- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

3 SEHK Growth Stocks With Up To 25% Insider Ownership

Reviewed by Simply Wall St

The Hong Kong market has recently seen a boost, with the Hang Seng Index gaining over 5% in response to the U.S. Federal Reserve's rate cut, despite some mixed economic data from China. This optimistic environment makes it an opportune time to explore growth companies with significant insider ownership, which can be a positive indicator of confidence and alignment between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| Akeso (SEHK:9926) | 20.5% | 54.7% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 78.9% |

| DPC Dash (SEHK:1405) | 38.2% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

| MicroTech Medical (Hangzhou) (SEHK:2235) | 25.8% | 105% |

We'll examine a selection from our screener results.

Alibaba Health Information Technology (SEHK:241)

Simply Wall St Growth Rating: ★★★★☆☆

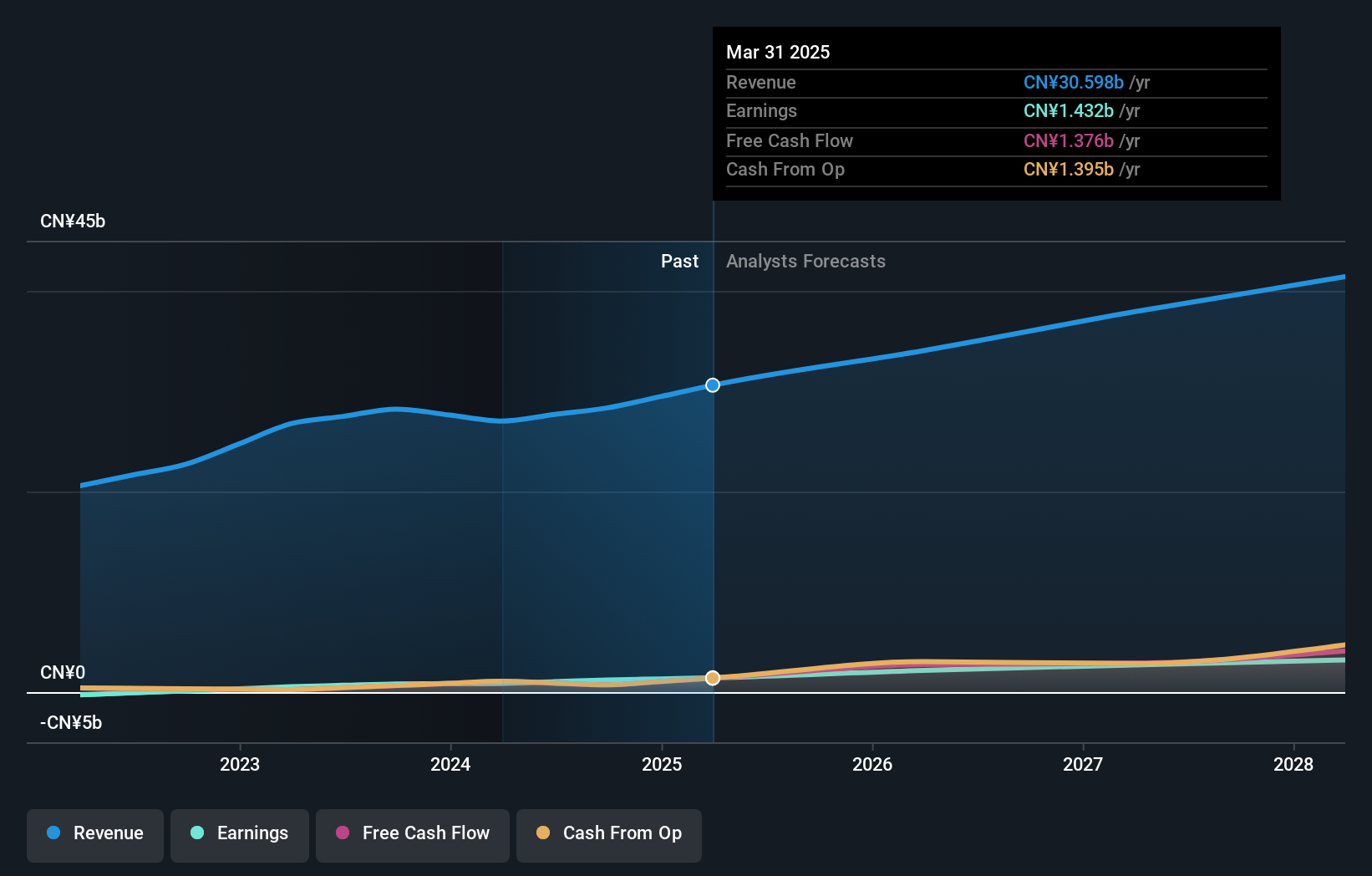

Overview: Alibaba Health Information Technology Limited operates in pharmaceutical direct sales, pharmaceutical e-commerce platforms, and healthcare and digital services in Mainland China and Hong Kong, with a market cap of HK$50.50 billion.

Operations: The company generates revenue primarily from the distribution and development of pharmaceutical and healthcare business, amounting to CN¥27.03 billion.

Insider Ownership: 19.3%

Alibaba Health Information Technology is poised for significant earnings growth, with forecasts suggesting a 23.9% annual increase over the next three years, outpacing the Hong Kong market's 11.8%. Despite recent shareholder dilution and low forecasted return on equity (13.7%), the stock trades at a substantial discount to its estimated fair value. The company has experienced robust revenue growth (10.8% annually) and recently underwent executive changes, with Mr. Zhu Shunyun transitioning to a non-executive role while remaining Chairman of the Board.

- Click here and access our complete growth analysis report to understand the dynamics of Alibaba Health Information Technology.

- Insights from our recent valuation report point to the potential overvaluation of Alibaba Health Information Technology shares in the market.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan operates as a technology retail company in the People’s Republic of China with a market cap of approximately HK$802.90 billion.

Operations: Meituan's revenue segments include CN¥228.13 billion from Core Local Commerce and CN¥77.56 billion from New Initiatives.

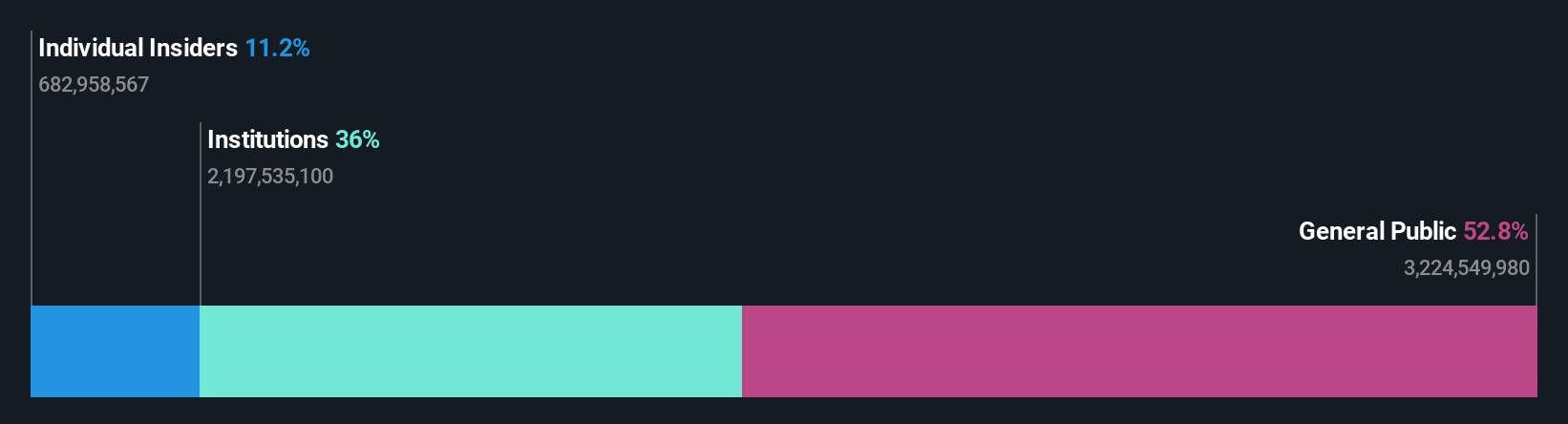

Insider Ownership: 11.6%

Meituan, a prominent growth company with high insider ownership in Hong Kong, has demonstrated substantial earnings growth, reporting net income of CNY 16.72 billion for the first half of 2024 compared to CNY 8.05 billion a year ago. The company's aggressive share buyback program, totaling HKD 7.17 billion from January to June and $2 billion from June to August, underscores management's confidence in its future prospects despite slower revenue growth forecasts (12.9% annually).

- Delve into the full analysis future growth report here for a deeper understanding of Meituan.

- In light of our recent valuation report, it seems possible that Meituan is trading beyond its estimated value.

Techtronic Industries (SEHK:669)

Simply Wall St Growth Rating: ★★★★☆☆

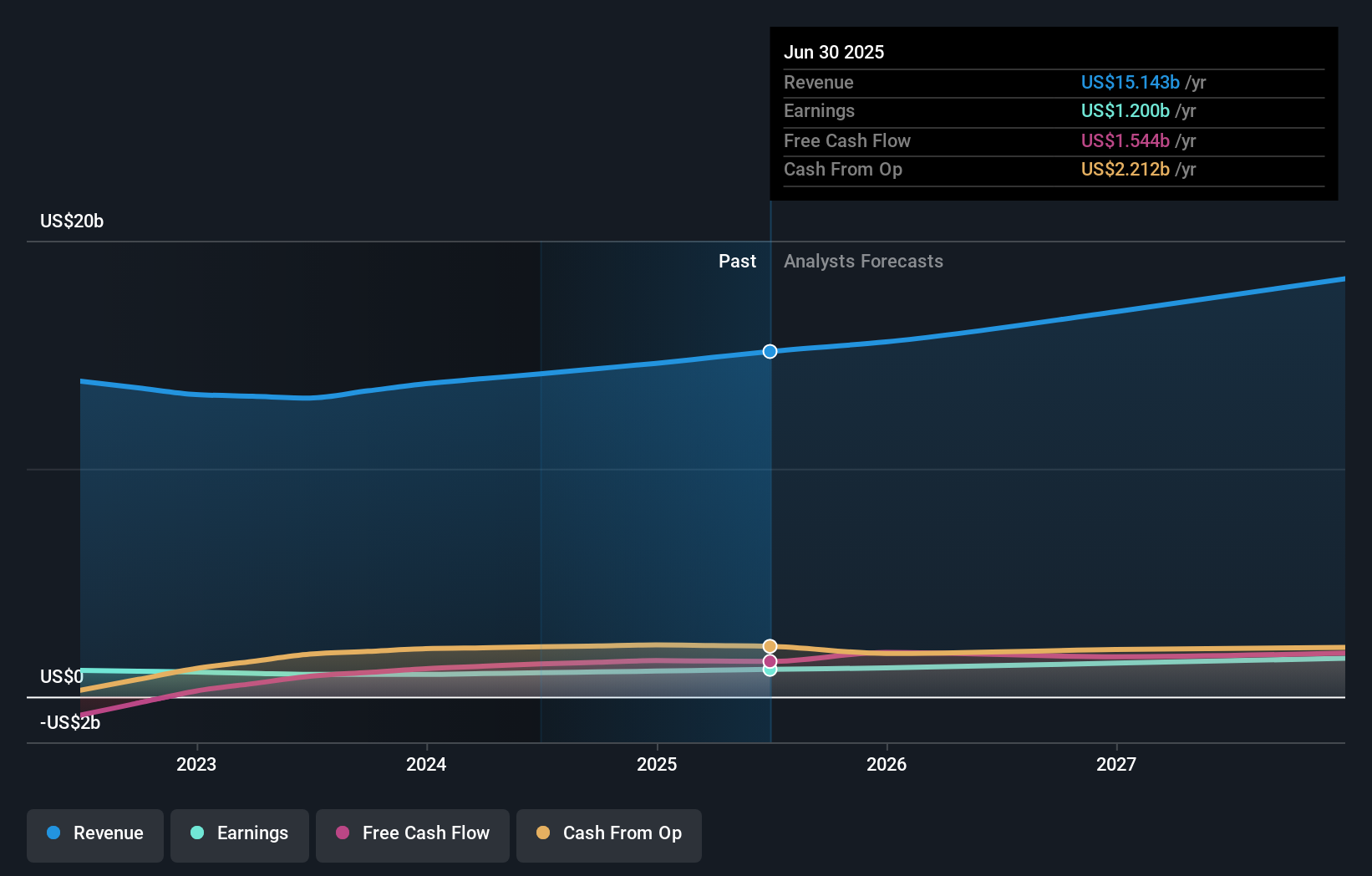

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and internationally with a market cap of HK$209.46 billion.

Operations: The company's revenue segments include Power Equipment at $13.23 billion and Floorcare & Cleaning at $965.09 million.

Insider Ownership: 25.4%

Techtronic Industries has shown solid growth with net income rising to US$550.37 million for the half year ended June 30, 2024, from US$475.78 million a year ago. The company recently increased its interim dividend to HKD 1.08 per share and appointed Steven Philip Richman as an Executive Director, signaling strong insider confidence. Despite revenue growth forecasts of 8.5% annually being slower than desired, earnings are expected to grow at a robust 15.3% per year.

- Get an in-depth perspective on Techtronic Industries' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Techtronic Industries implies its share price may be too high.

Key Takeaways

- Gain an insight into the universe of 47 Fast Growing SEHK Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Meituan, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3690

Meituan

Operates as a technology retail company in the People’s Republic of China.

Solid track record with excellent balance sheet.