Top SEHK Growth Companies With High Insider Ownership In October 2024

Reviewed by Simply Wall St

As global markets navigate escalating tensions in the Middle East and fluctuating oil prices, Hong Kong's Hang Seng Index has shown resilience, climbing by 10.2% amid optimism surrounding Beijing's support measures. In this climate of uncertainty, growth companies with high insider ownership can offer a compelling investment narrative as they often signal strong confidence from those closest to the business and may provide stability during volatile times.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 32.7% |

| Akeso (SEHK:9926) | 20.5% | 52.6% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Xiamen Yan Palace Bird's Nest Industry (SEHK:1497) | 26.7% | 23.8% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| DPC Dash (SEHK:1405) | 38.1% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 69.7% |

Here we highlight a subset of our preferred stocks from the screener.

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across the People's Republic of China, Hong Kong, Macau, Taiwan, and internationally with a market cap of approximately HK$974.20 billion.

Operations: The revenue segments for BYD include CN¥507.52 billion from automobiles and related products and CN¥154.49 billion from mobile handset components, assembly service, and other products.

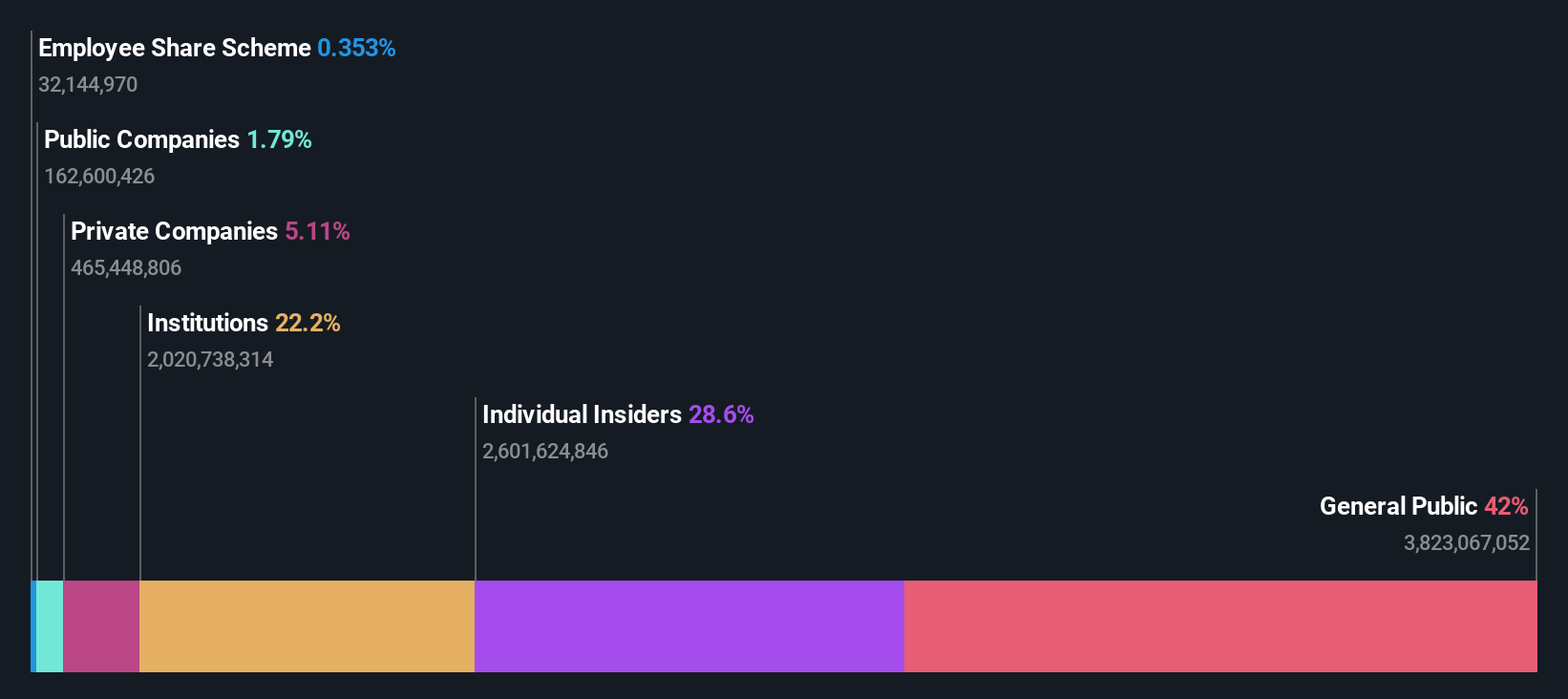

Insider Ownership: 30.1%

Earnings Growth Forecast: 15.5% p.a.

BYD's growth trajectory is underscored by its strong insider ownership, which aligns management interests with shareholders. The company's revenue and earnings are forecast to outpace the Hong Kong market, with expected annual profit growth of 15.5%. Recent sales data show robust volume increases year-over-year, indicating demand strength. A strategic partnership with Uber aims to expand BYD's electric vehicle reach globally, enhancing its competitive position and supporting long-term growth prospects in the EV sector.

- Click here and access our complete growth analysis report to understand the dynamics of BYD.

- Upon reviewing our latest valuation report, BYD's share price might be too optimistic.

ESR Group (SEHK:1821)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across various regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, and Europe with a market cap of HK$52.64 billion.

Operations: The company's revenue segments consist of Fund Management generating $627.98 million and New Economy Development contributing $113.33 million, while Investment activities reported a negative revenue of -$106.44 million.

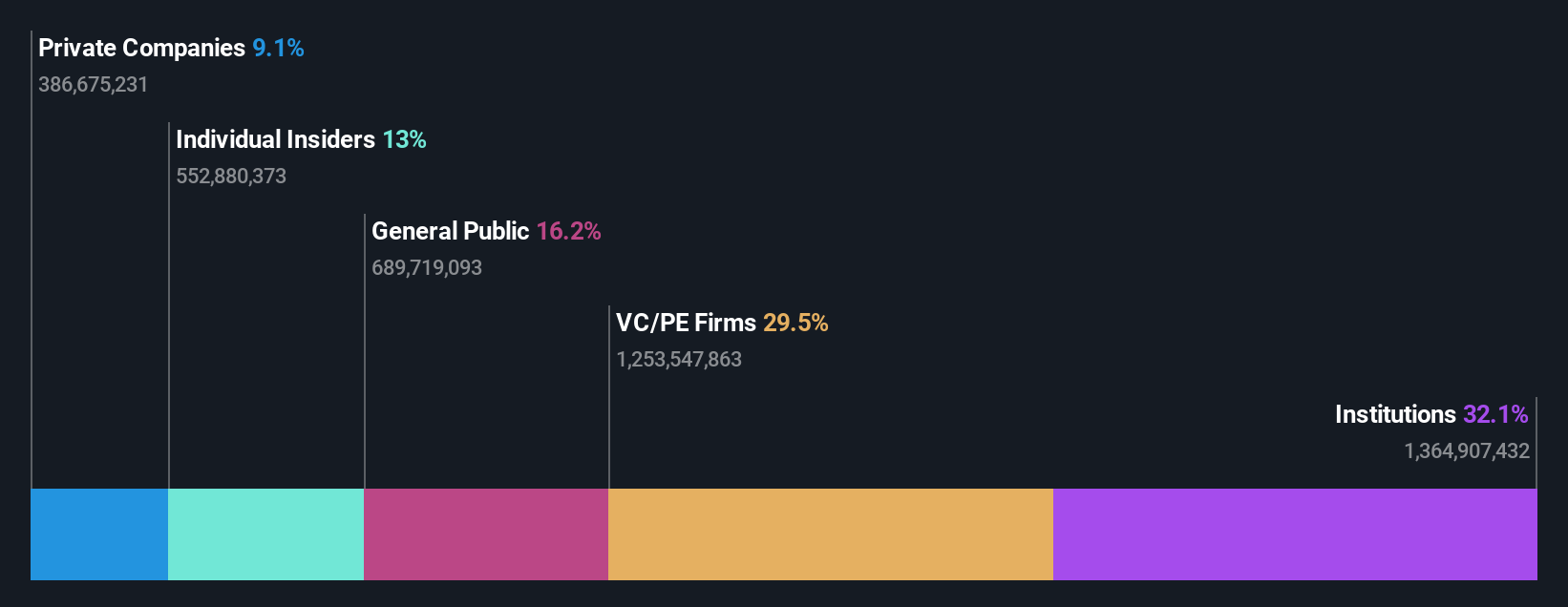

Insider Ownership: 13%

Earnings Growth Forecast: 78.9% p.a.

ESR Group demonstrates a strong growth outlook with forecasted revenue growth of 16.4% annually, surpassing the Hong Kong market average. Despite recent net losses due to non-cash asset revaluations, the company is expected to become profitable within three years. Trading significantly below its estimated fair value suggests potential for appreciation. Leadership changes include Brett Krause as interim chairman, bringing extensive investment management experience, which may influence strategic direction positively amidst current market challenges.

- Click here to discover the nuances of ESR Group with our detailed analytical future growth report.

- Our valuation report here indicates ESR Group may be overvalued.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan is a technology retail company operating in the People's Republic of China with a market capitalization of approximately HK$1.07 trillion.

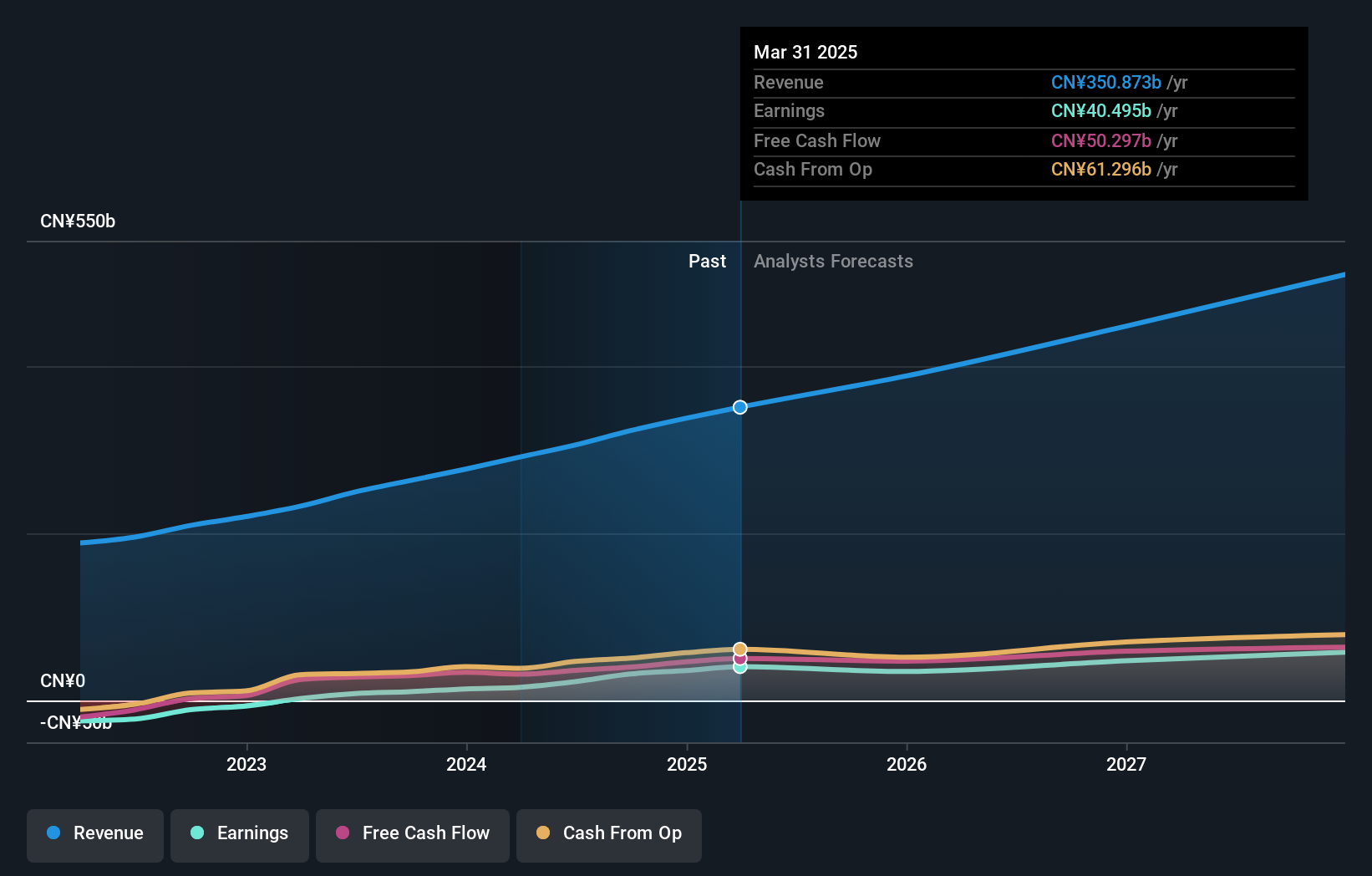

Operations: The company generates revenue primarily from its Core Local Commerce segment, which accounts for CN¥228.13 billion, and its New Initiatives segment, contributing CN¥77.56 billion.

Insider Ownership: 11.8%

Earnings Growth Forecast: 26.1% p.a.

Meituan exhibits robust growth potential with earnings expected to grow at 26.1% annually, outpacing the Hong Kong market. Recent financials show a significant increase in net income to CNY 16.72 billion for the first half of 2024, compared to CNY 8.05 billion a year earlier. Despite no substantial insider buying recently, insider selling remains minimal, indicating confidence in future prospects. The company has also engaged in substantial share buybacks totaling $2 billion this year.

- Dive into the specifics of Meituan here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Meituan is trading beyond its estimated value.

Summing It All Up

- Click this link to deep-dive into the 47 companies within our Fast Growing SEHK Companies With High Insider Ownership screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Solid track record with excellent balance sheet.