- Hong Kong

- /

- Capital Markets

- /

- SEHK:6608

Cautious Investors Not Rewarding Bairong Inc.'s (HKG:6608) Performance Completely

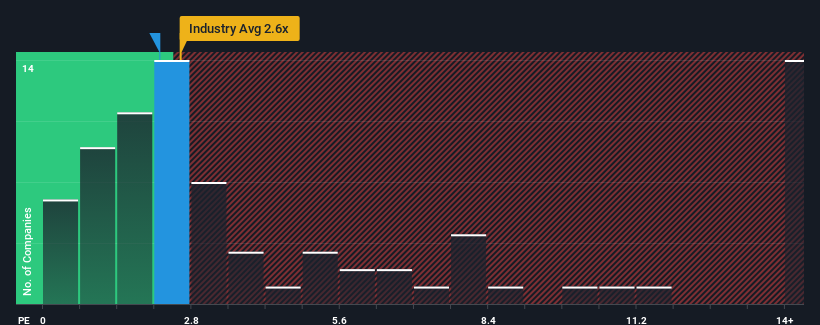

There wouldn't be many who think Bairong Inc.'s (HKG:6608) price-to-sales (or "P/S") ratio of 2.2x is worth a mention when the median P/S for the Capital Markets industry in Hong Kong is similar at about 2.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Bairong

How Bairong Has Been Performing

Bairong certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bairong.How Is Bairong's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Bairong's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 63% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 23% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 16% each year, which is noticeably less attractive.

In light of this, it's curious that Bairong's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Bairong's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Bairong's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Bairong, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bairong might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6608

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives