As global markets react to the recent Fed rate cut, Hong Kong's Hang Seng Index has seen a notable uptick, gaining 5.12% in a holiday-shortened week. This positive momentum sets the stage for examining growth companies with high insider ownership, which can be indicative of strong confidence from those closest to the business. In such an environment, stocks with significant insider investment often signal potential resilience and growth prospects, making them compelling options for investors looking to capitalize on current market conditions.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| Akeso (SEHK:9926) | 20.5% | 54.7% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 78.9% |

| DPC Dash (SEHK:1405) | 38.2% | 104.2% |

| Kindstar Globalgene Technology (SEHK:9960) | 16.5% | 88% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

Let's review some notable picks from our screened stocks.

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, with a market cap of HK$802.38 billion, operates in the automobiles and batteries sectors across China, Hong Kong, Macau, Taiwan, and internationally.

Operations: BYD's revenue segments include CN¥507.52 billion from Automobiles and Related Products and Other Products, and CN¥154.49 billion from Mobile Handset Components, Assembly Service, and Other Products.

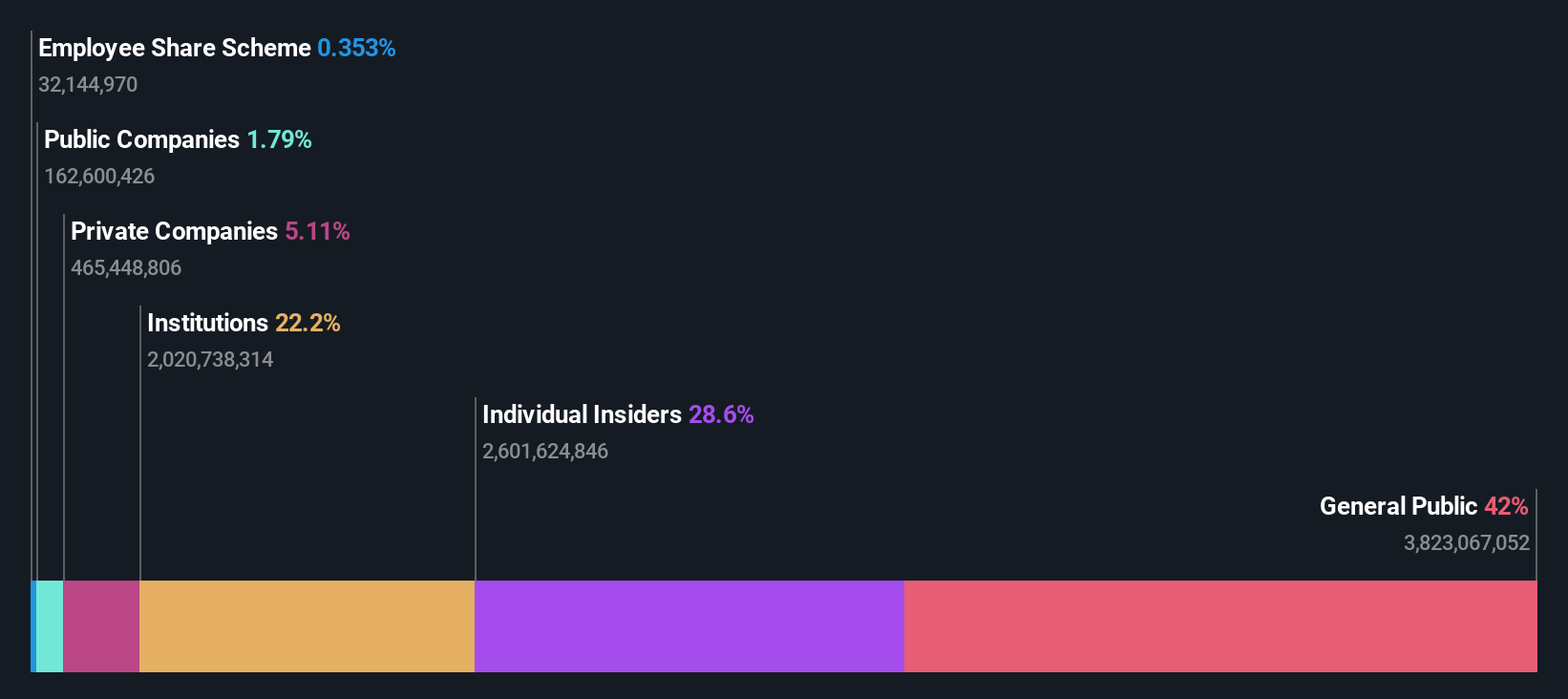

Insider Ownership: 30.1%

Earnings Growth Forecast: 15.2% p.a.

BYD has shown substantial growth with earnings up 36.2% over the past year and revenue forecasted to grow at 14.1% annually, outpacing the Hong Kong market's average. Recent unaudited production results for August 2024 reported a significant increase in volume year-over-year, reflecting strong operational performance. The company also announced a strategic partnership with Uber to introduce 100,000 new electric vehicles globally, enhancing its market presence and supporting further growth initiatives.

- Dive into the specifics of BYD here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of BYD shares in the market.

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd. (SEHK:1497) focuses on the research, development, production, and marketing of edible bird’s nest products in China and has a market cap of HK$6.02 billion.

Operations: The company's revenue segments include sales to online distributors (CN¥21.07 million), offline distributors (CN¥508.94 million), direct sales to online customers (CN¥907.52 million), offline customers (CN¥344.32 million), and e-commerce platforms (CN¥290.51 million).

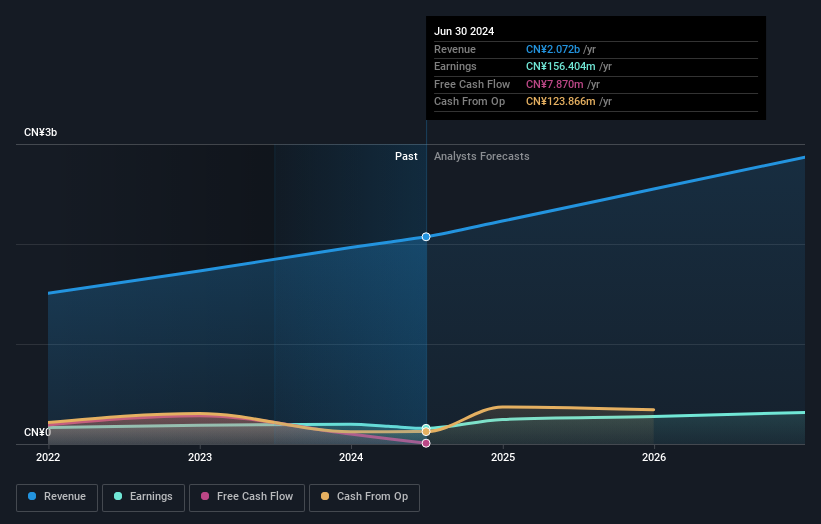

Insider Ownership: 26.7%

Earnings Growth Forecast: 23.8% p.a.

Xiamen Yan Palace Bird's Nest Industry has demonstrated steady revenue growth, reporting CNY 1.06 billion for the first half of 2024, up from CNY 951.2 million a year ago. Despite this, net income fell to CNY 58.08 million from CNY 101.08 million due to increased operational challenges. Insider ownership remains high, indicating confidence in long-term prospects. Analysts forecast a significant annual earnings growth rate of around 23.9%, outpacing the Hong Kong market average.

- Click here and access our complete growth analysis report to understand the dynamics of Xiamen Yan Palace Bird's Nest Industry.

- Our expertly prepared valuation report Xiamen Yan Palace Bird's Nest Industry implies its share price may be too high.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan operates as a technology retail company in the People’s Republic of China with a market cap of approximately HK$841.32 billion.

Operations: The company's revenue segments include Core Local Commerce generating CN¥228.13 billion and New Initiatives contributing CN¥77.56 billion.

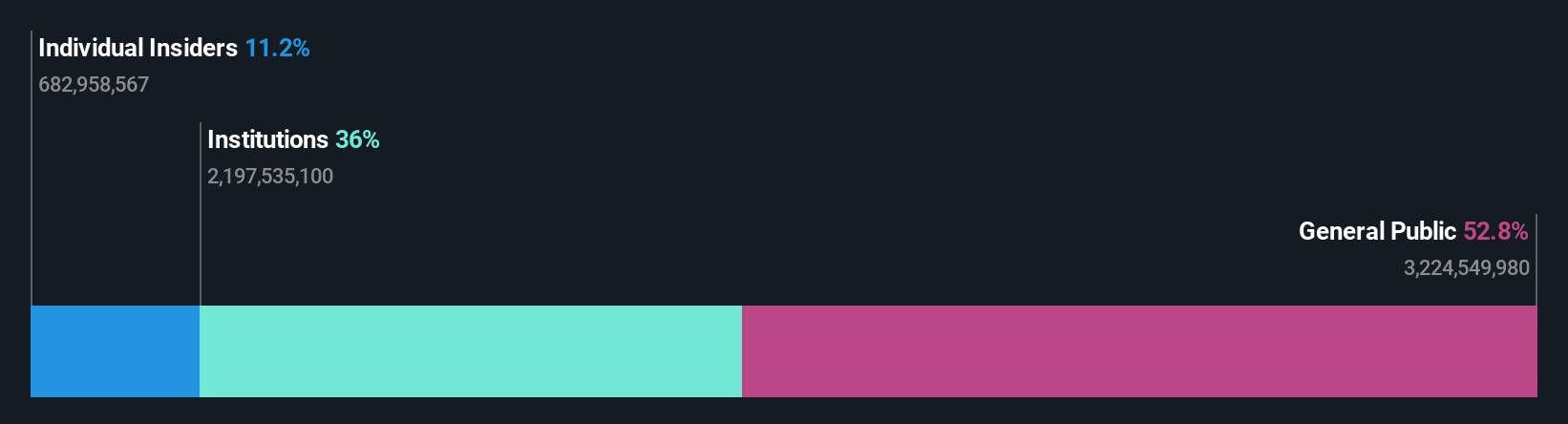

Insider Ownership: 11.6%

Earnings Growth Forecast: 26% p.a.

Meituan's earnings grew by 175.5% over the past year, and its revenue is forecast to grow at 12.9% annually, faster than the Hong Kong market average. Despite a lack of substantial insider buying recently, insider ownership remains high. The company has been actively repurchasing shares, completing buybacks totaling HKD 7.17 billion this year alone. Analysts expect Meituan’s earnings to grow significantly at around 26% per year over the next three years.

- Get an in-depth perspective on Meituan's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Meituan is trading beyond its estimated value.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing SEHK Companies With High Insider Ownership list of 47 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1497

Xiamen Yan Palace Bird's Nest Industry

Engages in the research, development, production, and marketing of edible bird’s nest (EBN) products to distributors, e-commerce platforms, and retail customers in the People’s Republic of China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives