- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

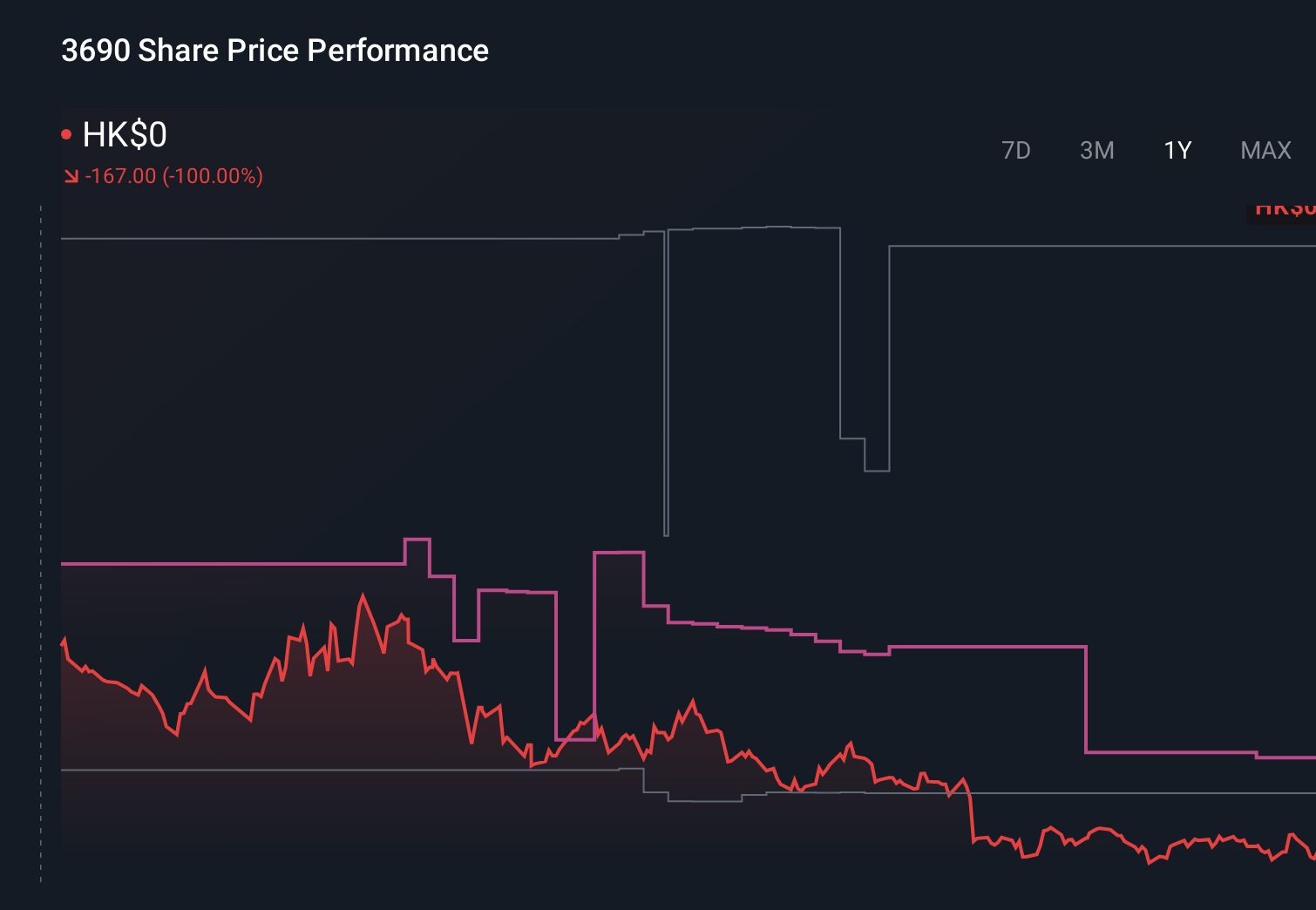

Does Meituan’s Q3 2025 Swing To Net Loss Change The Bull Case For Meituan (SEHK:3690)?

Reviewed by Sasha Jovanovic

- Meituan has reported its third quarter 2025 results, with revenue rising slightly year-on-year to CNY 95,488.11 million but shifting from a CNY 12,864.70 million net profit to a CNY 18,632.45 million net loss.

- This move from profit to loss despite higher sales points to pressure on costs or margins, raising questions about the quality of Meituan’s current growth.

- Next, we’ll examine how Meituan’s swing to a sizeable quarterly net loss could reshape its previously margin-focused investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Meituan Investment Narrative Recap

To own Meituan, you have to believe its vast user base and ecosystem can convert scale into durable profits despite intense competition and rising cost pressures. The latest quarter’s CNY 18,632.45 million net loss, against slightly higher revenue, directly challenges the near term margin story and makes cost control the key catalyst, while amplifying the risk that aggressive spending in new ventures could keep profitability volatile.

The most directly relevant recent announcement is Meituan’s Q2 2025 and H1 2025 earnings, where revenue also grew but net income already showed sharp year on year compression. Seen alongside the Q3 swing to loss, this earlier step down in profitability frames a pattern of weakening margins that could matter more to the story than top line growth alone.

But investors should be aware that rising courier incentives and industry wide subsidies could increasingly pressure Meituan’s unit economics and...

Read the full narrative on Meituan (it's free!)

Meituan's narrative projects CN¥496.8 billion revenue and CN¥48.4 billion earnings by 2028.

Uncover how Meituan's forecasts yield a HK$129.65 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Members of the Simply Wall St Community have shared 11 fair value estimates for Meituan, ranging from HK$83.35 to HK$318.18, underscoring how far apart views on upside potential can be. You can weigh these against the recent swing to a CNY 18,632.45 million quarterly net loss and the risk that sustained courier incentives and subsidies keep margins under pressure, before deciding which scenarios feel most realistic for the business.

Explore 11 other fair value estimates on Meituan - why the stock might be worth over 3x more than the current price!

Build Your Own Meituan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meituan research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Meituan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meituan's overall financial health at a glance.

No Opportunity In Meituan?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3690

Meituan

Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion