- Hong Kong

- /

- Energy Services

- /

- SEHK:2236

Wison Engineering Services Co. Ltd. (HKG:2236) Investors Are Less Pessimistic Than Expected

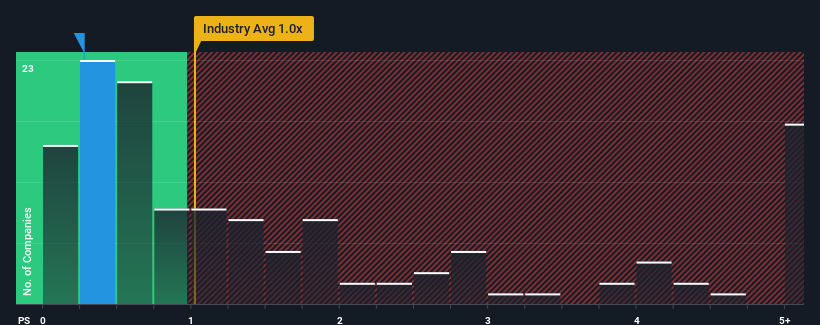

There wouldn't be many who think Wison Engineering Services Co. Ltd.'s (HKG:2236) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Energy Services industry in Hong Kong is very similar. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Wison Engineering Services

What Does Wison Engineering Services' P/S Mean For Shareholders?

For instance, Wison Engineering Services' receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Wison Engineering Services will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Wison Engineering Services?

The only time you'd be comfortable seeing a P/S like Wison Engineering Services' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. This means it has also seen a slide in revenue over the longer-term as revenue is down 14% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 17% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Wison Engineering Services is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Wison Engineering Services currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you settle on your opinion, we've discovered 1 warning sign for Wison Engineering Services that you should be aware of.

If these risks are making you reconsider your opinion on Wison Engineering Services, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wison Engineering Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2236

Wison Engineering Services

An investment holding company, provides chemical engineering, procurement, and construction management services in Mainland China, the United States, the Middle East, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives