- Hong Kong

- /

- Consumer Services

- /

- SEHK:79

It's Unlikely That Century Legend (Holdings) Limited's (HKG:79) CEO Will See A Huge Pay Rise This Year

Key Insights

- Century Legend (Holdings) to hold its Annual General Meeting on 3rd of June

- Total pay for CEO Samuel Tsang includes HK$3.72m salary

- Total compensation is 124% above industry average

- Century Legend (Holdings)'s EPS declined by 41% over the past three years while total shareholder loss over the past three years was 61%

The underwhelming share price performance of Century Legend (Holdings) Limited (HKG:79) in the past three years would have disappointed many shareholders. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 3rd of June, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

View our latest analysis for Century Legend (Holdings)

How Does Total Compensation For Samuel Tsang Compare With Other Companies In The Industry?

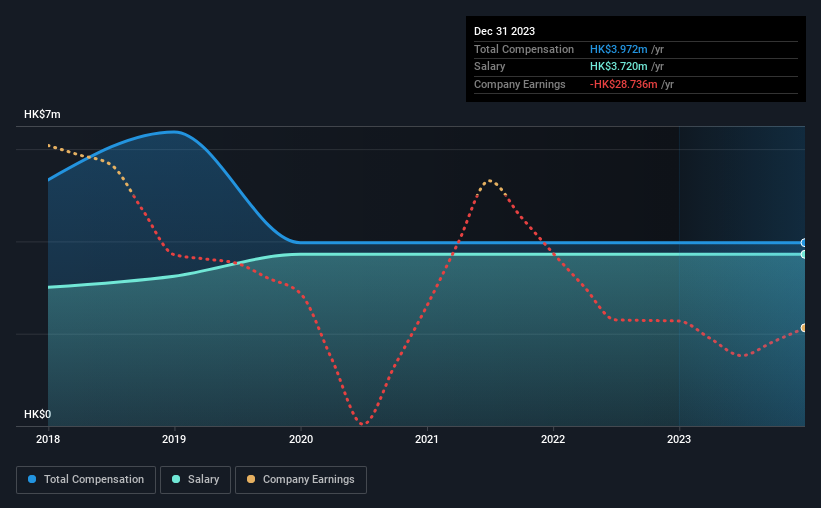

At the time of writing, our data shows that Century Legend (Holdings) Limited has a market capitalization of HK$19m, and reported total annual CEO compensation of HK$4.0m for the year to December 2023. There was no change in the compensation compared to last year. We note that the salary portion, which stands at HK$3.72m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Hong Kong Consumer Services industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$1.8m. This suggests that Samuel Tsang is paid more than the median for the industry. Moreover, Samuel Tsang also holds HK$5.1m worth of Century Legend (Holdings) stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$3.7m | HK$3.7m | 94% |

| Other | HK$252k | HK$252k | 6% |

| Total Compensation | HK$4.0m | HK$4.0m | 100% |

Talking in terms of the industry, salary represented approximately 85% of total compensation out of all the companies we analyzed, while other remuneration made up 15% of the pie. Century Legend (Holdings) pays out 94% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Century Legend (Holdings) Limited's Growth Numbers

Over the last three years, Century Legend (Holdings) Limited has shrunk its earnings per share by 41% per year. In the last year, its revenue is up 46%.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Century Legend (Holdings) Limited Been A Good Investment?

Few Century Legend (Holdings) Limited shareholders would feel satisfied with the return of -61% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for Century Legend (Holdings) that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:79

Century Legend (Holdings)

An investment holding company, engages in the hair styling, property investment, securities investment, and hospitality businesses in Hong Kong and Macau.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives