- China

- /

- Metals and Mining

- /

- SHSE:603315

Undiscovered Gems Three Promising Stocks In November 2024

Reviewed by Simply Wall St

In November 2024, global markets are navigating a landscape marked by uncertainty surrounding the incoming Trump administration's policies and their potential impact on corporate earnings, with notable fluctuations in key indices like the S&P 500 and Russell 2000. Amidst these shifting dynamics, identifying promising stocks requires a keen eye for companies that can thrive despite economic headwinds and policy changes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Tethys Petroleum | NA | 29.98% | 44.48% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Perfect Medical Health Management (SEHK:1830)

Simply Wall St Value Rating: ★★★★★★

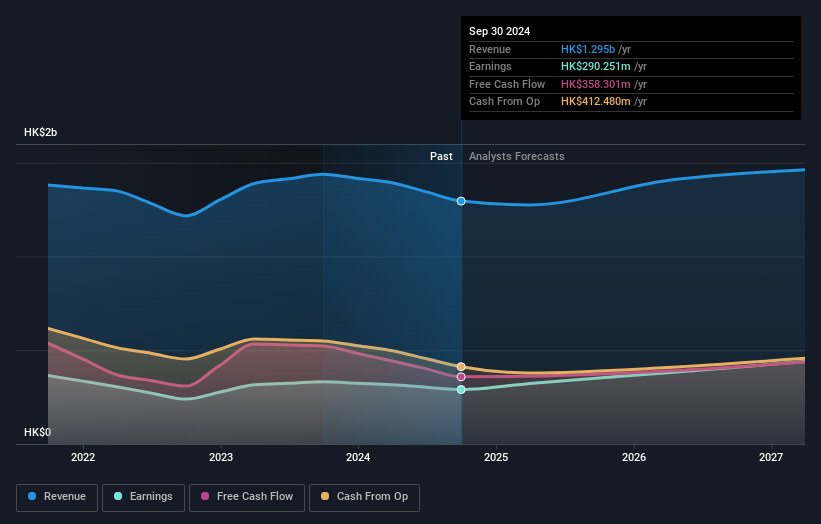

Overview: Perfect Medical Health Management Limited is an investment holding company that provides medical, aesthetic medical, and beauty and wellness services across Hong Kong, the People’s Republic of China, Macau, Australia, and Singapore with a market cap of approximately HK$3.35 billion.

Operations: Perfect Medical Health Management generates revenue primarily from medical, aesthetic medical, and beauty and wellness services, totaling approximately HK$1.39 billion. The company's financial performance can be analyzed through its net profit margin trends over recent periods.

Perfect Medical Health Management, a smaller entity in the healthcare sector, stands out with its debt-free status for the last five years. This financial discipline likely contributes to its high-quality earnings. Trading at 69% below estimated fair value suggests potential undervaluation. The company is forecasted to grow earnings by 11.56% annually, although recent growth of 0.05% lags behind the industry average of 4.6%. Despite this, positive free cash flow and profitability ensure a stable cash runway, positioning it as an intriguing prospect for those seeking untapped opportunities in healthcare investments.

Liaoning Fu-An Heavy IndustryLtd (SHSE:603315)

Simply Wall St Value Rating: ★★★★☆☆

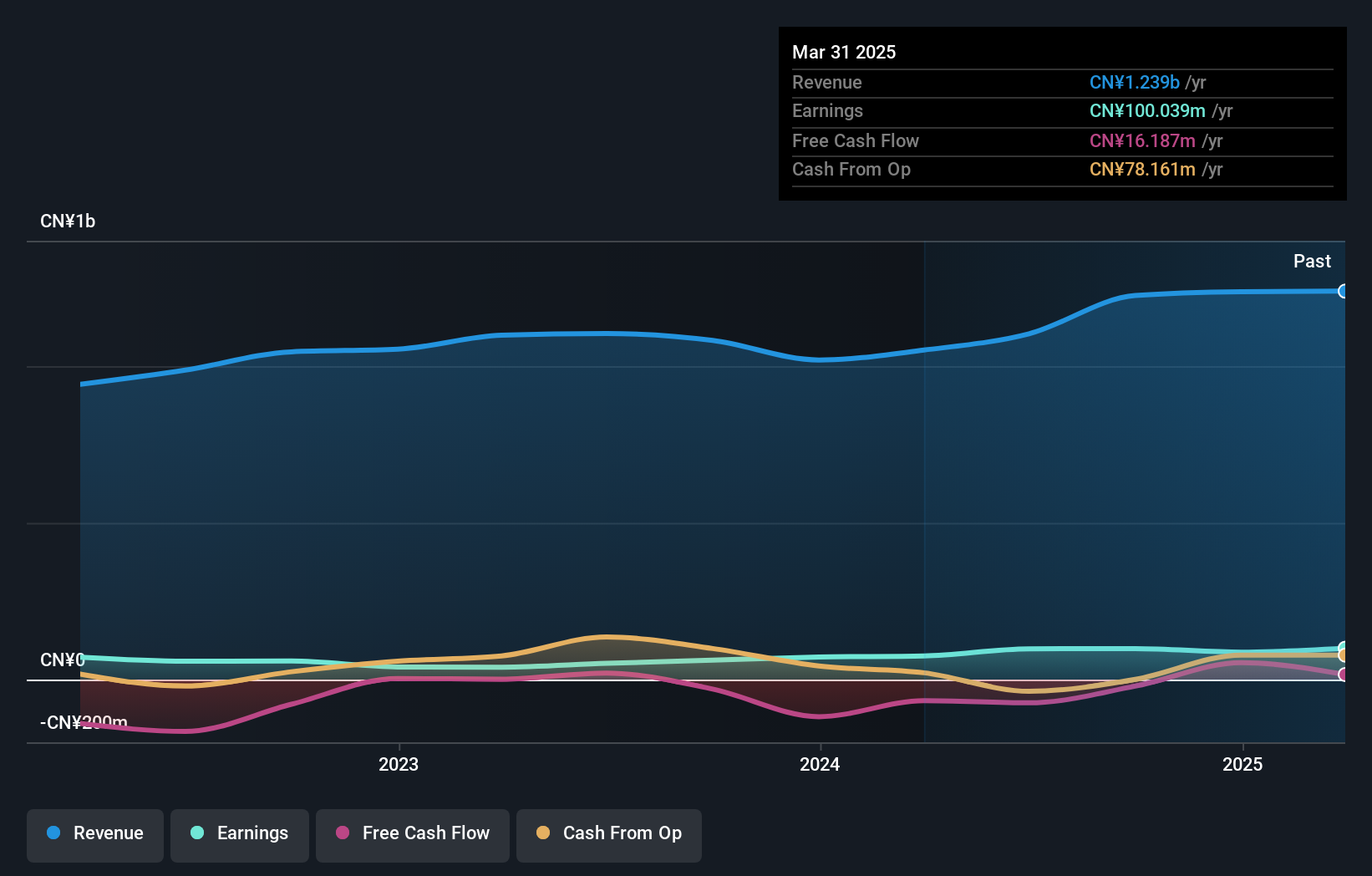

Overview: Liaoning Fu-An Heavy Industry Co., Ltd specializes in the production and sale of steel castings in China, with a market capitalization of CN¥3.35 billion.

Operations: Liaoning Fu-An Heavy Industry Co., Ltd generates revenue primarily through the production and sale of steel castings. The company's financial performance is reflected in its market capitalization of CN¥3.35 billion.

Liaoning Fu-An Heavy Industry has shown impressive growth, with earnings surging 59.5% over the past year, significantly outpacing the broader Metals and Mining sector's -3%. Despite a satisfactory net debt to equity ratio of 22.6%, there has been a rise from 18.4% to 33% over five years, indicating increased leverage. The company's price-to-earnings ratio stands at 33.9x, slightly below the CN market average of 35.9x, suggesting potential value for investors in this niche space. Recent financials reveal robust sales growth to CNY935 million and net income climbing to CNY83 million for the first nine months of 2024 compared to last year’s figures.

eGuarantee (TSE:8771)

Simply Wall St Value Rating: ★★★★★★

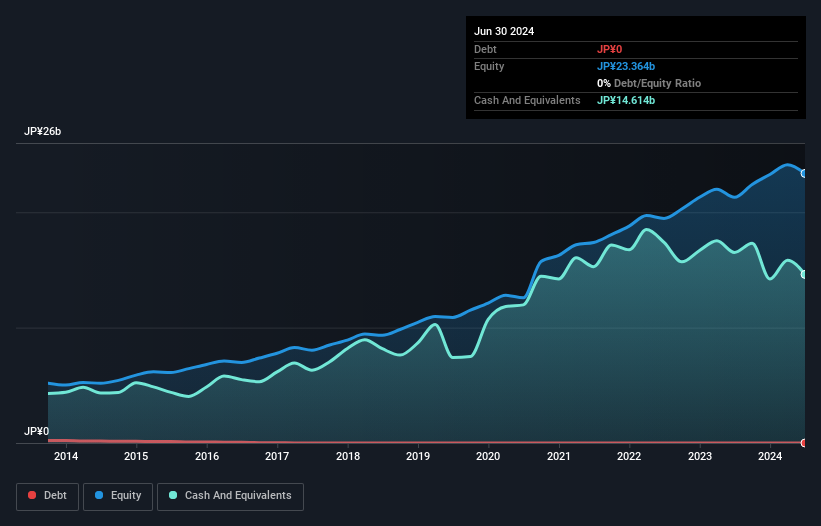

Overview: eGuarantee, Inc., along with its subsidiaries, operates in Japan's credit risk entrustment and securitization sector with a market capitalization of approximately ¥75.78 billion.

Operations: The primary revenue stream for eGuarantee comes from its Credit Guarantee segment, generating approximately ¥9.54 billion. The company's net profit margin is 23.45%.

eGuarantee, a nimble player in the financial sector, showcases high quality earnings with no debt on its books, which simplifies its financial landscape. Over the past five years, earnings have grown at an annual rate of 10.7%, although recent growth of 10.8% trails behind the broader industry's 25.5%. The company remains profitable and free cash flow positive, bolstered by a forecasted annual earnings growth of 12.79%. Recent announcements include their upcoming Q2 results for 2025 set for November 7th, reflecting active engagement with stakeholders and transparency in operations.

- Get an in-depth perspective on eGuarantee's performance by reading our health report here.

Examine eGuarantee's past performance report to understand how it has performed in the past.

Key Takeaways

- Discover the full array of 4627 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603315

Liaoning Fu-An Heavy IndustryLtd

Produces and sells steel castings in China.

Proven track record with adequate balance sheet.