- Hong Kong

- /

- Hospitality

- /

- SEHK:308

China Travel International Investment Hong Kong (HKG:308) Is Paying Out A Dividend Of HK$0.015

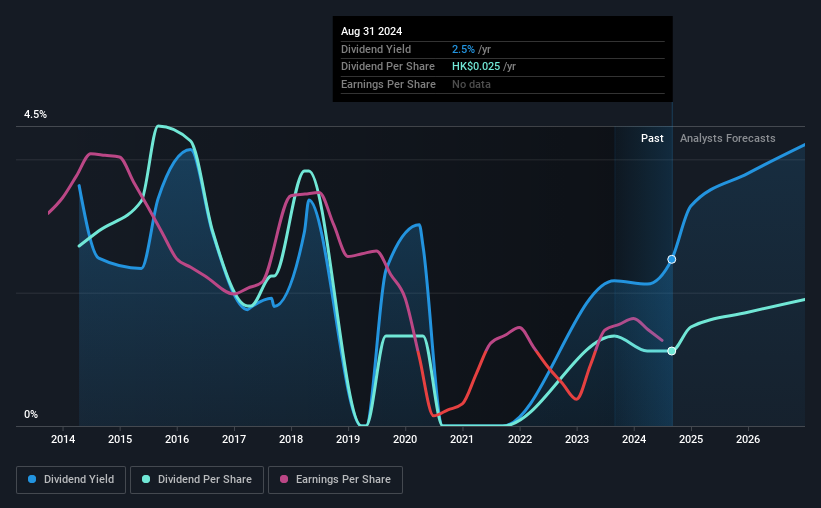

China Travel International Investment Hong Kong Limited (HKG:308) will pay a dividend of HK$0.015 on the 15th of October. This means the dividend yield will be fairly typical at 2.5%.

See our latest analysis for China Travel International Investment Hong Kong

China Travel International Investment Hong Kong's Earnings Easily Cover The Distributions

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Based on the last payment, earnings were actually smaller than the dividend, and the company was actually spending more cash than it was making. Paying out such a large dividend compared to earnings while also not generating any free cash flow would definitely be difficult to keep up.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 22% which is fairly sustainable.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The annual payment during the last 10 years was HK$0.06 in 2014, and the most recent fiscal year payment was HK$0.025. The dividend has shrunk at around 8.4% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. China Travel International Investment Hong Kong's EPS has fallen by approximately 36% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

China Travel International Investment Hong Kong's Dividend Doesn't Look Great

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 2 warning signs for China Travel International Investment Hong Kong that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:308

China Travel International Investment Hong Kong

Provides travel and tourism services.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives