- Hong Kong

- /

- Diversified Financial

- /

- SEHK:8525

Read This Before Buying Baiying Holdings Group Limited (HKG:8525) For Its Dividend

Today we'll take a closer look at Baiying Holdings Group Limited (HKG:8525) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

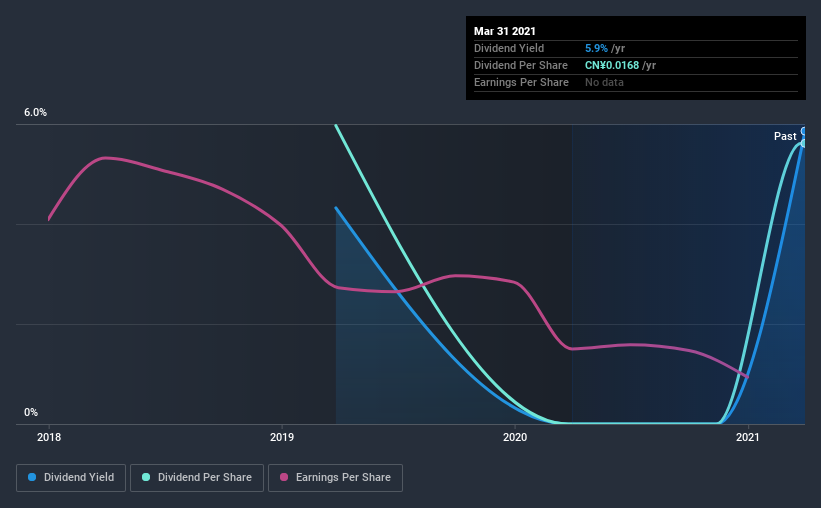

Baiying Holdings Group yields a solid 5.9%, although it has only been paying for two years. A high yield probably looks enticing, but investors are likely wondering about the short payment history. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Baiying Holdings Group paid out 72% of its profit as dividends, over the trailing twelve month period. A payout ratio above 50% generally implies a business is reaching maturity, although it is still possible to reinvest in the business or increase the dividend over time.

We update our data on Baiying Holdings Group every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. It has only been paying dividends for a few short years, and the dividend has already been cut at least once. This is one income stream we're not ready to live on. During the past two-year period, the first annual payment was CN¥0.02 in 2019, compared to CN¥0.02 last year. This works out to be a decline of approximately 3.0% per year over that time. Baiying Holdings Group's dividend hasn't shrunk linearly at 3.0% per annum, but the CAGR is a useful estimate of the historical rate of change.

A shrinking dividend over a two-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Baiying Holdings Group's earnings per share have shrunk at 39% a year over the past three years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Baiying Holdings Group's earnings per share, which support the dividend, have been anything but stable.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, we think Baiying Holdings Group has an acceptable payout ratio. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. With this information in mind, we think Baiying Holdings Group may not be an ideal dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 6 warning signs for Baiying Holdings Group (1 is significant!) that you should be aware of before investing.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you’re looking to trade Baiying Holdings Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Baiying Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8525

Baiying Holdings Group

An investment holding company, engages in the provision of equipment-based financing solutions to small and medium-sized enterprises, individual entrepreneurs, and large enterprises in the People’s Republic of China.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026