- Hong Kong

- /

- Entertainment

- /

- SEHK:9857

Asian Market Insights: Wealthink AI-Innovation Capital Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, with trade tensions and monetary policy shifts making headlines, investors are increasingly seeking opportunities in diverse sectors. Penny stocks, often associated with smaller or newer companies, present intriguing possibilities for those looking to explore beyond the mainstream market. Despite being considered an outdated term by some, these stocks continue to offer potential growth at accessible price points when backed by solid financials and fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.92 | HK$2.34B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.44 | HK$921.6M | ✅ 4 ⚠️ 1 View Analysis > |

| Chongqing Zaisheng Technology (SHSE:603601) | CN¥4.81 | CN¥4.83B | ✅ 3 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.51 | HK$2.06B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.18 | SGD478.24M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.68 | THB2.8B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.094 | SGD49.21M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.18 | SGD12.52B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.44 | THB9.05B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 956 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Wealthink AI-Innovation Capital (SEHK:1140)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wealthking Investments Limited, with a market cap of HK$2.38 billion, operates as an investment holding company in Hong Kong.

Operations: The company's revenue segment is derived entirely from its investment holding activities, amounting to HK$275.63 million.

Market Cap: HK$2.38B

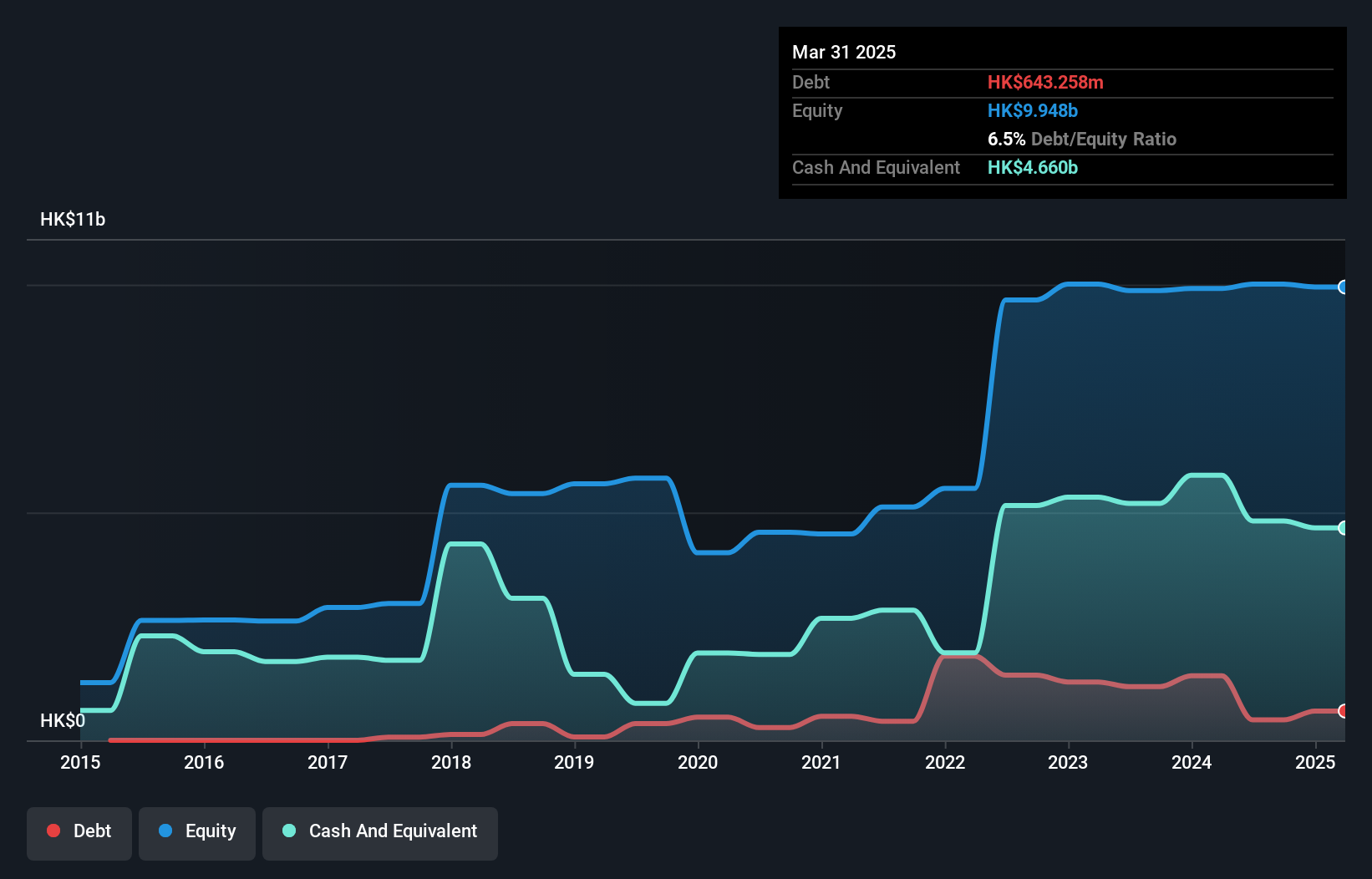

Wealthink AI-Innovation Capital's recent performance highlights both strengths and challenges typical of penny stocks. The company's earnings grew by 19.6% over the past year, surpassing industry averages, though this is below its five-year growth rate of 58% per year. Despite a volatile share price and significant insider selling recently, the company maintains a strong financial position with short-term assets exceeding liabilities and more cash than debt. However, negative operating cash flow suggests caution is warranted. Recent board changes include Ms. Wang Yun's appointment as Company Secretary, bringing extensive governance experience to the team amidst ongoing strategic shifts.

- Navigate through the intricacies of Wealthink AI-Innovation Capital with our comprehensive balance sheet health report here.

- Explore historical data to track Wealthink AI-Innovation Capital's performance over time in our past results report.

Linmon Media (SEHK:9857)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Linmon Media Limited is an investment holding company involved in the production, distribution, and licensing of drama series broadcasting rights in Mainland China and internationally, with a market cap of HK$1.42 billion.

Operations: The company's revenue primarily comes from Mainland China, with additional contributions from other countries and regions amounting to CN¥59.05 million.

Market Cap: HK$1.42B

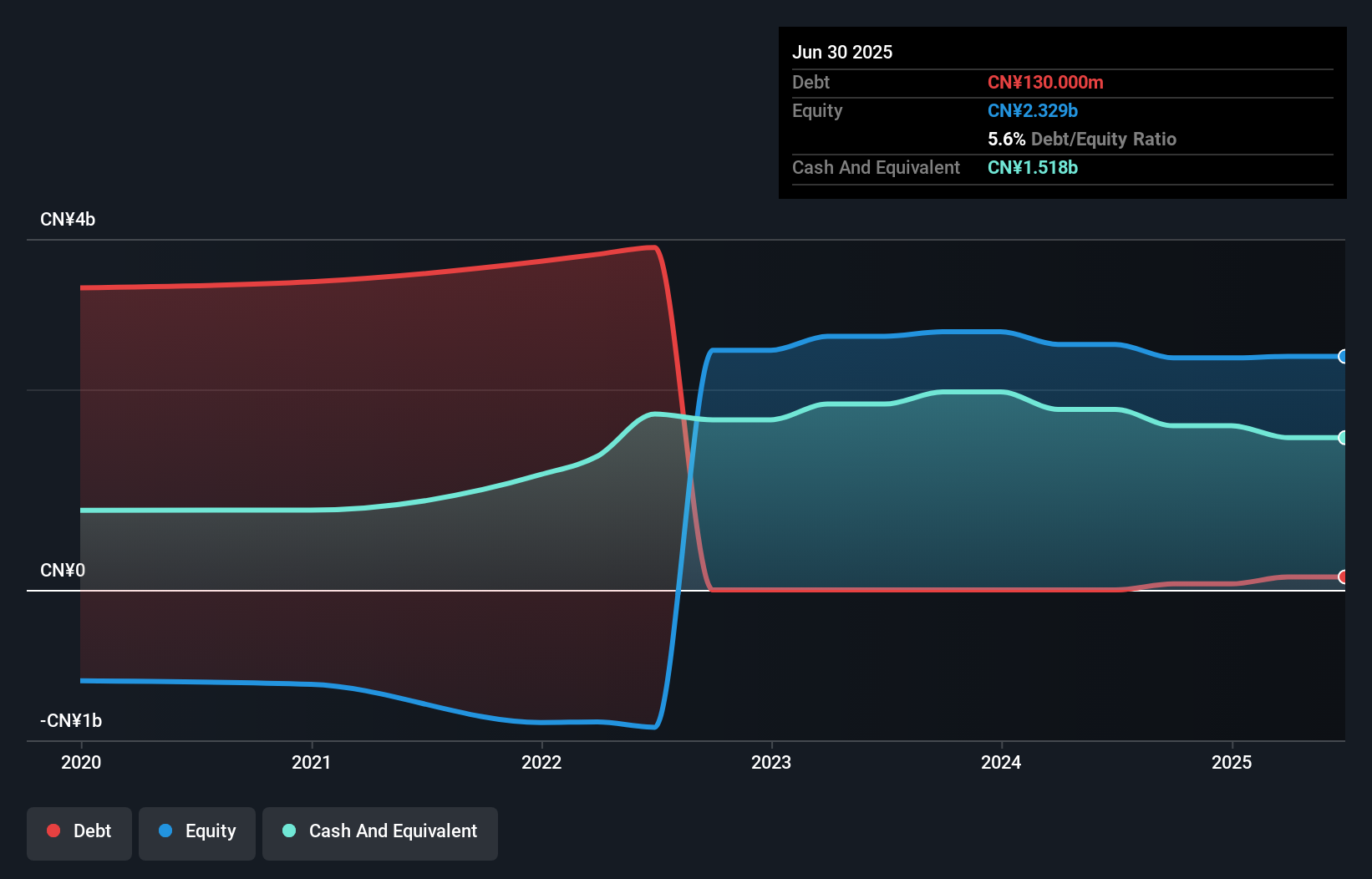

Linmon Media Limited has demonstrated a turnaround from loss to profit, reporting a net income of CN¥10.82 million for the first half of 2025, compared to a net loss the previous year. The company's financial health is robust, with short-term assets significantly exceeding liabilities and more cash than debt. Recent strategic moves include launching "The Showdown," a high-profile drama series in collaboration with major Chinese media entities, and releasing an international remake of its popular series on global platforms like Disney+. These initiatives reflect Linmon's focus on expanding its content reach and improving profitability.

- Click here and access our complete financial health analysis report to understand the dynamics of Linmon Media.

- Explore Linmon Media's analyst forecasts in our growth report.

Dongguan Rural Commercial Bank (SEHK:9889)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Rural Commercial Bank Co., Ltd. offers a range of banking products and services in China, with a market cap of HK$23.83 billion.

Operations: No specific revenue segments have been reported for this company.

Market Cap: HK$23.83B

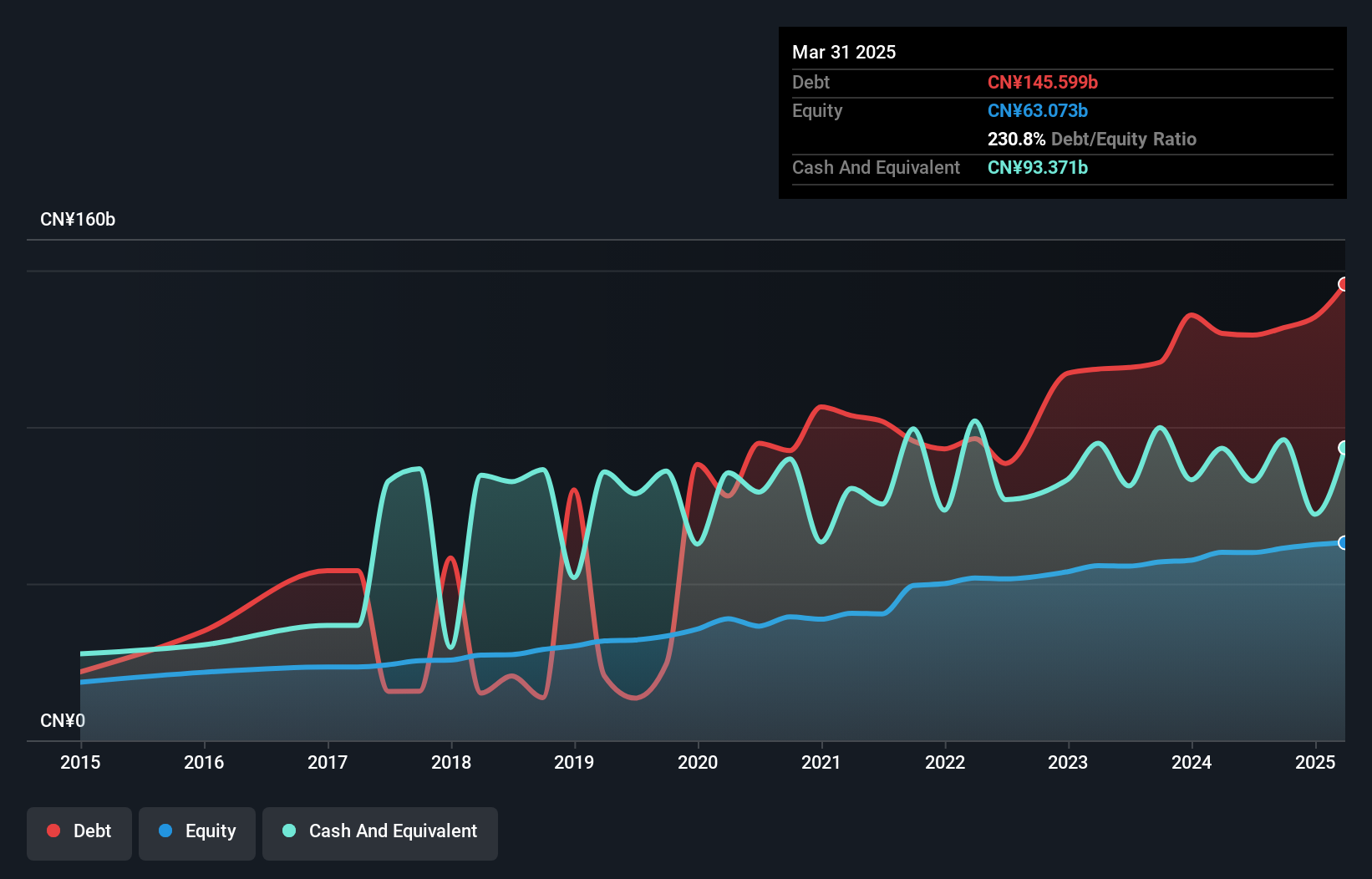

Dongguan Rural Commercial Bank's financial performance has been under pressure, with net interest income declining to CNY 4.24 billion for the first half of 2025 from CNY 4.70 billion a year earlier, and net income falling to CNY 2.63 billion from CNY 3.17 billion. Despite these challenges, the bank maintains a moderate assets-to-equity ratio of 12.1x and an appropriate loans-to-assets ratio of 50%. Its funding is primarily low-risk, supported by customer deposits making up most liabilities, while its allowance for bad loans stands at a sufficient level of 207%, indicating prudent risk management practices in place.

- Take a closer look at Dongguan Rural Commercial Bank's potential here in our financial health report.

- Review our historical performance report to gain insights into Dongguan Rural Commercial Bank's track record.

Key Takeaways

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 953 more companies for you to explore.Click here to unveil our expertly curated list of 956 Asian Penny Stocks.

- Searching for a Fresh Perspective? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9857

Linmon Media

An investment holding company, engages in the production, distribution, and licensing of broadcasting rights of drama series in Mainland China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives