- Hong Kong

- /

- Oil and Gas

- /

- SEHK:2686

Here's Why I Think AAG Energy Holdings (HKG:2686) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like AAG Energy Holdings (HKG:2686). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for AAG Energy Holdings

How Fast Is AAG Energy Holdings Growing Its Earnings Per Share?

Over the last three years, AAG Energy Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. AAG Energy Holdings boosted its trailing twelve month EPS from CN¥0.16 to CN¥0.20, in the last year. That's a 24% gain; respectable growth in the broader scheme of things.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Unfortunately, AAG Energy Holdings's revenue dropped 8.5% last year, but the silver lining is that EBIT margins improved from 72% to 78%. That's not ideal.

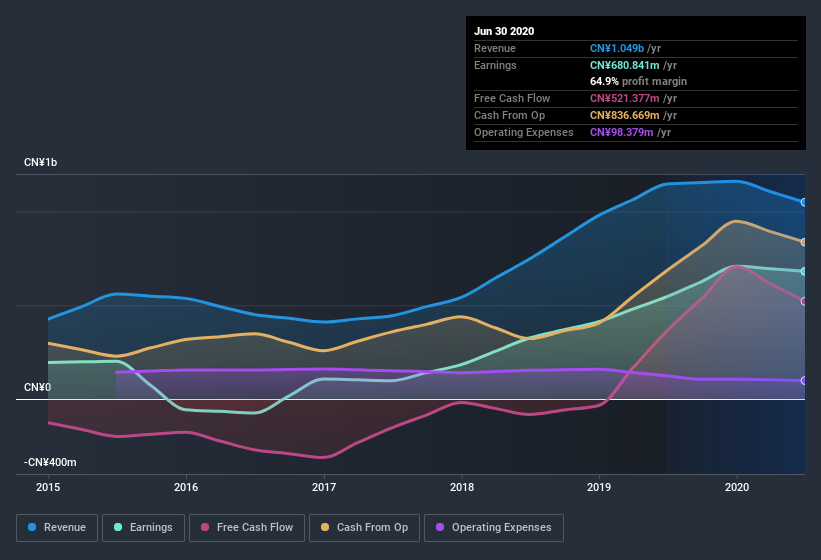

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are AAG Energy Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for AAG Energy Holdings is the serious outlay one insider has made to buy shares, in the last year. Indeed, Ming Weng has accumulated shares over the last year, paying a total of CN¥634m at an average price of about CN¥1.07. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

Along with the insider buying, another encouraging sign for AAG Energy Holdings is that insiders, as a group, have a considerable shareholding. With a whopping CN¥765m worth of shares as a group, insiders have plenty riding on the company's success. At 18% of the company, the co-investment by insiders gives me confidence that management will make long-term focussed decisions.

Should You Add AAG Energy Holdings To Your Watchlist?

One positive for AAG Energy Holdings is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. What about risks? Every company has them, and we've spotted 1 warning sign for AAG Energy Holdings you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of AAG Energy Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading AAG Energy Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2686

AAG Energy Holdings

AAG Energy Holdings Limited engages in the exploration, development, production, and sale of coalbed methane in the People's Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives