- Hong Kong

- /

- Diversified Financial

- /

- SEHK:1905

Uncovering Hidden Gems In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are experiencing heightened volatility, with small-cap stocks underperforming their larger counterparts, as evidenced by the Russell 2000 Index dipping into correction territory. Amidst inflation concerns and political uncertainties impacting broader market sentiment, investors are keenly observing economic indicators that suggest a choppy start to the year. In this environment, identifying hidden gems requires a focus on companies with strong fundamentals and resilience in challenging conditions, offering potential opportunities for those willing to explore beyond the mainstream.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Saudi Azm for Communication and Information Technology | 12.21% | 17.40% | 21.14% | ★★★★★☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Haitong Unitrust International Financial Leasing (SEHK:1905)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Haitong Unitrust International Financial Leasing Co., Ltd. operates as a financial leasing company in the People’s Republic of China, with a market capitalization of approximately HK$7.33 billion.

Operations: Haitong Unitrust generates revenue primarily from its financial services in the commercial sector, amounting to CN¥3.68 billion.

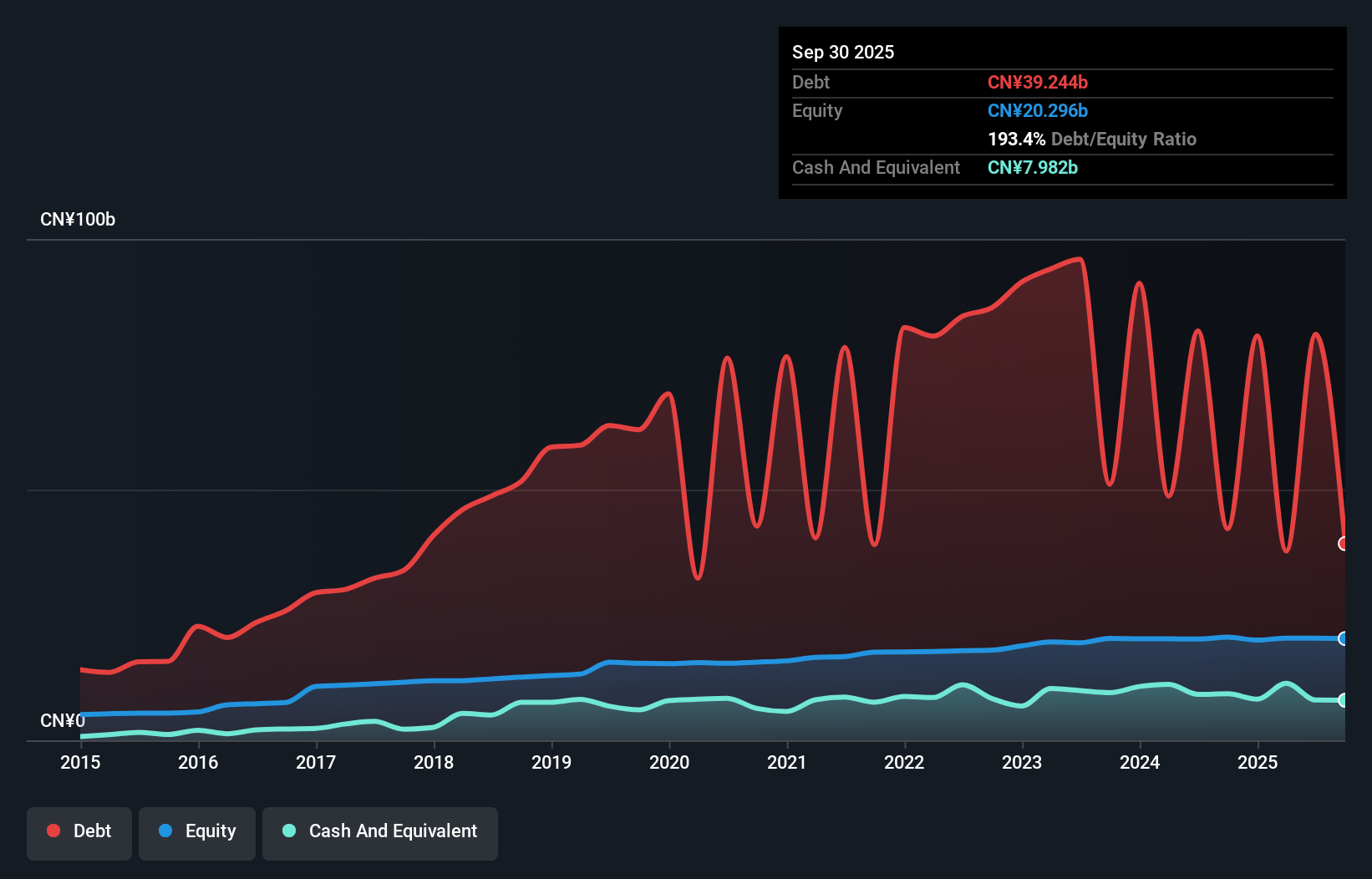

Haitong Unitrust, a dynamic player in the financial leasing sector, has shown resilience with earnings growth of 0.5% over the past year, outpacing the industry average of -6.6%. Despite carrying a high net debt to equity ratio of 160%, it has significantly improved from 403.4% five years ago. The company recently entered into notable finance lease arrangements worth RMB 100 million and RMB 142 million, reflecting strategic expansion moves. Trading at nearly 66% below its estimated fair value and boasting high-quality past earnings, Haitong Unitrust presents intriguing potential for investors seeking opportunities in financial leasing markets.

Suzhou Anjie Technology (SZSE:002635)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Anjie Technology Co., Ltd. is involved in the research, development, production, and sale of intelligent terminal components both in China and internationally, with a market cap of CN¥9.42 billion.

Operations: Anjie Technology generates revenue primarily through its intelligent terminal components. The company has a market cap of CN¥9.42 billion.

Anjie Tech, a small player in the tech sector, has been making waves with its robust earnings growth of 20% over the past year, outpacing the broader Electrical industry. The company reported sales of CNY 3.59 billion for the first nine months of 2024, up from CNY 3.07 billion a year prior, although net income slightly dipped to CNY 221.51 million from CNY 236.7 million last year. Despite this minor setback in profit margins, Anjie’s high-quality earnings and positive free cash flow suggest promising potential as it continues to outperform industry standards with forecasted annual growth at an impressive pace of nearly 36%.

Depo Auto Parts Industrial (TWSE:6605)

Simply Wall St Value Rating: ★★★★★★

Overview: Depo Auto Parts Industrial Co., Ltd. is a company that specializes in the manufacturing and sale of automotive and related lighting products, with a market capitalization of approximately NT$34.82 billion.

Operations: Depo Auto Parts Industrial generates revenue primarily from the research, development, manufacturing, and sales of various automotive lamps, totaling NT$19.87 billion.

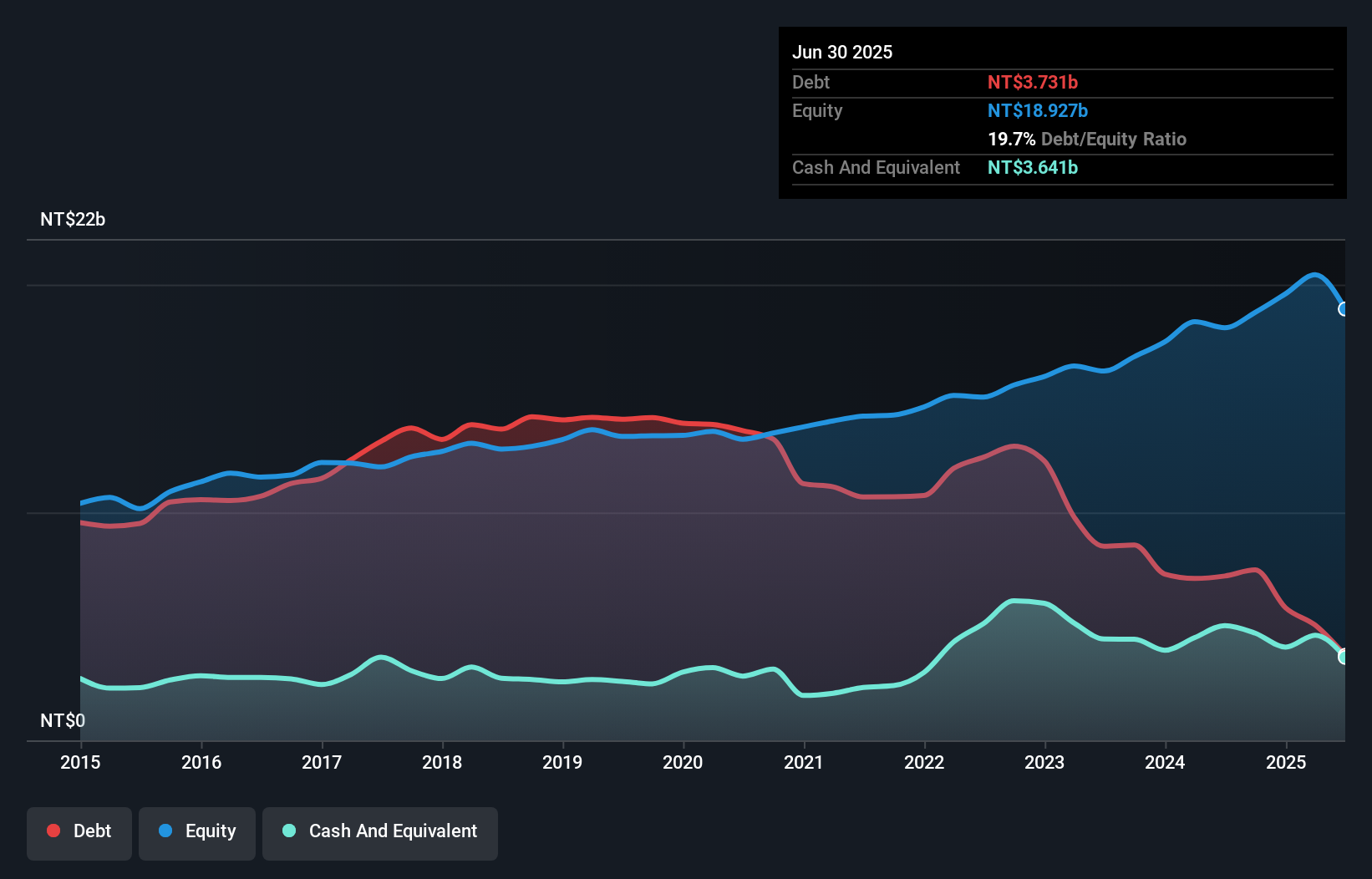

Depo Auto Parts Industrial, a smaller player in the auto components sector, has shown impressive growth with earnings surging 43% over the past year, outpacing industry averages. The company's net debt to equity ratio stands at a satisfactory 14.8%, reflecting solid financial health as it reduced its debt from 106% to 39.8% over five years. Trading at nearly 42% below estimated fair value suggests potential upside for investors. Despite recent operational disruptions due to an unfortunate accident, Depo's high-quality earnings and strong interest coverage of 9.9 times EBIT underscore its robust financial position and resilience in challenging times.

- Get an in-depth perspective on Depo Auto Parts Industrial's performance by reading our health report here.

Learn about Depo Auto Parts Industrial's historical performance.

Key Takeaways

- Reveal the 4518 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haitong Unitrust International Financial Leasing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1905

Haitong Unitrust International Financial Leasing

Through its subsidiaries, operates as a financial leasing company in the People’s Republic of China.

Good value average dividend payer.

Market Insights

Community Narratives