- Hong Kong

- /

- Oil and Gas

- /

- SEHK:386

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate through tariff uncertainties and mixed economic signals, investors are keenly observing the broader implications on their portfolios. With U.S. stocks experiencing a slight decline amid trade tensions and European indices showing resilience, dividend stocks can offer a stable income stream in such volatile times. When considering what makes a good stock, especially in the current environment, it's important to focus on companies with strong fundamentals and consistent dividend payouts that can potentially provide some cushion against market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.35% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

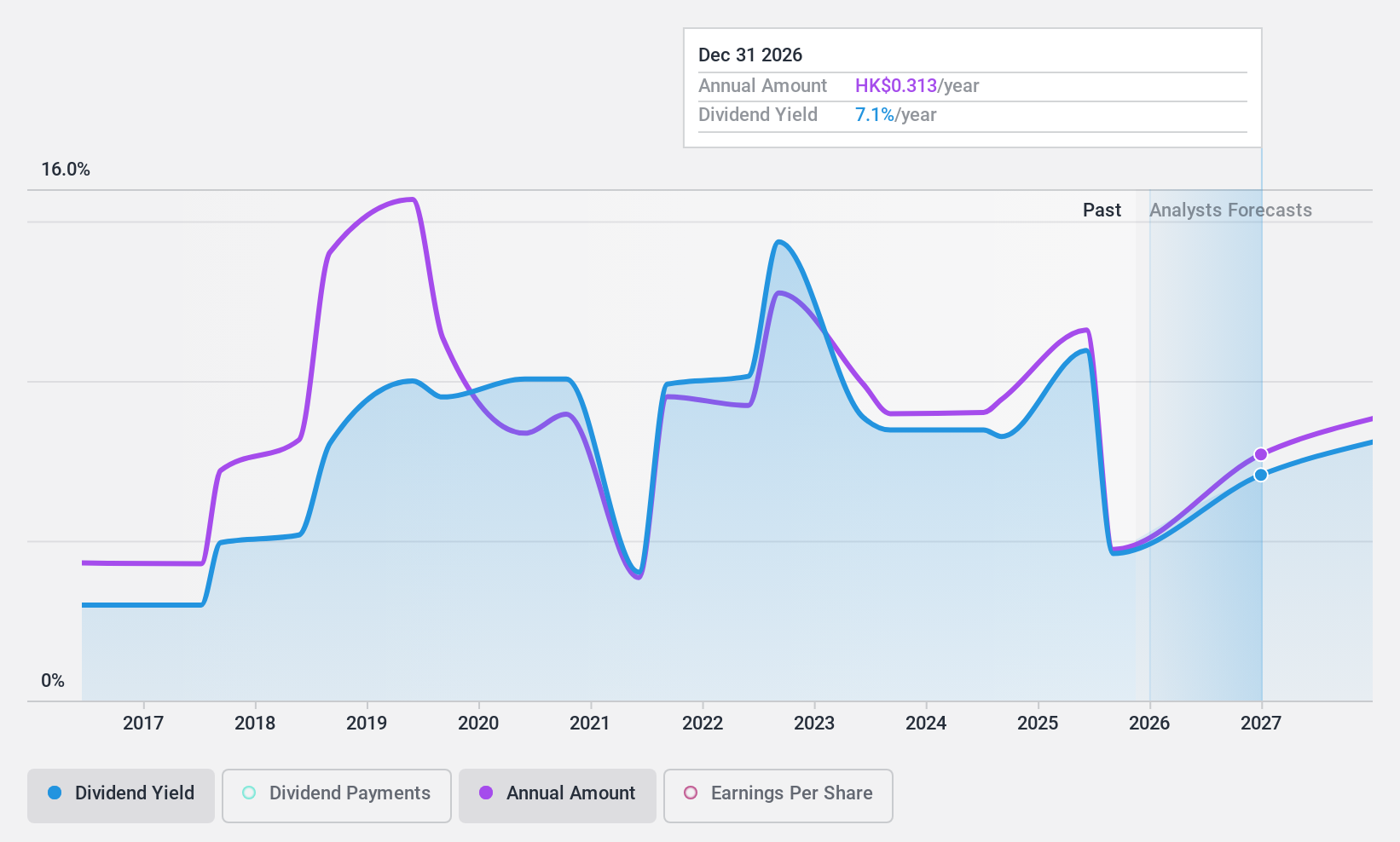

China Petroleum & Chemical (SEHK:386)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Petroleum & Chemical Corporation is an energy and chemical company involved in oil, gas, and chemical operations in Mainland China, Singapore, and internationally with a market cap of HK$738.49 billion.

Operations: China Petroleum & Chemical Corporation's revenue segments include Refining (CN¥1.52 billion), Chemicals (CN¥528.87 million), Exploration and Production (CN¥304.40 million), and Marketing and Distribution (CN¥1.77 billion).

Dividend Yield: 8.3%

China Petroleum & Chemical's dividend yield is among the top 25% in Hong Kong, yet its sustainability is questionable due to a high cash payout ratio of 164.6%. Despite an increase in dividends over the past decade, payments have been volatile with significant annual drops. The company's recent production and sales figures show mixed results, with oil and gas output rising while domestic refined oil product sales declined. A recent share buyback and strategic alliances may impact future performance.

- Click here and access our complete dividend analysis report to understand the dynamics of China Petroleum & Chemical.

- Our valuation report unveils the possibility China Petroleum & Chemical's shares may be trading at a discount.

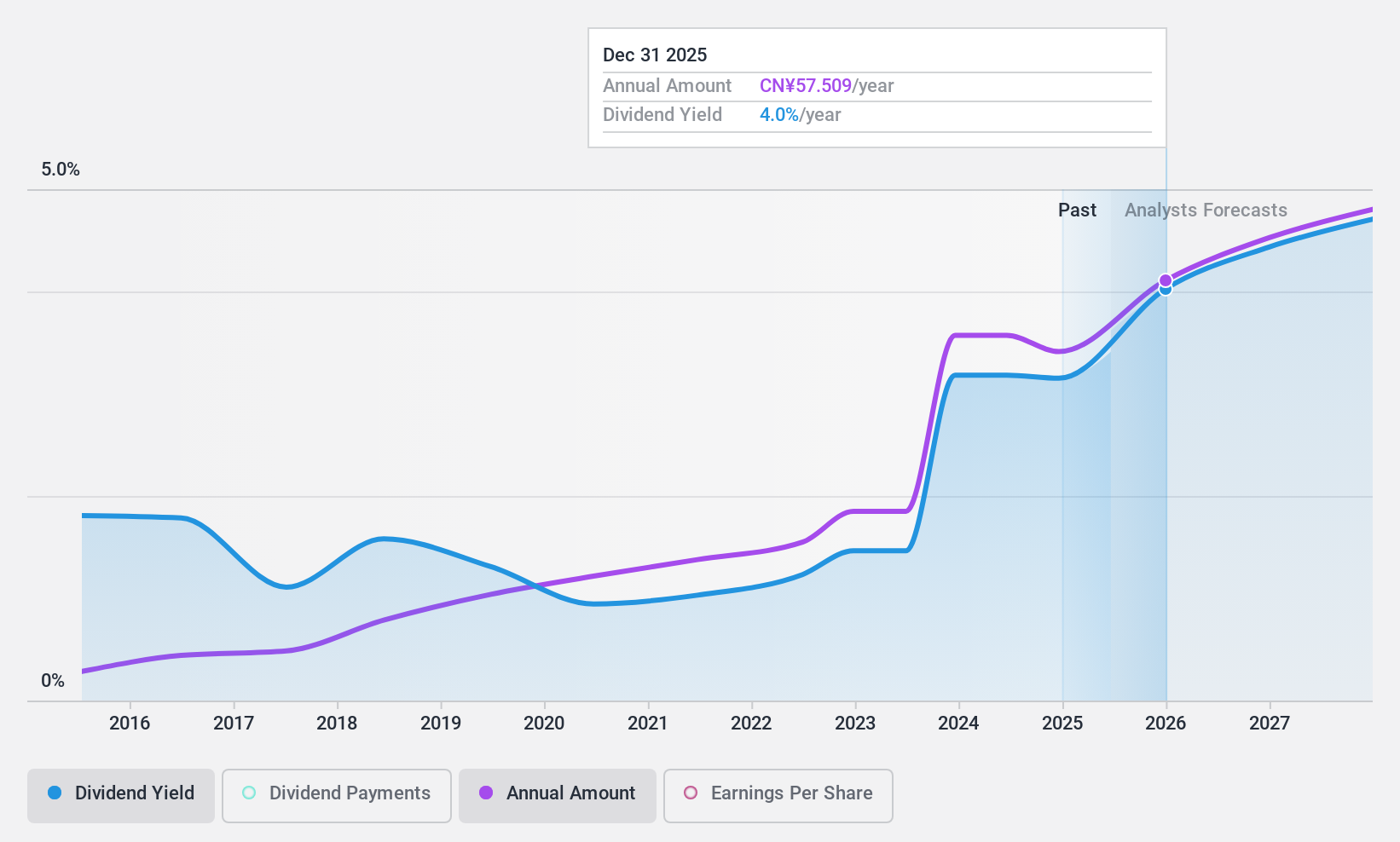

Kweichow Moutai (SHSE:600519)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kweichow Moutai Co., Ltd. is a company that produces and sells liquor products both in China and internationally, with a market cap of CN¥1.81 trillion.

Operations: Kweichow Moutai Co., Ltd.'s revenue primarily comes from its liquor segment, amounting to CN¥165.20 billion.

Dividend Yield: 3.5%

Kweichow Moutai's dividend yield is in the top 25% of Chinese stocks, but sustainability concerns arise due to a high cash payout ratio of 109.3%, indicating dividends are not well covered by free cash flows. Despite this, dividends have been stable and growing over the past decade. The stock trades at a discount to its estimated fair value, with analysts predicting price appreciation. Recent buyback activity was nonexistent, possibly affecting future capital allocation strategies.

- Click to explore a detailed breakdown of our findings in Kweichow Moutai's dividend report.

- Our valuation report here indicates Kweichow Moutai may be undervalued.

