- Hong Kong

- /

- Hospitality

- /

- SEHK:542

China Cultural Tourism and Agriculture Group Limited (HKG:542) Stocks Pounded By 32% But Not Lagging Industry On Growth Or Pricing

To the annoyance of some shareholders, China Cultural Tourism and Agriculture Group Limited (HKG:542) shares are down a considerable 32% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

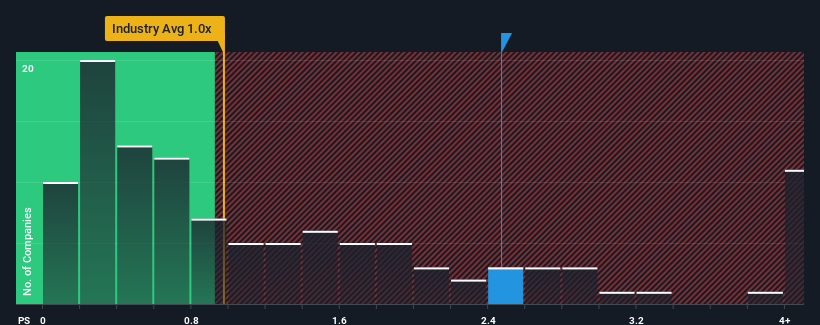

Although its price has dipped substantially, you could still be forgiven for thinking China Cultural Tourism and Agriculture Group is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.5x, considering almost half the companies in Hong Kong's Hospitality industry have P/S ratios below 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for China Cultural Tourism and Agriculture Group

How China Cultural Tourism and Agriculture Group Has Been Performing

As an illustration, revenue has deteriorated at China Cultural Tourism and Agriculture Group over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Cultural Tourism and Agriculture Group will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For China Cultural Tourism and Agriculture Group?

In order to justify its P/S ratio, China Cultural Tourism and Agriculture Group would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 81%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Comparing that to the industry, which is only predicted to deliver 19% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why China Cultural Tourism and Agriculture Group is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On China Cultural Tourism and Agriculture Group's P/S

Despite the recent share price weakness, China Cultural Tourism and Agriculture Group's P/S remains higher than most other companies in the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of China Cultural Tourism and Agriculture Group revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Before you take the next step, you should know about the 4 warning signs for China Cultural Tourism and Agriculture Group (1 is a bit unpleasant!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:542

China Cultural Tourism and Agriculture Group

Engages in the property development, hotel businesses, and trading of food and beverages in the People’s Republic of China.

Low with imperfect balance sheet.

Market Insights

Community Narratives