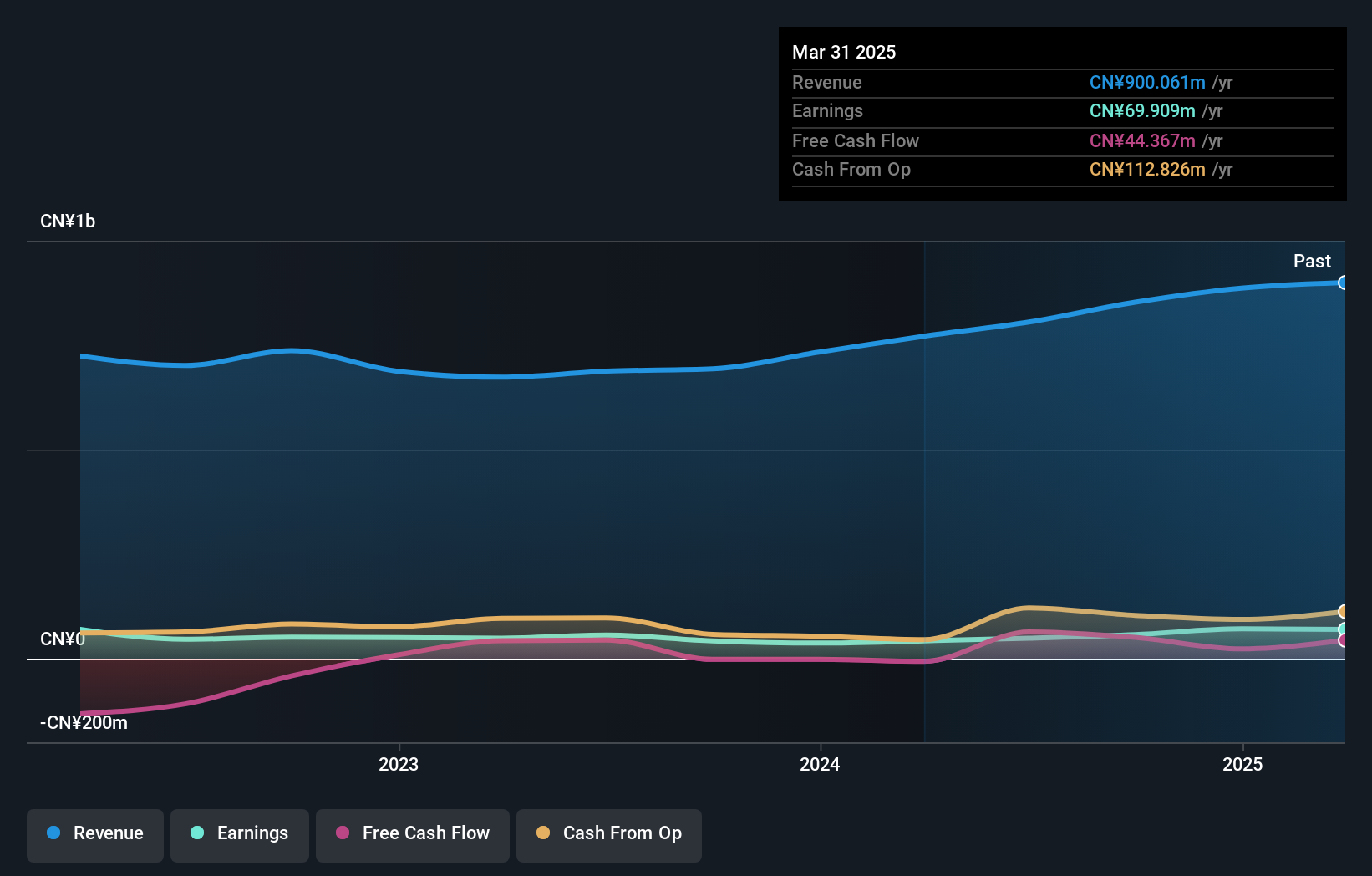

Jiangsu Xiehe Electronic Ltd., a small player in the electronics industry, has shown promising growth with earnings rising by 35.6% over the past year, outpacing the industry average of 2.3%. The company's net income for the nine months ending September 2024 reached CNY 46.59 million, up from CNY 26.29 million a year earlier, reflecting strong operational performance. Despite a historical decline in earnings by an average of 21.4% annually over five years, recent improvements are notable. The debt-to-equity ratio has significantly decreased from 21.1% to just 4.2%, indicating robust financial health and potential for future stability and growth within its sector.

Make It Happen

- Click this link to deep-dive into the 4644 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603929

L&K Engineering (Suzhou)Ltd

Provides specialized engineering technical services in China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives