- Hong Kong

- /

- Consumer Services

- /

- SEHK:839

A Look at China Education Group Holdings (SEHK:839) Valuation Following Strong Annual Sales and Earnings Growth

Reviewed by Simply Wall St

China Education Group Holdings (SEHK:839) released its annual earnings report, highlighting sharp growth in both sales and net income for the year ended August 31, 2025. The company’s improved financial metrics are attracting fresh attention from investors.

See our latest analysis for China Education Group Holdings.

Shares of China Education Group Holdings have seen a recent uptick following the latest earnings release, with a 1.82% gain in the last day and 4.87% over the past week. Despite these short-term moves, the total shareholder return over the past year remains down 15.8%. This reflects broader headwinds the business has faced. However, the company’s momentum appears to be turning a corner as markets absorb its strong results and growth prospects.

If this renewed momentum has you thinking about other opportunities, now could be a smart moment to broaden your view and discover fast growing stocks with high insider ownership

With shares still trading nearly 30% below analyst price targets despite this strong performance, the question now is whether investors are looking at a bargain or if the improvement is already reflected by the market.

Price-to-Earnings of 7.3x: Is it justified?

China Education Group Holdings is trading at a price-to-earnings ratio of 7.3x, which appears undervalued compared to both its peer group and its own estimated fair ratio. With a last close price of HK$2.8, the stock sits well below what valuation models might suggest for similar companies in the industry.

The price-to-earnings ratio (P/E) measures what investors are willing to pay for each dollar of earnings. In the education sector, where stability and growth prospects matter, a lower P/E can indicate undervaluation if profits are expected to rise.

The P/E of 7.3x is not only lower than the peer average of 16.7x but also far below its estimated fair P/E ratio of 15.3x. This suggests the market may be significantly underpricing the company’s future earnings potential. If investor sentiment shifts or earnings momentum continues, there is clear room for the stock’s valuation to move closer to that fair level.

Explore the SWS fair ratio for China Education Group Holdings

Result: Price-to-Earnings of 7.3x (UNDERVALUED)

However, sustained declines in sector sentiment or disappointing future enrollment numbers could limit the upside. This could potentially keep shares from realizing their perceived value.

Find out about the key risks to this China Education Group Holdings narrative.

Another View: Our DCF Model’s Perspective

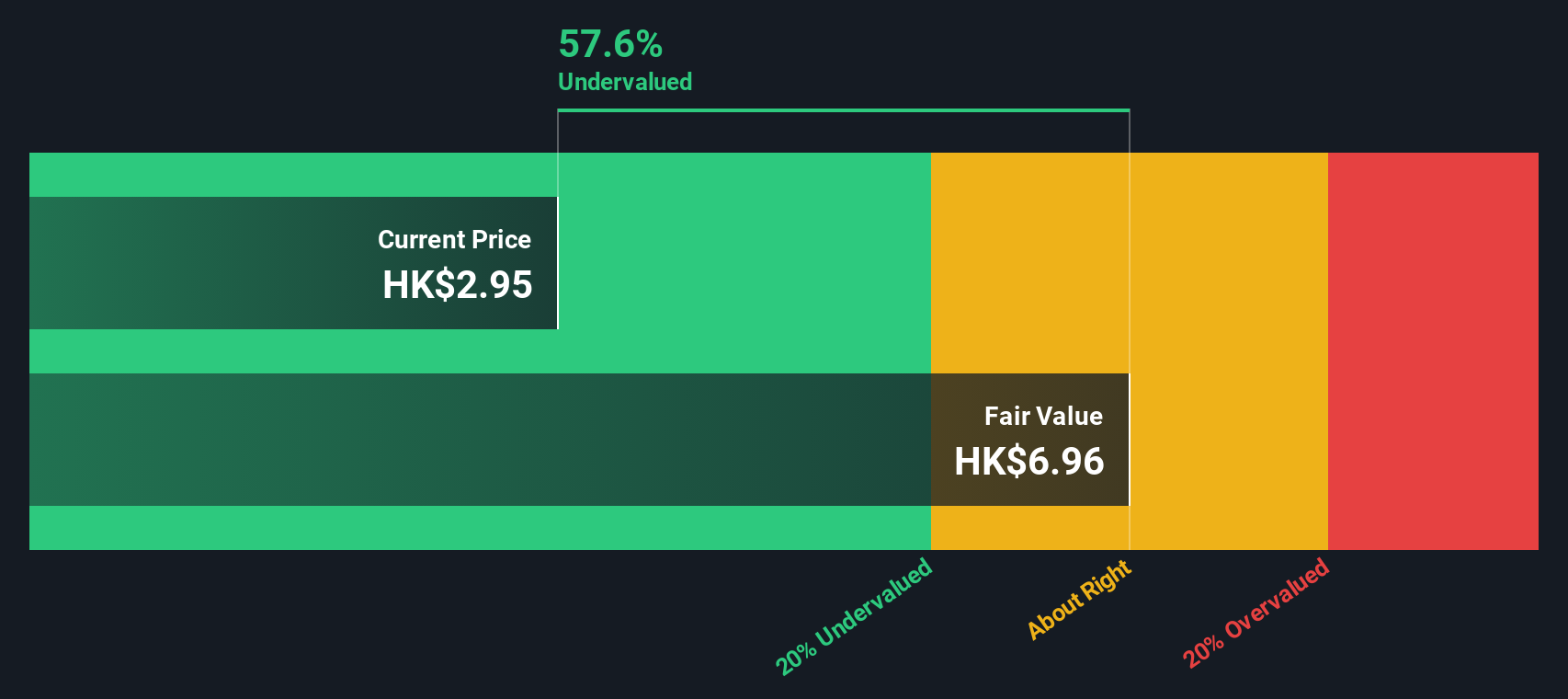

Looking at China Education Group Holdings through our SWS DCF model, an even wider gap emerges. The current share price of HK$2.8 is well below our estimated fair value of HK$6.83. This suggests the market is pricing in a lot more caution. Is the DCF model capturing hidden potential, or is the market’s skepticism justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Education Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Education Group Holdings Narrative

If you have a different perspective or want to dive into the numbers yourself, it only takes a few minutes to shape your own view and Do it your way.

A great starting point for your China Education Group Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one opportunity. Set yourself up for smarter returns by exploring other exciting stocks on Simply Wall Street’s custom screeners.

- Capture high yields for your portfolio by checking out these 15 dividend stocks with yields > 3% that consistently deliver over 3% returns to shareholders.

- Position yourself at the forefront of market innovation as you scan these 25 AI penny stocks transforming industries through artificial intelligence breakthroughs.

- Boost your chances of finding the next hidden gem by searching these 914 undervalued stocks based on cash flows that trade well below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:839

China Education Group Holdings

An investment holding company, engages in the operation of private higher and secondary vocational education institutions in Mainland China and Australia.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026