- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1797

Introducing Koolearn Technology Holding (HKG:1797), The Stock That Zoomed 223% In The Last Year

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. For example, the Koolearn Technology Holding Limited (HKG:1797) share price had more than doubled in just one year - up 223%. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for Koolearn Technology Holding

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Koolearn Technology Holding saw its earnings per share (EPS) drop below zero. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. We might get a clue to explain the share price move by looking to other metrics.

However the year on year revenue growth of 26% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

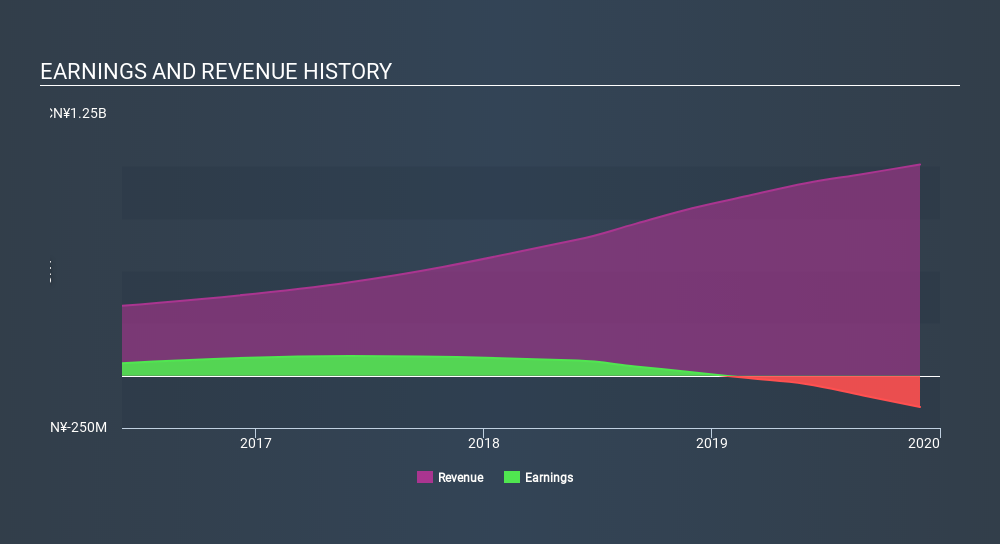

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that Koolearn Technology Holding shareholders have gained 223% over the last year. The more recent returns haven't been as impressive as the longer term returns, coming in at just 6.2%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). It's always interesting to track share price performance over the longer term. But to understand Koolearn Technology Holding better, we need to consider many other factors. For example, we've discovered 1 warning sign for Koolearn Technology Holding that you should be aware of before investing here.

Koolearn Technology Holding is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1797

East Buy Holding

An investment holding company, engages in the livestreaming e-commerce business in the People's Republic of China.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives