- Hong Kong

- /

- Hospitality

- /

- SEHK:9869

Newsflash: Helens International Holdings Company Limited (HKG:9869) Analysts Have Been Trimming Their Revenue Forecasts

Market forces rained on the parade of Helens International Holdings Company Limited (HKG:9869) shareholders today, when the analysts downgraded their forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

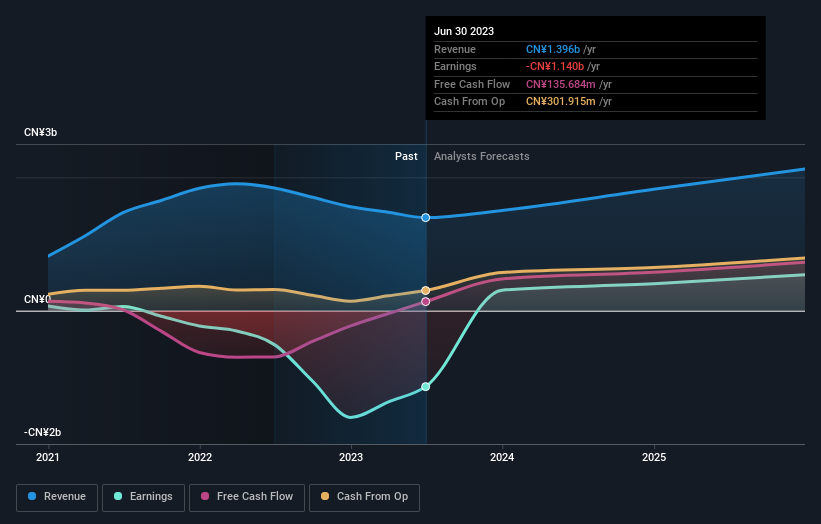

Following the downgrade, the most recent consensus for Helens International Holdings from its 15 analysts is for revenues of CN¥1.5b in 2023 which, if met, would be a credible 7.7% increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of CN¥1.8b in 2023. The consensus view seems to have become more pessimistic on Helens International Holdings, noting the measurable cut to revenue estimates in this update.

See our latest analysis for Helens International Holdings

Notably, the analysts have cut their price target 20% to CN¥9.88, suggesting concerns around Helens International Holdings' valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Helens International Holdings at CN¥17.31 per share, while the most bearish prices it at CN¥6.49. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely differing views on what kind of performance this business can generate. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. For example, we noticed that Helens International Holdings' rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 7.7% growth to the end of 2023 on an annualised basis. That is well above its historical decline of 24% a year over the past year. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 19% annually for the foreseeable future. So although Helens International Holdings' revenue growth is expected to improve, it is still expected to grow slower than the industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They're also anticipating slower revenue growth than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of Helens International Holdings' future valuation. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Helens International Holdings going forwards.

Thirsting for more data? We have estimates for Helens International Holdings from its 15 analysts out until 2025, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you're looking to trade Helens International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Helens International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9869

Helens International Holdings

An investment holding company, engages in the bar operations and franchise business in the People’s Republic of China (PRC) and Hong Kong.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives