- Hong Kong

- /

- Consumer Finance

- /

- SEHK:622

Top Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets rally on the back of easing core U.S. inflation and strong bank earnings, investors are eyeing opportunities in various sectors. Penny stocks, often associated with smaller or less-established companies, remain a point of interest due to their potential for significant returns when supported by solid financials. Despite the term's outdated origins, these stocks can offer unique value propositions and growth potential, making them worth considering for those looking to explore under-the-radar investments with promising prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.49B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.13B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.63 | HK$42.48B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £150.76M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR425.99M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$142.2M | ★★★★☆☆ |

Click here to see the full list of 5,714 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Hanhua Financial Holding (SEHK:3903)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hanhua Financial Holding Co., Ltd., along with its subsidiaries, offers financial services in the People’s Republic of China and has a market capitalization of approximately HK$814.20 million.

Operations: The company generates revenue from three main segments: Digital Finance (CN¥109.79 million), Digital Services (CN¥137.55 million), and Capital Investment and Management (CN¥36.49 million).

Market Cap: HK$814.2M

Hanhua Financial Holding has demonstrated significant earnings growth of 695.7% over the past year, surpassing its five-year average decline. Despite this, the company's Return on Equity remains low at 0.2%. It benefits from a strong balance sheet with short-term assets of CN¥9.6 billion covering both short and long-term liabilities, and it has reduced its debt to equity ratio significantly over five years. However, operating cash flow is negative, indicating potential challenges in covering debt through operations. Recent auditor changes may warrant attention for investors considering governance stability in their assessment.

- Take a closer look at Hanhua Financial Holding's potential here in our financial health report.

- Gain insights into Hanhua Financial Holding's past trends and performance with our report on the company's historical track record.

Oshidori International Holdings (SEHK:622)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oshidori International Holdings Limited is an investment holding company that provides financial services in Hong Kong, with a market cap of HK$939.85 million.

Operations: The company's revenue segments include Financial Services generating HK$9.61 million and Tactical and/or Strategical Investments contributing -HK$40.00 million, with Credit and Lending Services at -HK$4.94 million.

Market Cap: HK$939.85M

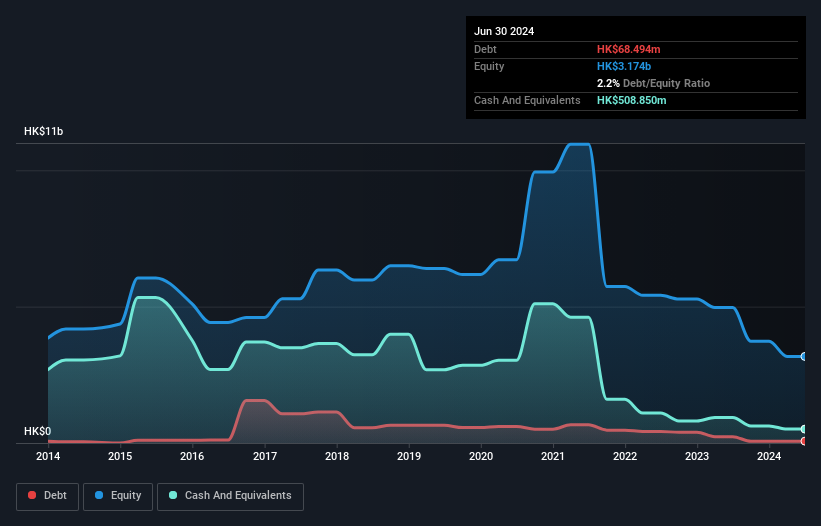

Oshidori International Holdings, with a market cap of HK$939.85 million, is currently pre-revenue, generating less than US$1 million in revenue. The company remains unprofitable with increasing losses over the past five years and a negative return on equity of -6.55%. Despite this, Oshidori has a strong financial position with short-term assets exceeding both its short and long-term liabilities and more cash than total debt. Its cash runway is sufficient for over three years based on current free cash flow levels. However, the stock's high volatility may concern investors seeking stability in penny stocks.

- Click to explore a detailed breakdown of our findings in Oshidori International Holdings' financial health report.

- Learn about Oshidori International Holdings' historical performance here.

TEAM Consulting Engineering and Management (SET:TEAMG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TEAM Consulting Engineering and Management Public Company Limited, along with its subsidiaries, offers integrated engineering, environmental, and management consultancy services both in Thailand and internationally with a market cap of THB2.62 billion.

Operations: The company's revenue is primarily derived from Project Management and Construction Supervision (THB363 million), Construction Management and Supervision for Various Types of Buildings and Infrastructure (THB329 million), Water Resources Projects (THB232 million), Geotechnical Engineering and Underground Structure Projects (THB216 million), Contracting and Other Related Business Services (THB195 million), Transportation and Logistics Projects (THB134 million), Urban, Building, and Infrastructure Projects (THB11 million), as well as Energy, Power, Oil and Gas, Petrochemical, Port, and Infrastructure Projects (THB99 million).

Market Cap: THB2.62B

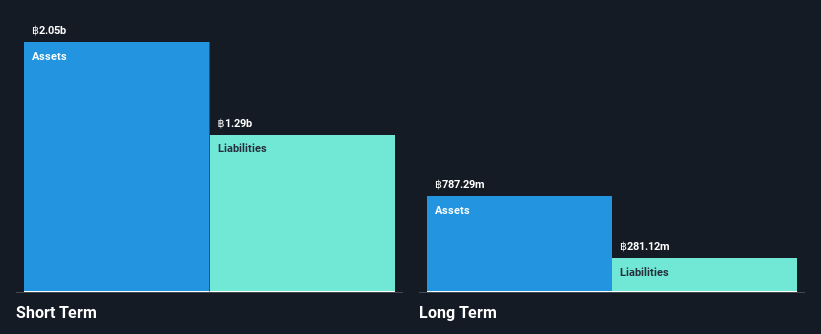

TEAM Consulting Engineering and Management, with a market cap of THB2.62 billion, has shown resilience despite negative earnings growth of -5.9% in the past year. The company's financial health is supported by short-term assets exceeding both short and long-term liabilities, and it maintains more cash than total debt. Recent executive changes aim to enhance strategic operations, potentially impacting future performance positively. However, the stock's high volatility might be a concern for investors seeking stability in penny stocks. Earnings quality remains high despite a slight decline in profit margins from 8% to 7.2% over the last year.

- Dive into the specifics of TEAM Consulting Engineering and Management here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into TEAM Consulting Engineering and Management's track record.

Turning Ideas Into Actions

- Explore the 5,714 names from our Penny Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:622

Oshidori International Holdings

An investment holding company, provides financial services in Hong Kong.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives