- Hong Kong

- /

- Capital Markets

- /

- SEHK:1461

Would Shareholders Who Purchased LUZHENG FUTURES' (HKG:1461) Stock Five Years Be Happy With The Share price Today?

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. For example the LUZHENG FUTURES Company Limited (HKG:1461) share price dropped 67% over five years. That's an unpleasant experience for long term holders. The good news is that the stock is up 1.6% in the last week.

See our latest analysis for LUZHENG FUTURES

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

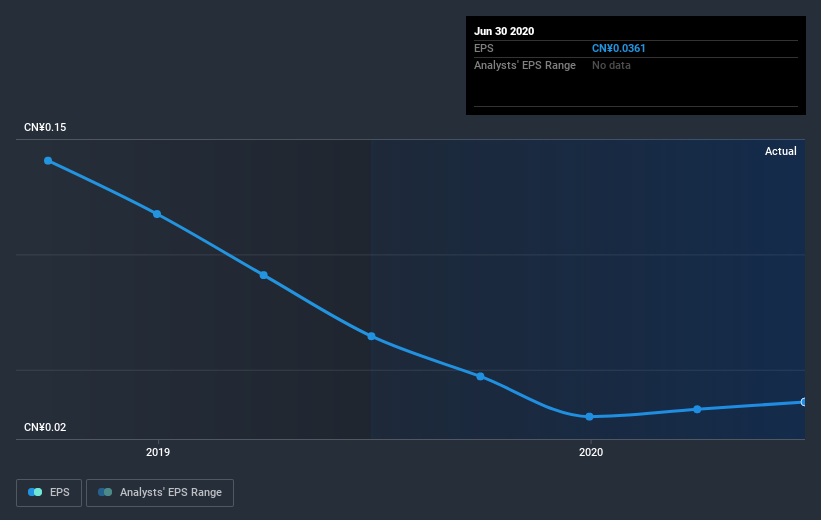

Looking back five years, both LUZHENG FUTURES' share price and EPS declined; the latter at a rate of 23% per year. This change in EPS is reasonably close to the 20% average annual decrease in the share price. This suggests that market participants have not changed their view of the company all that much. So it's fair to say the share price has been responding to changes in EPS.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into LUZHENG FUTURES' key metrics by checking this interactive graph of LUZHENG FUTURES's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered LUZHENG FUTURES' share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for LUZHENG FUTURES shareholders, and that cash payout explains why its total shareholder loss of 61%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While the broader market gained around 16% in the last year, LUZHENG FUTURES shareholders lost 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for LUZHENG FUTURES you should be aware of, and 1 of them makes us a bit uncomfortable.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade LUZHENG FUTURES, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zhongtai Futures might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1461

Zhongtai Futures

Provides brokerage services for commodity and financial futures.

Adequate balance sheet low.

Market Insights

Community Narratives