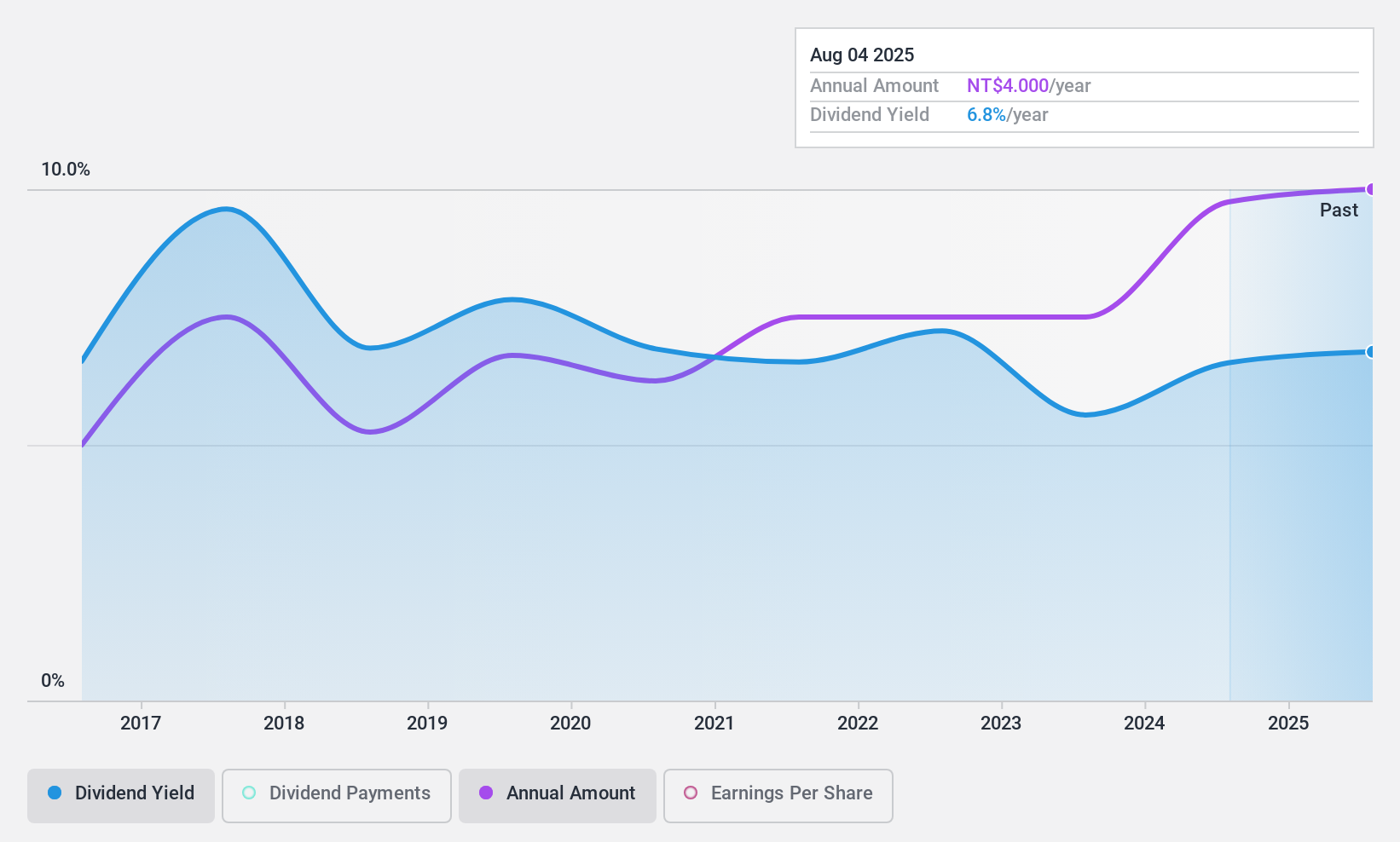

Ya Horng Electronic (TWSE:6201)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ya Horng Electronic Co., Ltd. manufactures and sells audio products, household appliances, and healthcare products across Taiwan, the United States, Japan, France, and other international markets with a market cap of NT$5.23 billion.

Operations: Ya Horng Electronic Co., Ltd. generates revenue from Taiwan's Operational Headquarters (NT$3.32 billion) and its Production Factories in China and Southeast Asia (NT$1.37 billion).

Dividend Yield: 6.7%

Ya Horng Electronic offers a high dividend yield in the top 25% of the Taiwanese market, supported by a payout ratio of 89.2% and a cash payout ratio of 56.3%, indicating coverage by both earnings and cash flows. However, dividends have been volatile over the past decade with an unstable track record, raising sustainability concerns. The stock trades at nearly 60% below its estimated fair value, suggesting potential undervaluation despite recent discussions on business operations and financial performance.

- Delve into the full analysis dividend report here for a deeper understanding of Ya Horng Electronic.

- Upon reviewing our latest valuation report, Ya Horng Electronic's share price might be too pessimistic.

Summing It All Up

- Navigate through the entire inventory of 1969 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:386

China Petroleum & Chemical

An energy and chemical company, engages in the oil and gas and chemical operations in Mainland China.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives