- Hong Kong

- /

- Hospitality

- /

- SEHK:780

Tongcheng Travel Holdings (SEHK:780): A Fresh Look at Valuation After Recent Share Price Movements

Reviewed by Kshitija Bhandaru

Tongcheng Travel Holdings (SEHK:780) has recently caught the attention of investors following some fresh market movements. The company’s stock has shifted slightly over the past month, inviting a closer look at what might be driving recent sentiment.

See our latest analysis for Tongcheng Travel Holdings.

This year, Tongcheng Travel Holdings has gained significant momentum, reaching a latest share price of $21.84 and delivering a strong year-to-date share price return of 23.11%. The recent dip in share price is minor compared to its solid one-year total shareholder return of 22.98% and an even more impressive 55.58% over three years. This suggests that underlying confidence in the company’s growth and fundamentals remains intact.

If you’re tracking companies with breakout growth stories, this is a great time to broaden your perspective and uncover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst price targets, investors are faced with a key question: Is Tongcheng Travel Holdings currently undervalued, or has the market already accounted for all of its expected future growth?

Most Popular Narrative: 14.1% Undervalued

With the narrative fair value for Tongcheng Travel Holdings set at HK$25.42, the latest closing price of HK$21.84 looks meaningfully below that benchmark. This valuation difference highlights market expectations for robust growth and more ambitious profit margins, creating a sense of optimism among investors tracking the company’s next moves.

Expansion into lower-tier Chinese cities, propelled by targeted high-value user acquisition and leveraging growing internet and smartphone adoption, is unlocking a large, increasingly digitized user base. This supports robust revenue growth and higher order frequency through the platform.

Want to discover what’s fueling this optimistic forecast? The story centers on aggressive top-line growth, margin expansion, and a powerful digital ecosystem strategy. But how bold are the financial leaps analysts are banking on? Dive into the full narrative to see the figures that power this valuation drama.

Result: Fair Value of $25.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including heavy reliance on Tencent’s ecosystem and mounting competition, which could pressure Tongcheng’s growth and profit margins going forward.

Find out about the key risks to this Tongcheng Travel Holdings narrative.

Another View: A Closer Look at Earnings Valuation

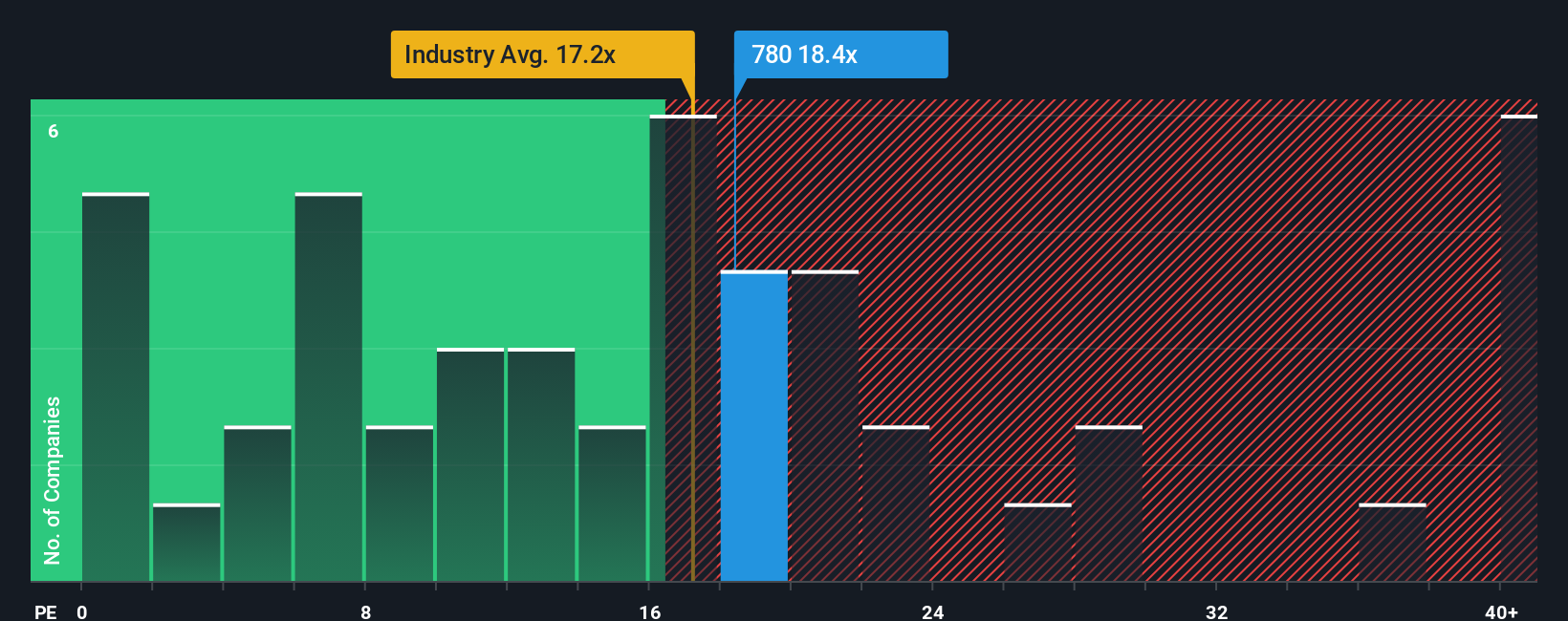

Shifting from fair value models to a focus on earnings, Tongcheng Travel Holdings’ current price-to-earnings ratio stands at 18.8x. This is noticeably higher than both the peer average of 13.1x and the Hong Kong Hospitality industry average of 16.5x. It also sits just above its fair ratio of 18.7x.

The gap between Tongcheng’s valuation and peers signals investors are paying a premium for growth. This raises questions about whether the recent momentum can be sustained. What might make the market rethink this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tongcheng Travel Holdings Narrative

If you’re eager to dig into the numbers on your own terms or want to shape the story differently, you can build a personalized narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tongcheng Travel Holdings.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Take action now and see what else is out there. Missing out could mean skipping tomorrow's market leaders.

- Collect steady income streams by checking out these 19 dividend stocks with yields > 3% that deliver yields above 3% and add reliability to your portfolio.

- Boost your portfolio's innovation factor by targeting these 24 AI penny stocks at the forefront of artificial intelligence, automation, and data-driven business models.

- Capitalize on unique opportunities in the field of decentralized finance and blockchain technology through these 79 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tongcheng Travel Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:780

Tongcheng Travel Holdings

An investment holding company, provides travel related services in the People’s Republic of China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives