- Hong Kong

- /

- Auto Components

- /

- SEHK:2025

Asian Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

Amidst global market volatility and renewed tariff threats, Asian markets have been navigating a complex economic landscape. Despite these challenges, certain sectors continue to offer intriguing opportunities for investors willing to explore beyond the mainstream indices. Penny stocks, often associated with smaller or newer companies, remain a notable area of interest due to their potential for growth at lower price points. By focusing on those with strong financial health and solid fundamentals, investors can uncover hidden gems that may offer both stability and potential upside in today's market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Halcyon Technology (SET:HTECH) | THB2.66 | THB798M | ✅ 2 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.096 | SGD40.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.179 | SGD35.66M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.07 | SGD8.15B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.93 | HK$3.34B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.49 | HK$51.41B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.14 | HK$719.28M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.21 | HK$2.02B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.98 | HK$1.65B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,169 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ruifeng Power Group (SEHK:2025)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ruifeng Power Group Company Limited is an investment holding company focused on the design, development, manufacture, and sale of cylinder blocks and heads in the People's Republic of China, with a market cap of HK$2.48 billion.

Operations: The company's revenue is primarily derived from cylinder blocks, generating CN¥716.83 million, followed by cylinder heads at CN¥213.16 million, and ancillary cylinder block components and others contributing CN¥26.86 million.

Market Cap: HK$2.48B

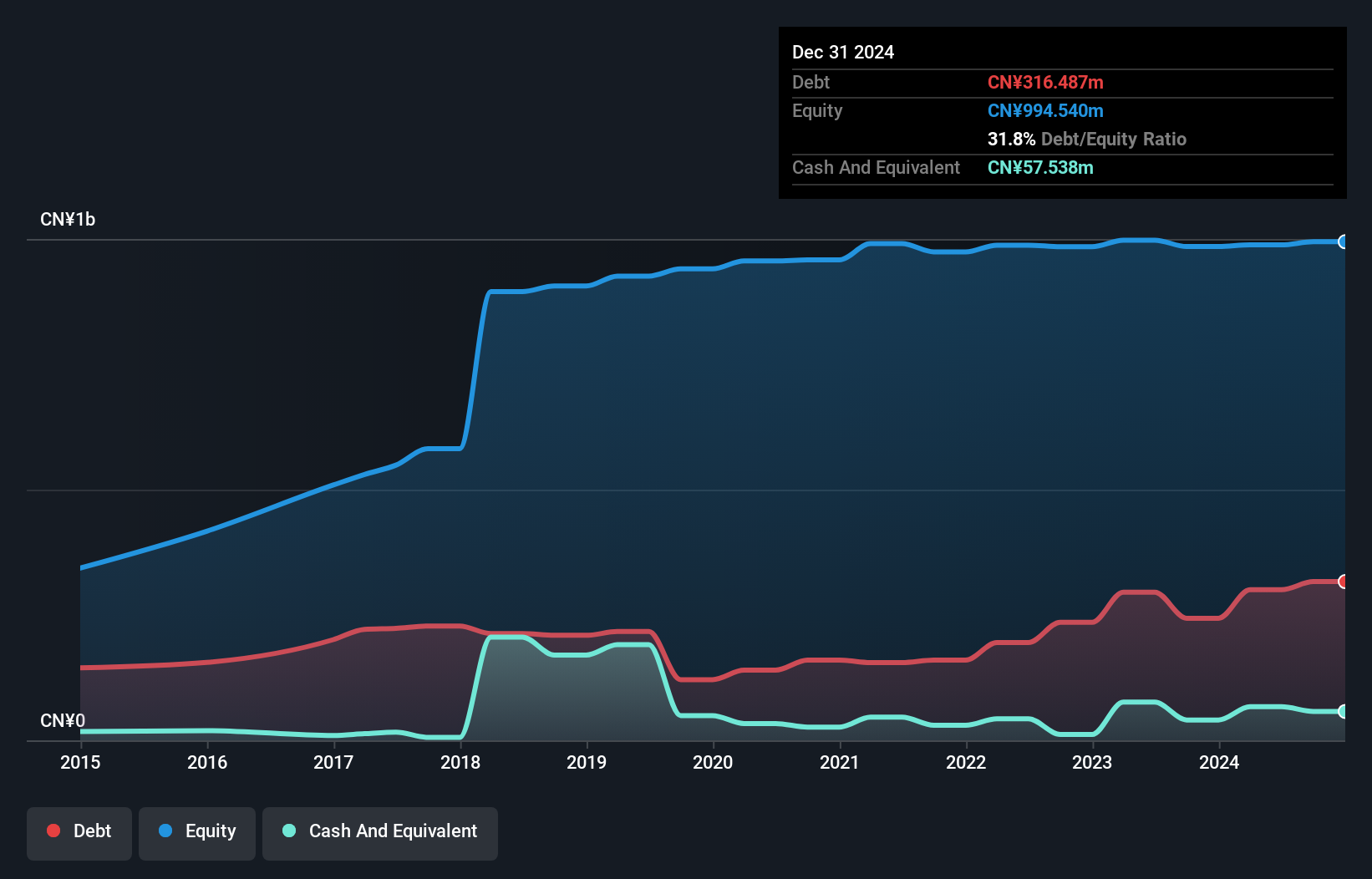

Ruifeng Power Group's recent performance reflects a significant earnings growth of 71.5% over the past year, outpacing the Auto Components industry. The company's revenue increased to CN¥956.85 million, driven by higher sales volume and tax benefits, resulting in net income rising to CN¥19.32 million from CN¥11.27 million previously. Despite low return on equity at 1.9%, Ruifeng has maintained stable weekly volatility and satisfactory debt levels with a net debt to equity ratio of 26%. The board is experienced with an average tenure of 7.6 years, while short-term assets exceed both short- and long-term liabilities comfortably.

- Navigate through the intricacies of Ruifeng Power Group with our comprehensive balance sheet health report here.

- Learn about Ruifeng Power Group's historical performance here.

AGTech Holdings (SEHK:8279)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AGTech Holdings Limited is an integrated technology and services company operating in the People's Republic of China and Macau, with a market capitalization of HK$2.31 billion.

Operations: The company's revenue is primarily derived from its Lottery Operation, contributing HK$261.14 million, and Electronic Payment and Related Services, generating HK$338.92 million.

Market Cap: HK$2.31B

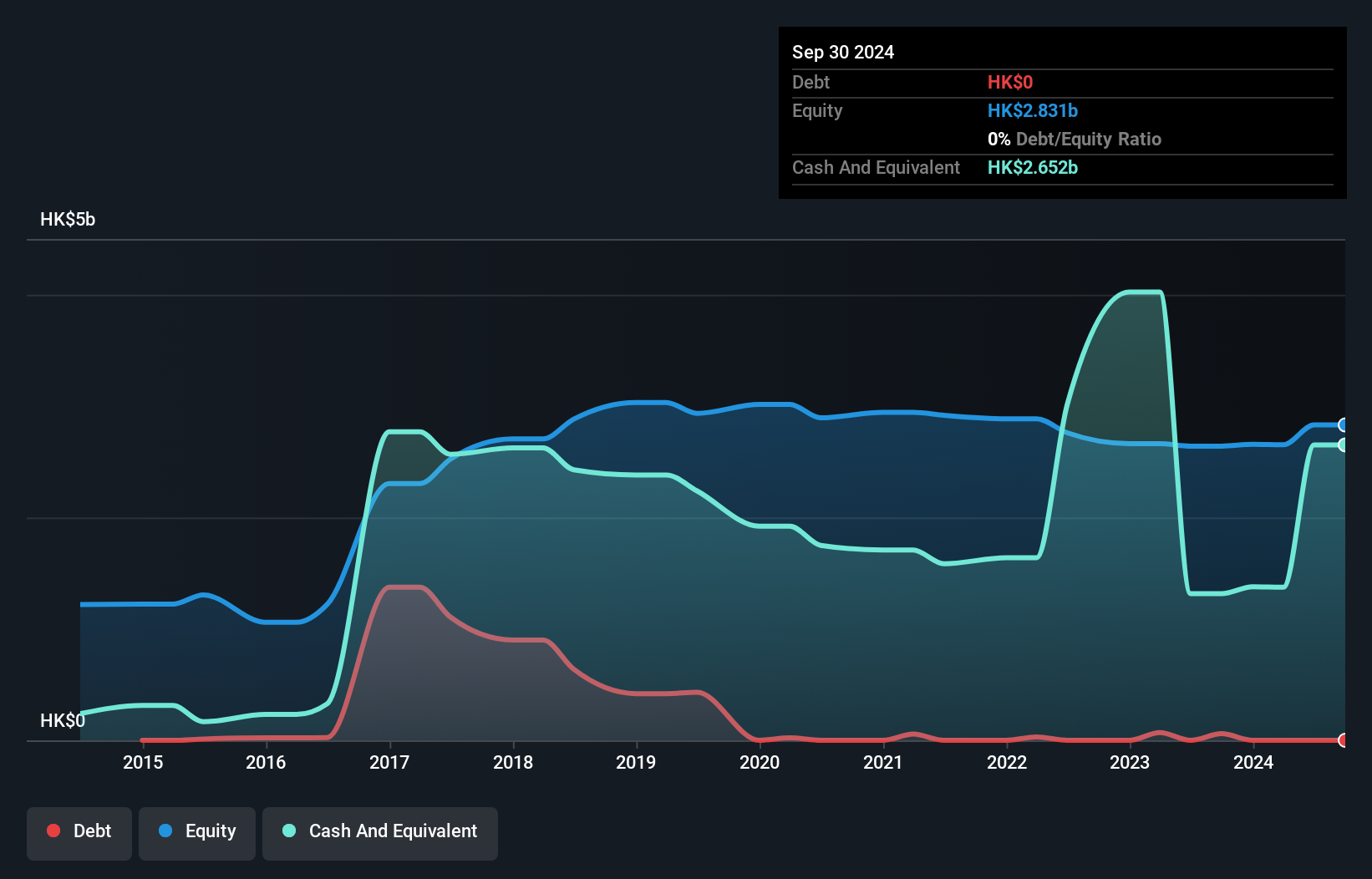

AGTech Holdings has shown impressive earnings growth of 69.9% over the past year, surpassing its five-year average of 37.8%, and remains debt-free, having reduced its debt from a previous ratio of 7.3%. The company generates significant revenue from its Lottery Operation (HK$261.14 million) and Electronic Payment Services (HK$338.92 million). Despite a low return on equity at 1.2%, AGTech's management team is seasoned with an average tenure of 6.3 years, while short-term assets (HK$3.1 billion) comfortably cover both short- and long-term liabilities, indicating solid financial health amidst stable volatility levels.

- Click here and access our complete financial health analysis report to understand the dynamics of AGTech Holdings.

- Evaluate AGTech Holdings' historical performance by accessing our past performance report.

Creative China Holdings (SEHK:8368)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Creative China Holdings Limited is an investment holding company involved in serial program and film production, as well as film rights investment in the People's Republic of China, Hong Kong, and Southeast Asia, with a market cap of HK$294.68 million.

Operations: The company generates revenue from several segments, including Concert and Event Organisation (CN¥2.24 million), Serial Program/Film Production and Film Distribution and Income Rights (CN¥148.19 million), Artist Management (CN¥0.38 million), and Mobile Application Development and Operation (CN¥0.34 million).

Market Cap: HK$294.68M

Creative China Holdings has faced challenges with declining revenue and net income, reporting CN¥151.14 million in sales for 2024, down from the previous year. Despite a low return on equity of 7.9%, the company maintains a satisfactory net debt to equity ratio of 1.4% and well-covered interest payments with EBIT at 25.6 times coverage. The board's seasoned experience contrasts with its volatile share price and negative earnings growth over the past year (-44.5%). While short-term assets (CN¥407.5M) exceed liabilities, negative operating cash flow indicates potential liquidity concerns amidst complex market competition.

- Dive into the specifics of Creative China Holdings here with our thorough balance sheet health report.

- Understand Creative China Holdings' track record by examining our performance history report.

Turning Ideas Into Actions

- Click here to access our complete index of 1,169 Asian Penny Stocks.

- Curious About Other Options? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2025

Ruifeng Power Group

An investment holding company, engages in the design, development, manufacture, and sale of cylinder blocks and heads in the People's Republic of China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives