- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

SEHK Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

Amid a backdrop of mixed global economic indicators and fluctuating markets, the Hong Kong stock market has shown resilience, marked by a modest gain in the Hang Seng Index during a holiday-shortened week. In such an environment, growth companies with high insider ownership in Hong Kong could be particularly noteworthy for investors looking for potential opportunities where leadership has significant skin in the game.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Fenbi (SEHK:2469) | 32.7% | 43% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 73.4% |

| DPC Dash (SEHK:1405) | 38.2% | 90.2% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

| Beijing Airdoc Technology (SEHK:2251) | 28.7% | 83.9% |

Underneath we present a selection of stocks filtered out by our screen.

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$731.47 billion.

Operations: The company's revenue is generated primarily from its automobiles and batteries business segments.

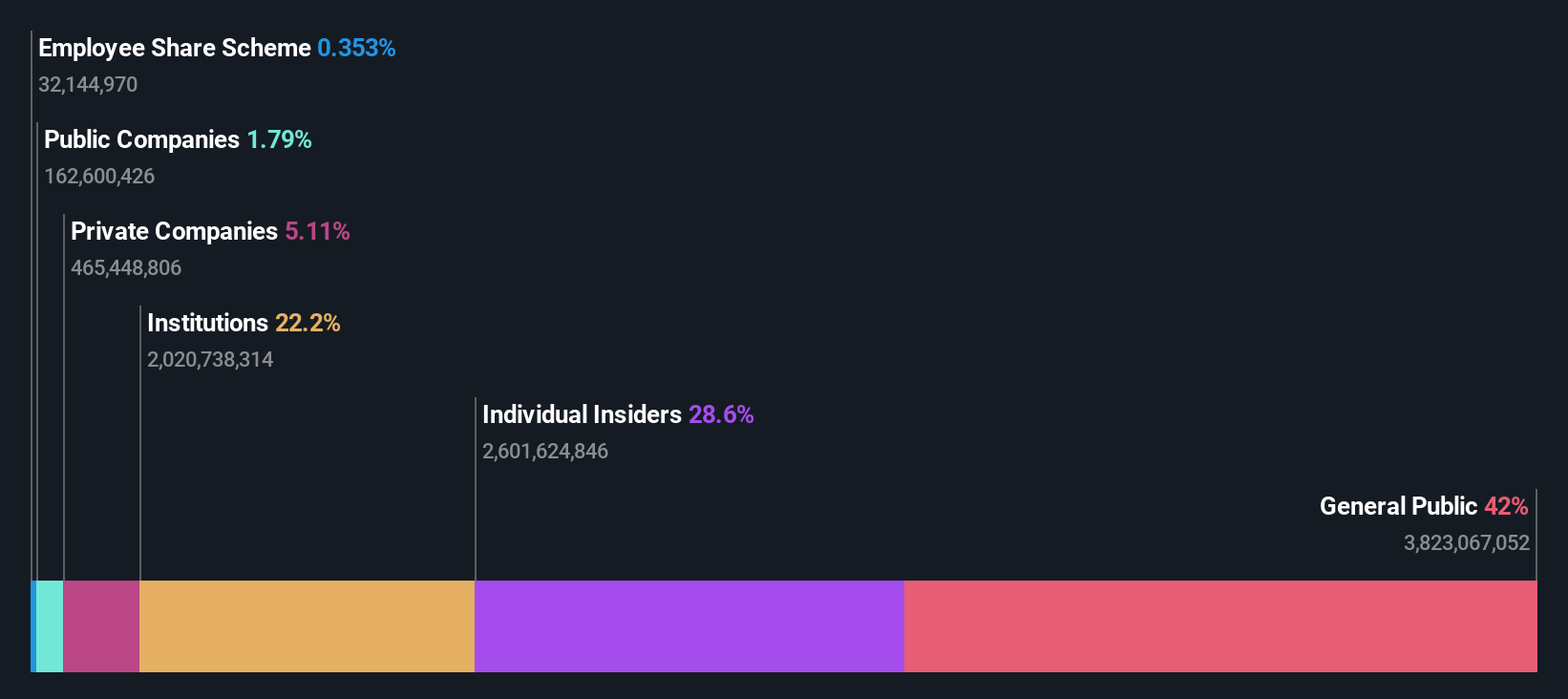

Insider Ownership: 30.1%

Earnings Growth Forecast: 14.8% p.a.

BYD Company Limited, a prominent player in the electric vehicle sector, has demonstrated robust growth with significant year-over-year increases in both sales and production volumes as of June 2024. Despite trading at 33.6% below its estimated fair value, BYD's earnings are expected to grow by 14.76% annually, outpacing the Hong Kong market's growth. However, insider trading activity has been neutral with no substantial buying or selling reported over the past three months. The company's strategic expansions and product innovations continue to solidify its market position.

- Click here and access our complete growth analysis report to understand the dynamics of BYD.

- Our expertly prepared valuation report BYD implies its share price may be too high.

ESR Group (SEHK:1821)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, and Europe with a market capitalization of HK$47.27 billion.

Operations: The company's revenue is derived from fund management, generating HK$774.64 million, and new economy development, contributing HK$105.48 million.

Insider Ownership: 13.1%

Earnings Growth Forecast: 26.5% p.a.

ESR Group is trading at a substantial 39.7% below its estimated fair value, indicating potential undervaluation. Forecasted earnings growth for ESR is robust, expected to increase by 26.47% annually, outperforming the Hong Kong market's average. However, the company faces challenges with low forecasted return on equity and significant one-off items affecting earnings quality. Recent events include a potential privatization proposal valued between US$7 billion and US$8 billion, suggesting investor confidence and strategic shifts that may influence future growth trajectories.

- Navigate through the intricacies of ESR Group with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that ESR Group's current price could be inflated.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★★☆

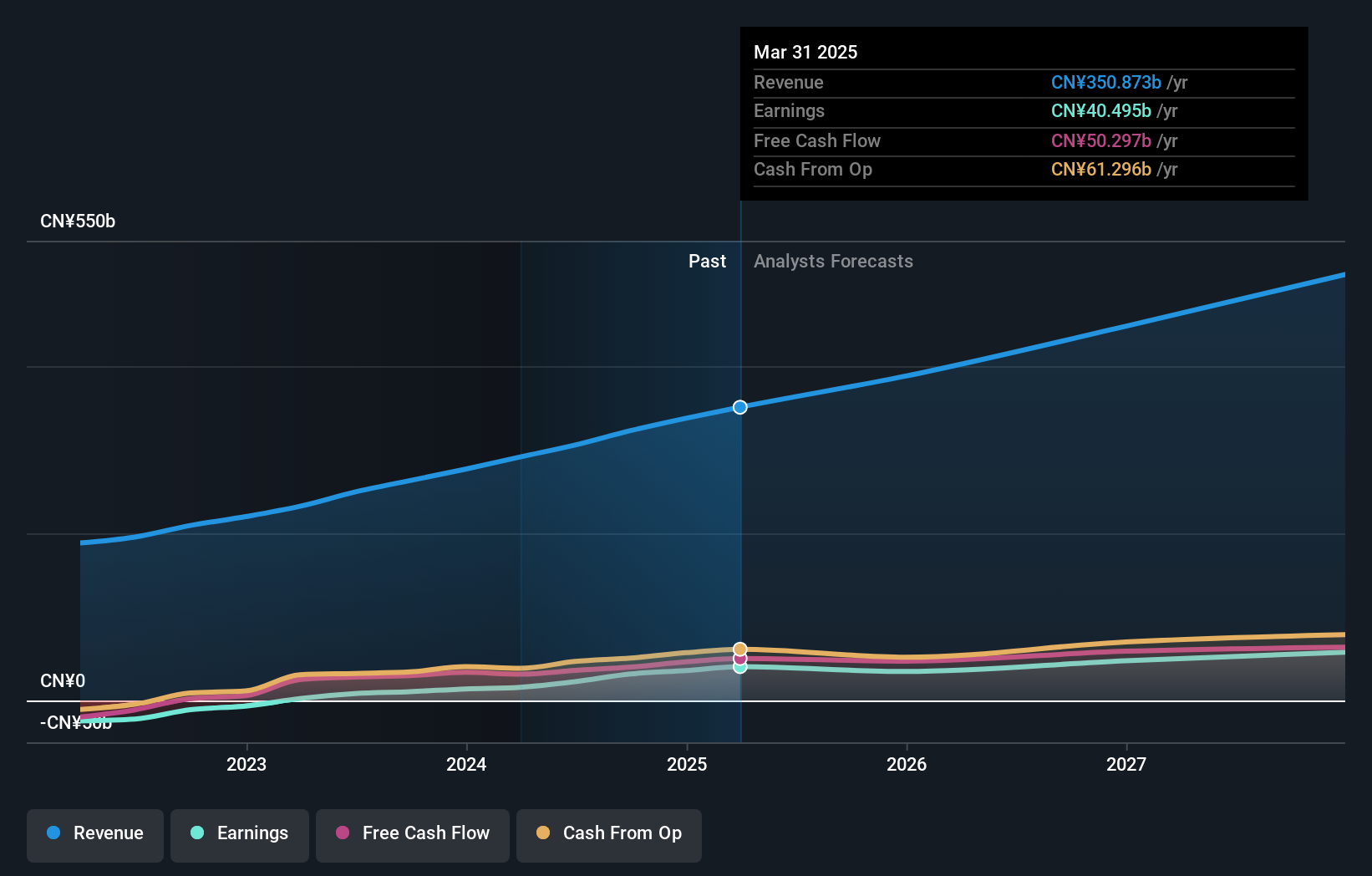

Overview: Meituan is a technology retail company based in the People's Republic of China, with a market capitalization of approximately HK$718.98 billion.

Operations: The company generates revenue through technology retail operations in China.

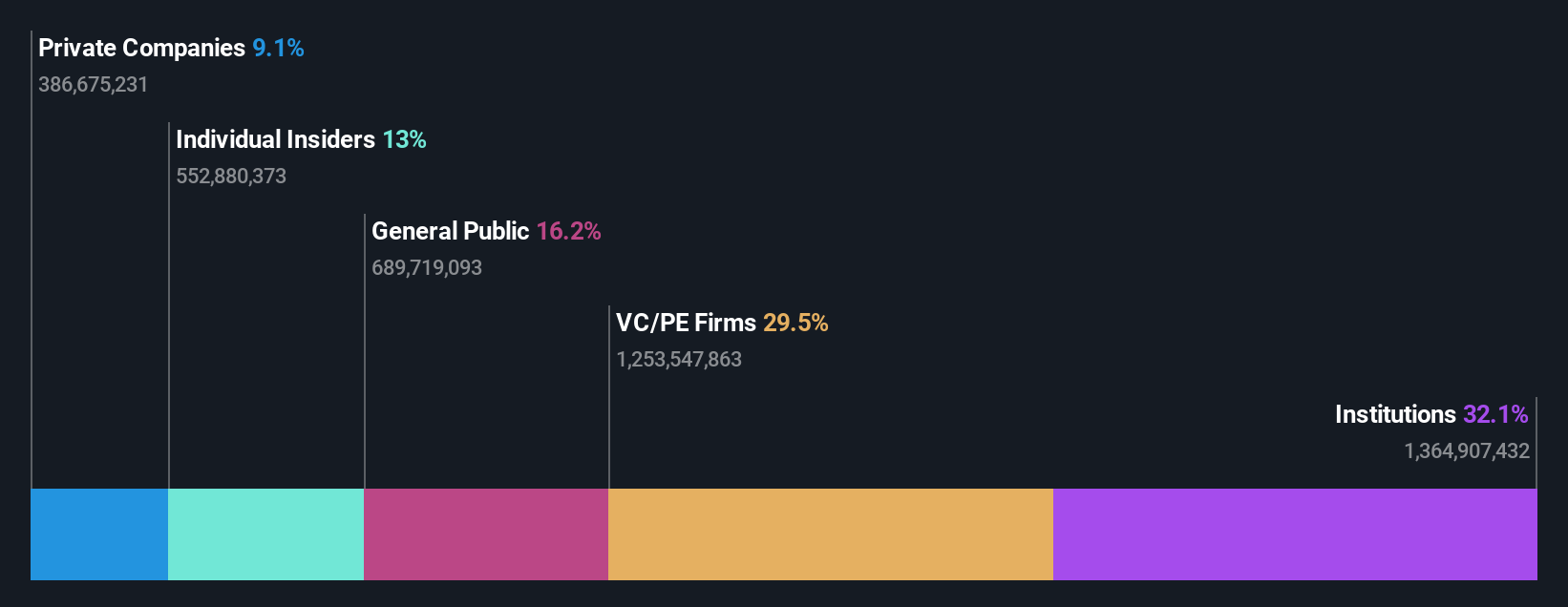

Insider Ownership: 11.4%

Earnings Growth Forecast: 31.2% p.a.

Meituan has demonstrated substantial growth, with a recent earnings increase of 568.2% over the past year and an expected annual profit growth rate of 31.2%, significantly outpacing the Hong Kong market average. Despite trading at 66.4% below its estimated fair value, suggesting potential undervaluation, concerns remain due to one-off items affecting financial results and no significant insider buying in the last three months. Recent strategic moves include a US$2 billion share repurchase program, indicating confidence in future growth prospects amidst operational adjustments and governance enhancements during their latest annual general meeting.

- Unlock comprehensive insights into our analysis of Meituan stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Meituan shares in the market.

Summing It All Up

- Navigate through the entire inventory of 54 Fast Growing SEHK Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Meituan, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3690

Meituan

Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives