- Hong Kong

- /

- Consumer Services

- /

- SEHK:3978

Here's Why We Think China Beststudy Education Group's (HKG:3978) CEO Compensation Looks Fair for the time being

Key Insights

- China Beststudy Education Group will host its Annual General Meeting on 16th of May

- Total pay for CEO Junjing Tang includes CN¥1.55m salary

- The total compensation is similar to the average for the industry

- China Beststudy Education Group's total shareholder return over the past three years was 52% while its EPS was down 9.0% over the past three years

China Beststudy Education Group (HKG:3978) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 16th of May. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for China Beststudy Education Group

Comparing China Beststudy Education Group's CEO Compensation With The Industry

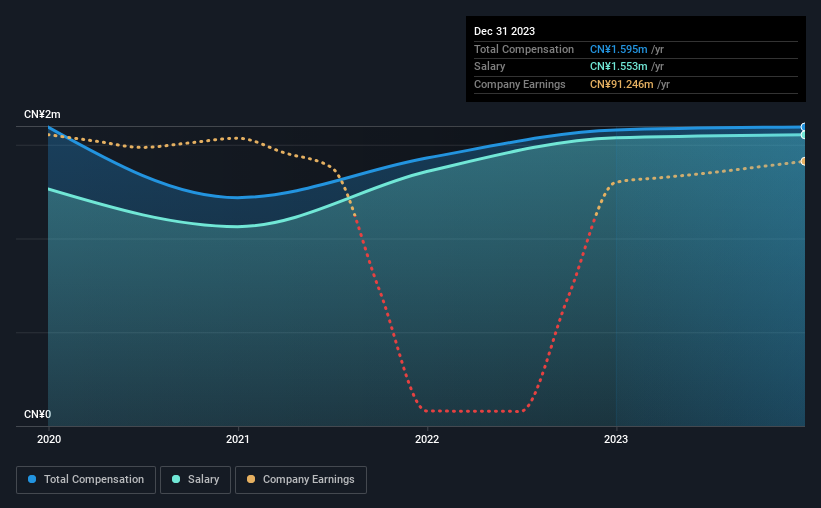

According to our data, China Beststudy Education Group has a market capitalization of HK$2.5b, and paid its CEO total annual compensation worth CN¥1.6m over the year to December 2023. That's mostly flat as compared to the prior year's compensation. In particular, the salary of CN¥1.55m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Hong Kong Consumer Services industry with market capitalizations ranging between HK$1.6b and HK$6.3b had a median total CEO compensation of CN¥1.7m. So it looks like China Beststudy Education Group compensates Junjing Tang in line with the median for the industry. Moreover, Junjing Tang also holds HK$587m worth of China Beststudy Education Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥1.6m | CN¥1.5m | 97% |

| Other | CN¥42k | CN¥42k | 3% |

| Total Compensation | CN¥1.6m | CN¥1.6m | 100% |

Talking in terms of the industry, salary represented approximately 85% of total compensation out of all the companies we analyzed, while other remuneration made up 15% of the pie. Investors will find it interesting that China Beststudy Education Group pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

China Beststudy Education Group's Growth

China Beststudy Education Group has reduced its earnings per share by 9.0% a year over the last three years. The trailing twelve months of revenue was pretty much the same as the prior period.

The decline in EPS is a bit concerning. And the flat revenue is seriously uninspiring. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has China Beststudy Education Group Been A Good Investment?

Boasting a total shareholder return of 52% over three years, China Beststudy Education Group has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Junjing receives almost all of their compensation through a salary. Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 3 warning signs for China Beststudy Education Group (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3978

China Beststudy Education Group

Provides after-school education services for K-12 student groups in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.